Nationwide Review of 3rd Quarter Performance

Market performance showed no signs of an aged cycle in the third quarter. The flood of new units continued unabated in markets across the country, with about 60,000 new units delivered in the quarter. What has changed recently compared to late 2017 and early in 2018 is demand.

Net absorption* in the second and third quarters of 2018 alone outpaced that of the entire year in 2017. In the third quarter of this year, net absorption reached about 111,000 units—nearly doubling newly supplied units. This resulted in an average occupancy gain of around 0.6% and an average effective rent gain of 1.25% for the quarter. As of the end of September, national average occupancy stood at just under 92.5%, and average effective rent per unit surpassed $1,300 for the first time.

View the full monthly Markets Stats PDF

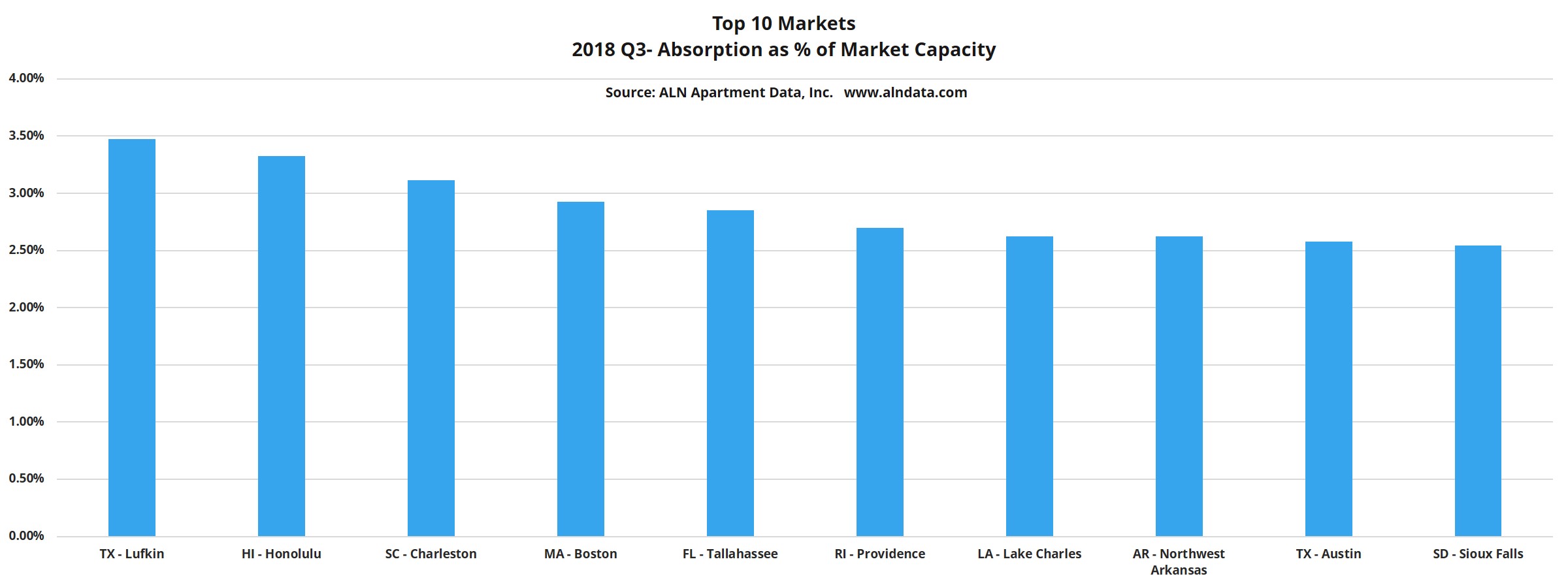

Some areas outperformed the national averages significantly. That’s a positive sign, as some regions will have a more pronounced seasonal effect in the traditionally strong third quarter. Let’s now look at how specific regions of the country fared during the last three months.

Third Quarter Review by Regions

Washington/Oregon

Every market in this region remained above the national average for average occupancy in the quarter, but occupancy change was a mixed bag. The Seattle market gained 0.7% in average occupancy, while the Spokane market lost just over 1%. However, Spokane remains above 95% occupied despite this retraction. The Portland market nearly ended the quarter at 95% as well but fell just short with an average occupancy around 94.5% thanks to a 0.6% quarterly increase.

Both the Portland and Seattle markets significantly surpassed new supply with net absorption. The net gain in rented units in Seattle was more than 2,600 units with new deliveries totaling only 1,000 units. Similarly, Portland absorbed about 1,100 units while bringing just under 300 new units to market.

When looking at average effective rent on a per unit basis, only Spokane topped the national average growth of 1.25%. Thanks in part to consistently high average occupancies, effective rent grew by 1.9% in the quarter. Portland and Seattle each came in just under the national average at 1.2%. Despite falling short of the national average for percent change in the quarter, both markets remain well above the national average regarding actual effective rents.

California

Excepting the Los Angeles- Orange County market with over 3,000 new units, the California markets largely experienced a break from new supply during the quarter. Areas like the Central Coast, San Joaquin Valley and Sacramento added no new properties, while San Bernardino- Riverside, San Diego and San Francisco- Oakland added three or less properties. Despite this, average occupancy growth was mostly below the national average across the state. As with the Pacific Northwest region, part of the cause was already high occupancies—so there’s not much cause for concern. In fact, every market in the state ending September with an average occupancy of at least 94%, with the San Joaquin Valley area leading the way at 97%.

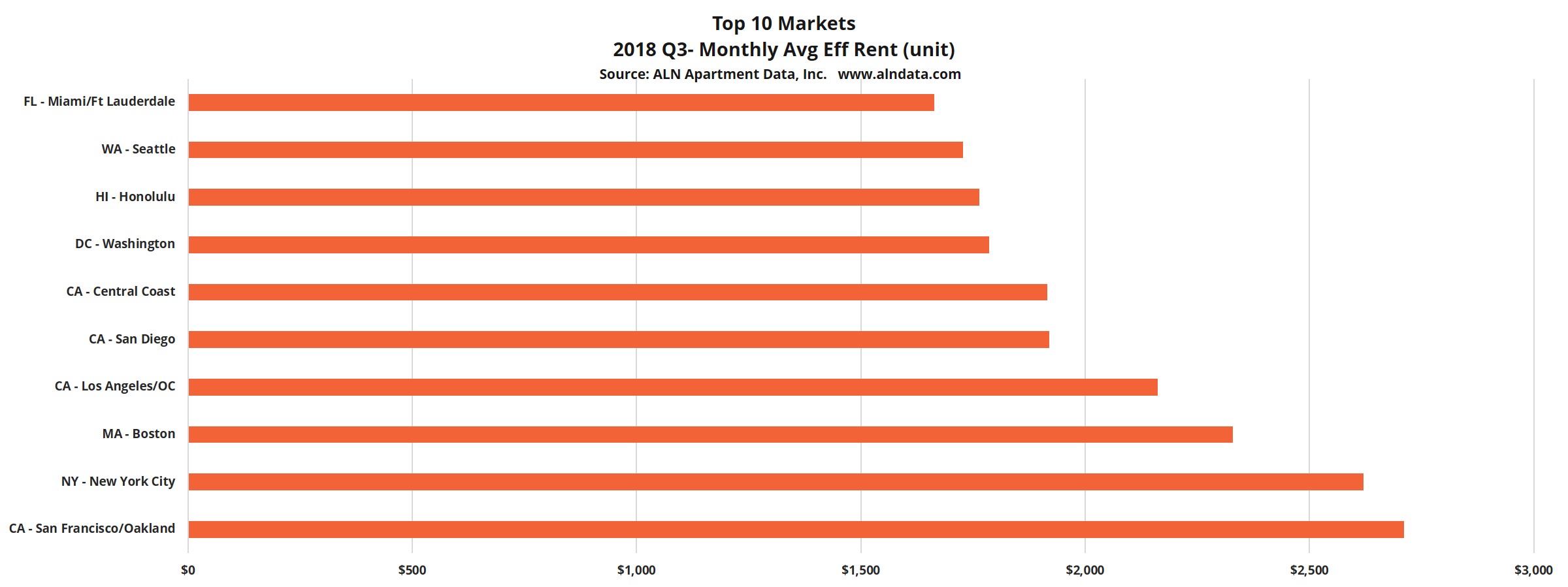

Both Sacramento and San Bernardino- Riverside saw effective rents climb by about 1.75%, while San Joaquin Valley also beat the national average by achieving about 1.6% rent growth in the period. Both LA and the Bay Area managed 1% rent growth in the quarter despite their already high rents, and the Central Coast area came in on the low end for the state with 0.9% quarterly appreciation. San Joaquin Valley is the only market in the state to have an average effective rent below that of the national average, and the major California markets all ended September with average rent per unit near, or above $2,000.

Arizona/Nevada/New Mexico

Reno is the lone market in this region to meet the national average for occupancy growth of 0.6% over the last three months. Markets like Las Vegas, Albuquerque and Phoenix all gained between 0.3% and 0.4% in the period, while Flagstaff remained flat at just under 94%. Each of the markets in these states ended Q3 right at 94% occupied, apart from Phoenix at 93%.

Phoenix was the location of most of the new supply, with more than 2,100 new units delivered. Las Vegas was the only other market with any new supply but added less than 500 new units. Net absorption in the Phoenix area surpassed its new supply by about 300 units, while Las Vegas managed to absorb double the units that were newly introduced.

Flagstaff saw rents rise by 1% in the quarter and was the only market in these states that failed to outperform the national average of 1.25%. Both Phoenix and Las Vegas, thanks in part to the new supply, both topped 2% growth. Tucson fell just short of the 2% mark, but only by five basis points. The best performing market was Reno, with a gain of more than 3.25% to end September with an average effective rent per unit of just under $1,270.

Idaho/Utah/Montana/Wyoming/Colorado

Unsurprisingly, most of the new construction activity for this region was in the Denver- Colorado Springs and Salk Lake City markets. The Denver- Colorado Springs area added over 4,000 new units, and Salt Lake City added more than 1,000. Montana and Boise, Idaho took advantage of the lack of deliveries and added about 1.6% and 1.25% to their average occupancy respectively. Each also ended September with average occupancy at 96%. Even with the new supply, the Denver- Colorado Springs area managed about a 0.6% gain to 91% and Salt Lake City ended the quarter up just under 0.5% to 91% as well. Wyoming was the lone geography in this region to lose ground, sliding back about 0.4% to 91%.

Only Wyoming fell short of the national average for effective rent growth amongst this group, with rents gaining about 0.1%. Boise and Salt Lake City each added more than 2% to their average rent. Denver- Colorado Springs and Montana did better than 1.25% growth.

North Dakota/South Dakota/Nebraska/Iowa/Kansas

Effective rent change wasn’t as rosy in this region. Multiple markets like Fargo, Rapid City and Sioux Falls managed to gain only 0.5% or less in average rent. Bismarck suffered a decline to the tune of nearly 1.5% in the period. The only areas to reach 1% appreciation were Des Moines and Lincoln, but both fell below the national average of 1.25%.

Movement in average occupancy was varied across these markets. The only new supply to speak of was the introduction of around 1,000 units in Omaha. Despite little to no supply pressure, occupancies slid in Bismarck by nearly 1.5%, in Lincoln by 0.1% and Omaha by nearly 2%.

On the other side of the coin, average occupancy rose in Sioux Falls and in Fargo by almost 3% in the quarter and by 1% in Des Moines. Each of these markets significantly outpaced the national average for occupancy percent growth. Having said that, many of the areas in these states are below the national average for occupancy. That includes each of the three markets just mentioned, as well as Wichita and Bismarck.

Oklahoma/Louisiana/Arkansas/Missouri

Average effective rent in every market in this group are significantly below the national average. Even so, some markets still saw negative rent growth. The average in Lake Charles fell by 1%, Columbia fell by 0.8% and Springfield declined by 0.25%. On the flip side, the Northwest Arkansas area, Monroe and St. Louis all rose by at least 1.5% from July through September. Places like Oklahoma City, Tulsa and Kansas City all gained more than 1%.

The nearly 1,300 new units added in the Kansas City area were nearly more than the remaining markets in this region combined. Other notable new supply included around 500 units in both Little Rock and St. Louis, and about 600 units in Baton Rouge. Despite the relative lack of new units, the only markets to not lag the national average for occupancy in the quarter were Springfield, Columbia and New Orleans at about 95%, 94% and 93% respectively.

Baton Rouge saw occupancies fall by more than 1.5% to end at just under 85%. Oklahoma City just managed to end the period at 90% after a 1% improvement, a threshold not broken there since the summer of 2015.

Texas

Rent gains in the primary Texas markets didn’t fare well in the third quarter. Austin saw appreciation of 2% as the lone bright spot, while Houston remained flat. Both Dallas-Fort Worth and San Antonio fell short of a 1% gain. The secondary and tertiary markets across the state were more of a mixed bag. The Abilene area saw rents climb by 3.5%, San Angelo topped 2% growth and Longview- Tyler touched 1.3%. Beaumont, Texarkana and Midland-Odessa all suffered retractions in effective rent, but at least in the case of Midland- Odessa, that isn’t terrible news. The area has been the most expensive for average rents in the entire state since the end of 2017.

The Dallas- Fort Worth market led the way by a large margin in new deliveries—with more than 5,300 brought to market in the quarter. Austin added just over 2,100 units during that span and San Antonio added just less than 1,100 units. No other Texas market added 1,000 or more, although Houston did fall slightly short at around 970 units.

Austin was the only market to add substantial units and still post a healthy average occupancy improvement. A 1.6% gain brought occupancy to about 91.5% to end September thanks to absorption north of 5,000 units. Other markets to surpass 1% occupancy growth were Amarillo, Harlingen, Laredo and Lubbock, all rising by 1-1.7%. Lufkin led the way with a gain just under 4% to end the quarter at 93.5%.

Areas such as Wichita Falls, Texarkana, Midland-Odessa and College Station all declined more than 1% in average occupancy.

Minnesota/Wisconsin/Illinois

There was less spread in rent growth between the markets in this region compared to some others. The Green Bay-Appleton-Oshkosh area led the way with a 1.1% increase, but Milwaukee, Peoria and Chicago were all right at 1%. Minneapolis-St. Paul fell just short of that group with a gain of 0.9%. Springfield and Madison both rose by about 0.4% and Moline was the lone market to lose ground—but by less than 0.2%.

Chicago has more new construction deliveries than the rest of this group combined with 1,200 new units. A net increase of 2,500 newly rented units was responsible for an occupancy gain of 0.5% to just over 90%. Absorption was also strong in Minneapolis-St. Paul. Over 1,500 units were newly rented while less than 300 were added. The result was average occupancy rising by about 0.75% in the quarter to end at 95.5%. Madison performed best in this group, with a 1.5% jump thanks to absorption of 600 units while introducing none.

Moline, Green Bay-Appleton-Oshkosh and Milwaukee all gave up ground due to absorption underperforming new supply. None declined by even 0.5%, so there isn’t much cause for concern.

Michigan/Ohio/Indiana

No market in these states gained more in average occupancy than the 0.5% increase in Indianapolis. Areas such as Fort Waye and Toledo saw some retraction, by 0.6% and 0.25% respectively. Both paled in comparison to the nearly 2% decline in the South Bend market. Despite a relative lack of occupancy growth, every market in this group remained above the national average to end September. Leading the way was Detroit, at about 96%. South Bend, Grand Rapids-Kalamazoo-Battle Creek and Toledo all maintained average occupancy above 94% as well.

Effective rents in this region tend to be below the national average, but rent growth was above average in areas across these states. Fort Wayne saw rents climb about 1.75% during the quarter, to end at about $736. The Grand Rapids-Kalamazoo-Battle Creek area did better, with a gain of 1.8%. This brought the average effective rent to around $870. The Cleveland-Akron market was another to manage 1.8% appreciation. Columbus, Cincinnati-Dayton, Detroit and South Bend all met, or exceeded, the national average in the period for rent growth. Evansville saw the smallest gain, at about 0.25% and Indianapolis fell just short of the national average with a 1.1% positive change.

Kentucky/Tennessee/West Virginia

Even without much new supply, occupancy gains were hard to come by here over the last three months. More new units were delivered in Nashville, nearly 700, than in any other market. Thanks to a net change in rented units of 2,500 units, occupancy rose by 2%. Lexington was the only other market where occupancy increased by even 0.5%. The 1.2% gain was enough to propel Lexington to 93% average occupancy. Knoxville lost almost a full percent and Charleston declined by just under 0.5%. Even with most areas moving laterally at best in the quarter, occupancies remain above 91% across this region.

Effective rents throughout the Tennessee markets drove growth for this region in the period. Rent growth in Chattanooga topped 2%, and was closely followed by Knoxville, Memphis and Nashville with gains of 1.8%, 1.75% and 1.4% respectively. It’s no coincidence these are also the markets with the notable new construction activity. Given the healthy absorption in each, it’s clear these higher priced new deliveries are being met with demand.

Charleston rents rose by 0.8% in the quarter, while both Kentucky markets grew less than 0.5%.

Virginia/DC/Maryland

At 96%, Roanoke is the only market in this group to end the quarter with an average occupancy not falling within 93-94%. There’s been no new supply to speak of in Roanoke over the last 12-months, and the 1.2% quarterly occupancy gain was the first above 1% for the area since Q3 of 2017. The DC metro added about 1,300 units and absorbed almost 4,500 net units. This resulted in a 0.75% occupancy move. Baltimore took advantage in a break from major deliveries to add more than 1.25% in occupancy after renting 2,100 net new units. Like Roanoke, Norfolk also gained 1.2% in a period with no new units.

Likely due to the decreased deliveries in Baltimore, the markets in this region with lower average rents drove the rent growth in Q3. Roanoke saw rents climb by 1.7%, and Richmond was right behind at 1.6%. DC came in just above 1% for growth in the period, bringing the average effective rent to about $1790 per unit. Baltimore fell short of 1%, but just so, with a gain of 0.9%.

Mississippi/Alabama/Georgia/South Carolina/ North Carolina

The new construction pipeline has its fingerprints on the performance of this region. The markets lagging in average occupancy are those that have struggled with the flow of new units. Mobile occupancy declined by 0.5% to end the period at about 89% while delivering no units. But the market is still failing to absorb the more than 600 new units delivered in the last year. Augusta occupancy declined by 0.75% to end September a hair under 90% despite no new supply as well. Like Mobile though, there are still 500 new units from the previous quarters that have yet to offset by net absorption. Asheville has seen average occupancy decline from 93.5% to begin Q3 2017 to 87% to end Q3 2018 thanks to 1,500 new units in that span. Net absorption in that time has totaled less than 600 units.

The larger markets have fared better. Atlanta added about 1,200 new units while absorbing 5,700. This drove occupancy up by about 1.25% to end September at 92.5%. Raleigh-Durham had 2,600 newly rented units in the period after adding only 1,200. This improved occupancy by about 1%. Similarly, Charleston gained 3% in average occupancy thanks to absorption that was more than six times the 200 new units added.

Rent growth was very good in much of this region. Effective rents in Myrtle Beach rose 2.4%, Wilmington managed 2.2% and Savannah touched 2%. Average rent in Atlanta, Asheville, Macon, Greensboro-Winston Salem and Greenville-Spartanburg each grew between 1.8% and 1.9% in the period. Only the Jackson-Central Mississippi area went the wrong way, with a decline of about 0.15%.

Florida

Florida is another part of the country we’ve been watching closely because of the new construction activity. Markets like Fort Myers-Naples, Jacksonville and Orlando have struggled to keep pace—and Tampa has barely done so. Fort Myers-Naples suffered a 1.4% occupancy decline thanks to negative absorption on top of the addition of nearly 300 new units. Jacksonville has added 3,000 units since the start of Q3 2017 while newly renting only 2,200 net units. Orlando had added more units than were absorbed in three straight quarters before delivering no new units in Q3 2018. Thanks to the break in new supply, occupancy rose by 1.4% in the period to get back to 92%.

Tallahassee led the way for the state with a quarterly occupancy gain of 3.25% to cross 90% occupancy for the first time in more than a year. Miami-Fort Lauderdale performed well too. Thanks to absorbed units nearly tripling new supply, occupancy rose by 1.6% to end at just under 92%. Gainesville managed a 1% improvement. Jacksonville, Melbourne and Palm Beach all lost ground, with Palm Beach representing the worst decline at 0.8%.

Tallahassee also led the way for effective rent growth by being the only market to jump more than 3%–ending up 3.25%. Pensacola came in just behind with a 2.9% change to end the quarter at $1,060 per unit. The other big mover was the 2% gain in Gainesville. Rents in Orlando rose about 1.3%, while Miami-Fort Lauderdale, Tampa and Palm Beach each ended the quarter up by 1%.

Pennsylvania/New York/New Jersey/Delaware

The New York City metro area added more units than the rest of this group combined, though this shouldn’t be a surprise. 4,300 units were delivered between July and September, and average occupancy rose 30 basis points to 90.3% thanks to 5,000 newly rented units. The Philadelphia market added around 425 new units, the fewest in more than a year. This pushed occupancy up by just under 1% to end the period at just over 94%. Pittsburgh performed best, with a 2.2% growth rate due to healthy absorption and a pause in construction pipeline deliveries. The upstate New York area remains near 95% occupancy representing a gain of about 0.5% in the quarter.

Pittsburgh also led the way in effective rent growth. A 1.4% change brought the average to around $1,150 per unit. The Buffalo-Rochester-Syracuse market added 1.25%, and the New York metro area gained 1%. Philadelphia rent grew by 0.8% bringing the average to just under $1,300 per unit. Regarding rent on a per-unit basis, New York still doubles the next highest market in this region with an average effective rent a little above $2,600.

Connecticut/Rhode Island/Massachusetts/New Hampshire/Vermont/Maine

Boston and Providence were the only areas with notable construction deliveries in the period, with about 600 and 300 new units respectively. Boston paced the field in occupancy growth thanks to net absorption coming just short of 3,800 units. The resulting 2.3% gain brought the market average to about 92.5% to end September. Providence managed to add nearly 600 newly rented units to offset new supply, and a 1.4% occupancy growth meant the market ended the period above 96%. The 0.9% improvement in Springfield was the only other to be above 0.5% in this group.

Effective rent growth was healthy across the board. Only Hartford, at 1% appreciation, fell below the national growth average of 1.25%. Concord rents rose by 3%, Providence 3.1% and just under 2% in Boston. Springfield and Vermont overall did better than 1.5% growth as well.

Takeaways

Rent growth has declined from the unsustainable levels earlier in the cycle. However, rents continue to climb at a moderate pace without the aid of significantly rising concessions. Occupancy growth has also slowed, but few markets seem in danger of sliding lower than 90%. The new construction pipeline also slowed in the quarter. This was a necessary adjustment given there were signs of market softening appearing in areas across the county to open the year.

It appears legitimate demand remains strong enough to continue an upward, if shallower, trajectory moving forward. Coming up are the seasonally down quarters, but short of a major economic change or a major ramp-up in new supply, the current cycle appears ready to continue its marathon.

Note: All numbers referenced are based on conventional multifamily units in ALN’s markets.

*Net absorption refers to the net change in rented units over a specified period of time

Nationwide Multifamily Data

ALN OnLine makes it easy to research individual properties, submarkets, markets and more – available nationwide and with flexible pricing options!