Mid-Year 2019 – Sizing Up Multifamily Performance

July is here, and that means that it’s time for our mid-year review. (That also means we just came back from the NAA Apartmentalize conference and expo in Denver!) Let’s look at how the multifamily industry has performed through the first two quarters by looking at some highlights as we move across the country by region. Unless stated otherwise, all numbers will refer to conventional units.

View the full monthly Markets Stats PDF

Mid-Year Nationwide

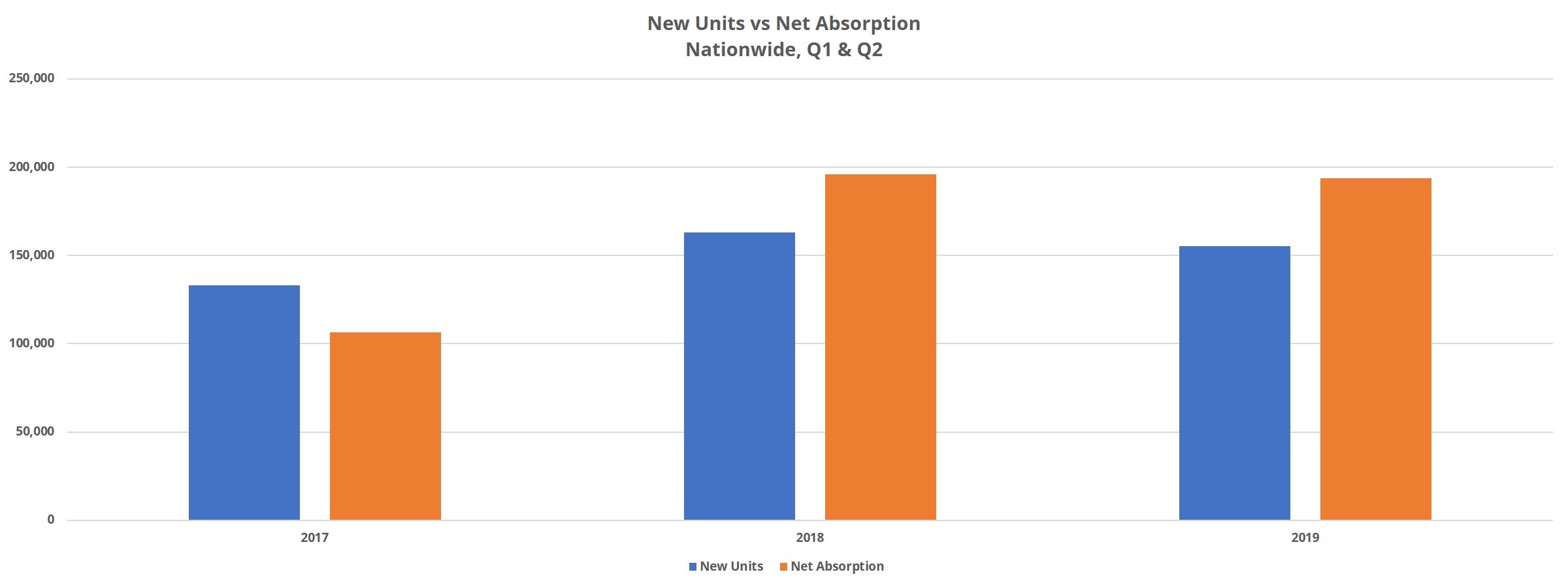

Nearly 1,000 new properties comprised of more than 155,000 units were delivered in the first half of the year. This marks a slight reduction of about 7,000 units from the same period in 2018. National average occupancy ended June just above 92%, which is where it was to open the year. Average effective rent gain so far this year is at about 2.9%, which is below the 3.5% appreciation in the opening half of 2018.

Washington/Oregon

The biggest story in this group is the continued growth in Seattle. The market added nearly 6,000 new units while net absorption* was more than 8,000 units. This led to an average occupancy gain of nearly 1% to end June just above 93%. Despite coming into the year with average effective rent per unit already in the top 10% of markets nationally, rent growth surpassed the 2.9% nationwide mark in the first two quarters—gaining about 3.8% to finish at just below $1,800 per unit.

The Portland market has also been active this year, adding almost 4,000 units. Here though, net absorption hasn’t quite kept pace, with about 2,000 apartments newly rented. The result has been a 1% decline in average occupancy to 93%. Average effective rent gain in Portland was equal to the national average of 2.9%, which brought the average rent per unit to about $1,350 per month.

California

Like Seattle, the Los Angeles – OC market fell within the top 10% of markets nationwide for both new units and absorption. The area added around 4,300 new units and absorbed just over 4,100 units. This balance accounted for flat average occupancy in the period, and it ended June at just above 93%. However, rent growth failed to reach even 2%, thanks in some part to an increase in the availability and value of rent concessions.

The San Francisco – Oakland region was the other California market with robust new supply. Nearly 3,300 new units were added in the last six months. Demand was solid, as just less than 3,000 units were newly rented. As a result, average occupancy gained around 12 basis points to finish on-par with the Los Angeles – OC market. Rent growth of 2.5% is just below the national average, but this area is already home to the highest average rent in the country – $2,800 monthly per unit.

The San Joaquin Valley market had a strong first half of the year. Less than 500 units were added, but net absorption was nearly 1,000 units and average occupancy was 97% as of the end of June. Rent growth was 3.9% – the highest in the state, thanks to unfilled demand and a resulting decrease in rent concessions.

Arizona/Nevada/New Mexico

Phoenix led the way in this group with new units, adding nearly 3,900. Thanks to nearly 6,000 previously vacant units being rented, average occupancy rose by about 20 basis points to finish June at 93%. Average effective rent growth was robust, managing a 5.5% gain in the period.

Las Vegas was the other market in these states to add at least 1,000 new units, delivering just under 1,400. Demand wasn’t quite equal, with about 1,100 absorbed units in the same span. However, average occupancy finished up Q2 2019 above 94%. Here too, rent growth was strong. Las Vegas added about 5.4% to average effective rent.

Another market of note in this region is Albuquerque. In fact, it bears some resemblance to another smaller market mentioned earlier, San Joaquin Valley. There wasn’t much new supply to speak of – less than 300 units – but net absorption topped 1,000 units. Average occupancy ended June at just below 96% as a result. As with San Joaquin Valley, effective rent change in Albuquerque was the strongest in this group of markets – at 5.6%.

Idaho/Utah/Colorado

The Denver – Colorado Springs market is off to a very strong 2019. The market added just less than 6,000 new units in the first two quarters and absorbed about 11,000 units. The effect was average occupancy crossing the 91% mark to end June. This area was already home to one of the higher average effective rents in the country before beginning 2019 with a rent gain of about 4%, well above the national average. As of the end of June, average monthly rent is about $1,500 per unit.

The Salt Lake City area also had a fair bit of construction activity, adding just below 1,500 new units. Demand was up to the task, and a little more than 1,500 units were newly rented to keep occupancy at a hair over 92%. Rent growth fell just short of the national average, coming in at 2.8%.

The Boise market added a few new properties in the period and gained just more than 1% in average occupancy thanks to healthy absorption. Rent growth was the story though, as rents climbed more than 6% to finish up the second quarter at $1,100 per unit per month.

North Dakota/South Dakota/Nebraska/Iowa/Kansas

The major mover in this region for the first two quarters was Omaha. The area added more than 1,200 new units, and net absorption was almost 1,400 units. Unsurprisingly, average occupancy was essentially flat, ending June at about 92%. Average effective rent growth was only about 2%, due in some part to the increase in the average concession package value offered for new leases.

Another interesting market was Des Moines, where less than 300 new units were delivered but more than 700 units were newly rented. The 2% jump in average occupancy brought the market average up to 92%. Rent growth was a tepid 1.6% though, which was the lowest mark of any market in this group with at least 75 conventional properties.

Bismarck continues to exhibit the symptoms of some other tertiary markets around the country. A lack of new units combined with existing demand have created a situation where average occupancy is above 95% and rents are more expensive than would be typical for a market of its size. Thanks to rent growth above 4% so far in 2019, the average rent per unit is now more than $950 per month. That is high enough to be in the top 10% of more than 180 ALN markets across the country.

Oklahoma/Louisiana/Arkansas/Missouri

The Oklahoma City market was the site of the most new construction in this group in the opening half of 2019. The area added more than 1,100 new units, but the total number of rented units increased by only about 800. This drove average occupancy down by about 40 basis points to finish Q2 2019 at just under 90%.

In other larger markets in this region, demand was quite positive. Little Rock absorbed more than 1,500 units and saw average occupancy rise nearly 3% to just above 92%. New Orleans gained around 50 basis points in average occupancy to just over 92% after adding about 900 new units but absorbing over 1,100. Kansas City and St. Louis added more than 2,000 newly rented units each, and both ended June at 92% occupancy as well.

For the most part rents in this region are comfortably below the national average. With a couple of exceptions, rent growth in the first two quarters was tepid. New Orleans managed a 3.5% increase in average effective rent. That increase put the average rent over $1,000 per month for the first time and added New Orleans to the top 10% of markets nationally for average effective rent. That was surpassed only by the 3.6% gain in St. Louis. Oklahoma City and the Northwest Arkansas area each managed to hit 3% rent growth in the period.

Texas

No market in the country added more units, or absorbed more units, than the Dallas – Fort Worth (DFW) market to start the year. It isn’t even close. More than 12,000 new units were delivered in the last six months, and the number of rented units increased by over 15,000. Thanks to this demand, average occupancy rose about 70 basis points despite the flood of units to finish June at 91%. Rent growth was slightly below the 2.9% national mark at 2.7%, bringing the average unit to just under $1,200 per month.

Behind DFW, Houston was the location of the second highest absorption number in the county. There were almost 9,400 more rented units in the area than at the end of 2018, and 6,000 new construction units hit the market during that time. Also, like DFW, average occupancy rose by around 70 basis points, and finished just over 90%. Rent growth was 2% in the period, bringing the average unit to about $1,100 per month.

The Austin market continues to be active as well, with 5,700 units added and almost 5,400 units absorbed. Occupancy remained flat, ending June a hair under 92%. Of the major Texas markets, this area is where rents are still rising significantly. An average effective rent gain of more than 4% brought the average unit to $1,300 per month.

San Antonio added only about 2,500 new units but absorbed 3,500 to bring average occupancy back to 90%. Rent growth was strong here as well, rising 3.5% in the first six months of 2019 to finish at a little over $1,000 per month.

Minnesota/Wisconsin/Illinois

With 5,700 new units delivered, the Chicago area added more new units than the rest of the markets in this region combined. Demand wasn’t quite up to pace though, as only about 4,300 units were newly rented in the opening six months of the year. This resulted in a 40-basis point reduction in average occupancy down to 90%. Rent growth was a strong 4% in the period, bringing the average unit to about $1,600 per month.

The Minneapolis – St. Paul area added 2,500 new units, a number equaled by net absorption. The market remains at 95% average occupancy and effective rent growth of 3.5% brought the average rent to $1,300 per month as of the end of June.

The market with the strongest demand in this group was Milwaukee, with more than 6,100 units newly rented. Thanks to a drawback in deliveries, the result was a nearly 2.5% jump in average occupancy to just over 93%. Rent change was in-line with the national average with an increase of 3% to about $1,100 monthly per unit.

Michigan/Ohio/Indiana

The Indianapolis market delivered about 1,000 new units in the period but added more than 2,100 rented units that were previously vacant. That volume of absorbed units put the area in the top 10% of markets nationally and the result was an uptick in average occupancy to just over 92%. Rent growth was a respectable 2.5%, which brought average monthly rent to $900 per unit.

Leading the way in new construction was the Columbus market with nearly 2,500 new units. Strong absorption nearing 2,000 units was enough to minimize the occupancy impact of the new units. Average occupancy fell about 45-basis points to finish just shy of 92%.

The other active market to start 2019 was Detroit, where more than 1,500 units were brought to market. Average occupancy there remains at 95% thanks to more than 1,400 previously vacant apartments now being occupied. Average effective rent per unit also crossed the $1,000 threshold after a 3% gain.

Kentucky/Tennessee/West Virginia

Adding almost as many new units as the rest of the markets in this group combined took its toll on average occupancy in Louisville. After delivering 2,000 new units but adding only 1,200 newly rented units, average occupancy declined by 125 basis points to 90%. On the flip side of the coin, average effective rent growth was a strong 3.7%, well above the national average.

Nashville introduced about 1,000 new units and rented almost 3,300 previously unoccupied units. This resulted in a 2.1% average occupancy gain to finish June at almost 93%. Average effective rent rose by 3.5%, bringing the average unit to around $1,230 per month.

Charleston had a less rosy first half of the year. Despite no new units, average occupancy fell by about 40 basis points due to negative absorption. However, average occupancy remains above 93%. Rent growth was an anemic 1.5% with the average unit now leasing at $900 per month.

Virginia/DC/Maryland

The Washington DC market, with its 5,600 new units, led the way in this region in new supply. Thanks to absorption of almost 5,700 units, there was a slight uptick of about 25 basis points in the area’s average occupancy to almost 94%. Rent growth was a healthy 2.5% relative to the 2.9% national average, and average effective rent settled just above $1,800 per month as of the end of June.

Baltimore, Norfolk and Richmond each added right around 1,100 new units in the period. Baltimore stood out in that almost 2,700 units were newly rented in the first half of the year. Norfolk managed absorption of around 1,500 units and Richmond filled 1,000 previously unoccupied units. There are other similarities in the performance of these markets as well. Baltimore, Norfolk and Richmond ended Q2 2019 with average occupancy at 94%, 94% and 93% respectively – all marginally above the national average of 92%.

Baltimore, with an average effective rent per unit of about $1,350, is slightly pricier than Norfolk and Richmond. Norfolk average effective rent rose by 2.6% to finish just above $1,100, and Richmond managed a 3.3% gain to a little more than $1,100 as well.

Mississippi/Alabama/Georgia/South Carolina/ North Carolina

Less than 400 units were delivered across the Alabama markets in total, more than half located in the Huntsville market. Montgomery experienced a 75-basis point increase in average occupancy to finish June at just above 90%. Mobile experienced the largest change, with a 120-basis point increase to end the quarter slightly below 90%. Rent growth was healthy across the state, with no market gaining less in average effective rent than the 2.25% increase in Montgomery. Leading the way in rent growth was Huntsville, where average effective rent rose by more than 4.5% to finish the period at almost $800 per unit monthly.

Atlanta ended June with an average occupancy of 92% after a 20-basis point slide after net absorption of about 3,700 units and the introduction of 4,500 new units. Rent growth was strong at 3.7% bringing he average unit to approximately $1,250 per month. Augusta managed a 5% improvement in average occupancy to almost 92% thanks to 1,000 newly rented units in a period where less than 100 new units were delivered. Other strong performers when it comes to rent include Savannah and Augusta, which added 3% and 4% respectively to their average effective rent.

Like Alabama, the Mississippi markets haven’t had much new construction activity so far this year. After an average occupancy gain of about 50 basis points in both the Gulfport – Biloxi and Jackson – Central Mississippi markets, the areas ended the second quarter with an average occupancy of 92% and 94% respectively. Rent growth was about the national average. Gulfport – Biloxi managed about a 2.3% gain and the Jackson – Central Mississippi area saw average rent climb nearly 3%.

Myrtle Beach, Greenville – Spartanburg and Charleston each added 2,000 or more new units, while in North Carolina, Raleigh – Durham added more than 3,000. None of those markets managed to outpace the new supply with newly rented units in a region that had lackluster occupancy results. Columbia, SC was the only market to gain more than 1% in average occupancy, rising 1.7% to finish at 92%.

Raleigh – Durham and Charleston were essentially flat, with average occupancy of just under 92% and 87% respectively. On the other hand, rent growth was strong for most of the markets in these two states. Fayetteville, Greensboro – Winston Salem, Raleigh – Durham and Greenville – Spartanburg all topped 3% effective rent growth. Even better, Wilmington and Charleston topped 5%.

Florida

Orlando added 6,000 new units in the first six months of the year. That was, by far, the most of any market in Florida. Only about 3,300 previously vacant units were leased in the period though, so average occupancy fell nearly 2% to 91%. Effective rent growth was a respectable 2.9%, bringing the average unit to just over $1,300 per month.

Tampa and Miami each added more than 3,000 new units and while Miami suffered negative net absorption to the tune of 1,200 units, Tampa had almost 4,700 vacant units rented in the period. The result is that Miami’s average occupancy dipped just below 90%, whereas Tampa is approaching 92%. Each area managed 2.5% effective rent growth, and the average Miami unit remains about $100 per month more expensive than in Tampa.

Fort Myers – Naples delivered 2,600 new construction units, but only increased the number of rented units in the market by about 1,900. Average occupancy fell 5% in the first half of 2019, ending June at 85%. Rent growth failed to hit 2% and the average monthly rent is now about $1,300 per unit.

Fort Lauderdale managed to increase the number of rented units by almost 1,700 units while at the same time bringing about 1,600 new units to market. Similarly, Jacksonville added about 1,100 new units and was able to increase the number of rented units by almost 1,400. Both markets are hovering around 92% for average occupancy.

Jacksonville added 2% to average effective rent bringing the average unit rent to almost $1,100. Fort Lauderdale average effective rent gained nearly 1.5% to finish above $1,650 per unit.

Pennsylvania/New York/New Jersey

The New York City market introduced over 5,300 new units to start the year and the number of leased units increased by almost 8,900 units. This strong demand contributed to a 1.4% increase in average occupancy for the area, which ended June just below 92%. Effective rent rose by slightly less than 2% and the average unit rent was about $2,600 as of the end of June.

Philadelphia, the only other market in this group to deliver at least 1,000 new units in the first two quarters, added 1,800 new units. Demand was more than enough, and net absorption was almost 3,700 units. Average occupancy ended the period just above 94%. Rent growth of 2.7% fell just shy of the national average, but at about $1,350 per unit, Philadelphia remains in the top 10% of markets for average effective rent.

Pittsburgh took advantage of a break in deliveries with a 1.6% jump in average occupancy to over 94% after 1,300 units were newly rented. Average effective rent growth was a little below the national average of 2.9% at about 2.3% and the average unit now rents for about $1,100 per month.

Connecticut/Rhode Island/Massachusetts/New Hampshire

Only two markets in these states added any new units in the first half of the year, Hartford and Boston. Hartford added about 700 new units and about 700 new units were newly rented in the period as well. Average occupancy ended at about 93% and a 2.8% increase in average effective rent brought the average unit to about $1,350 per month.

Boston added more than 3,100 units with net absorption of about 2,500 units for a 70-basis point average occupancy loss. This decrease pushed occupancy to just below 93%. Average effective rent per unit now stands at around $2,300 after an almost 3% gain in the first half of the year.

No other market in this group saw occupancy move more than 50 basis points in either direction. Concord led the way in rent growth with a 4% gain and Providence saw a 3% rise in average effective rent.

Mid-Year Takeaways

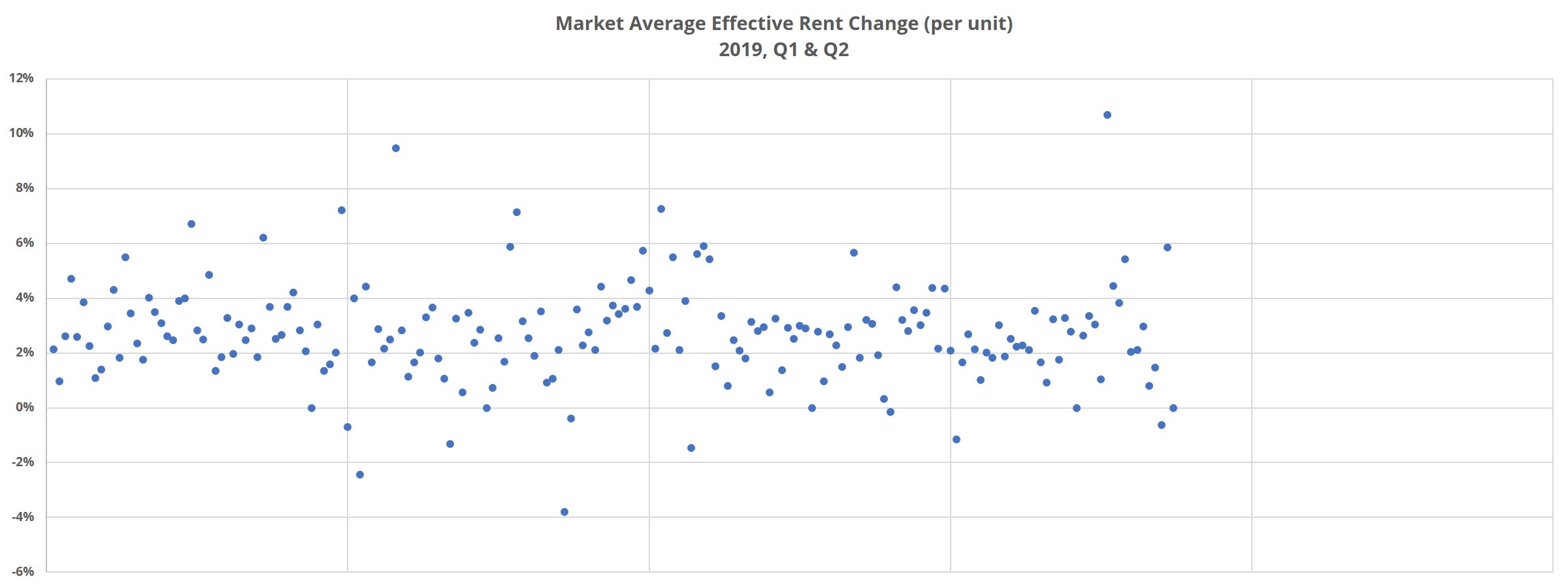

The opening half of 2019 wasn’t a bad one for multifamily, but the overall picture is one of continued slowing growth. For the most part, market average occupancies are bunched in the 90-93% range and effective rent growth was less than 3% in more than 60% of markets in the country. Even among those above that threshold, there were far fewer than in previous years with gains of 5% or more.

There are still plenty of markets performing very well, but compared to earlier periods in this cycle, there is more variance in performance between markets. As we look ahead, one thing to keep an eye on is the potential for further overheating in markets continuing to deliver a large volume of new units despite occupancy softness.

*Net absorption refers to the net change in the number of rented units.

Disclaimer: All content and information within this article is for informational purposes only. ALN Apartment Data, Inc. makes no representation as to the accuracy or completeness of any information in this or any other article posted on this site or found by following any link on this site. The owner will not be held liable for any losses, injuries, or damages from the display or use of this information. All content and information in this article may be shared provided a link to the article or website is included in the shared content.