Is Multifamily Overbuilding?

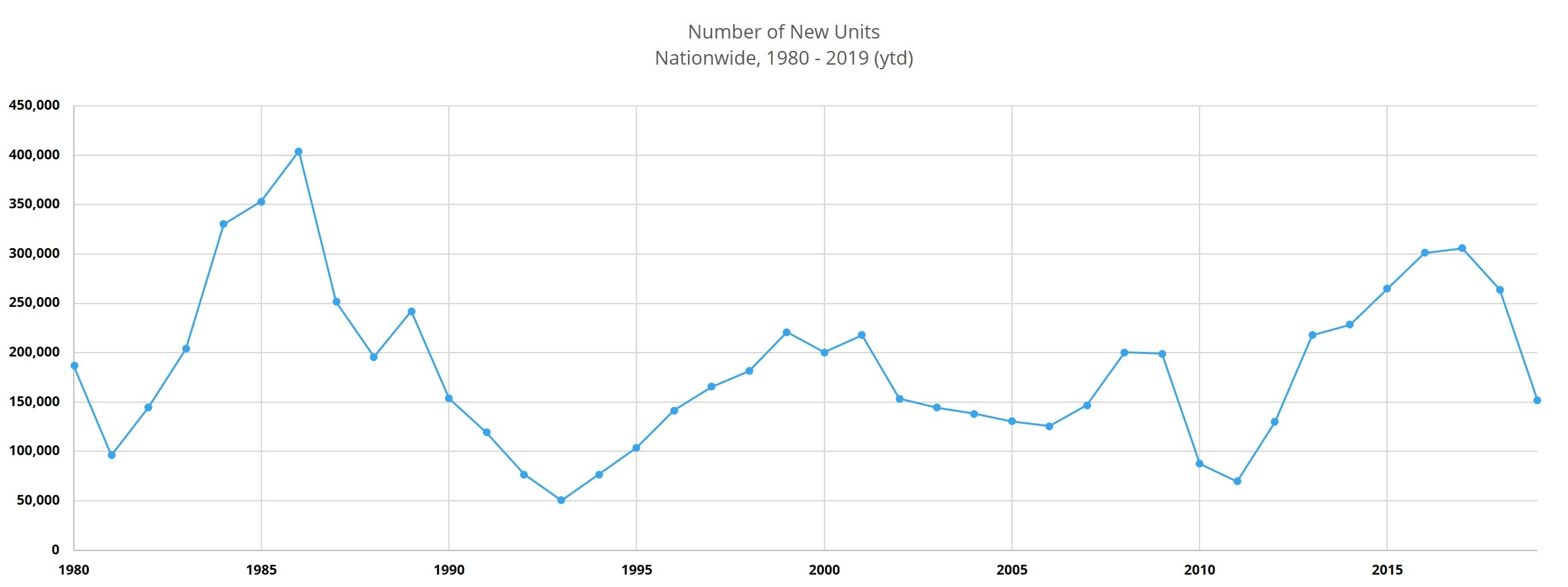

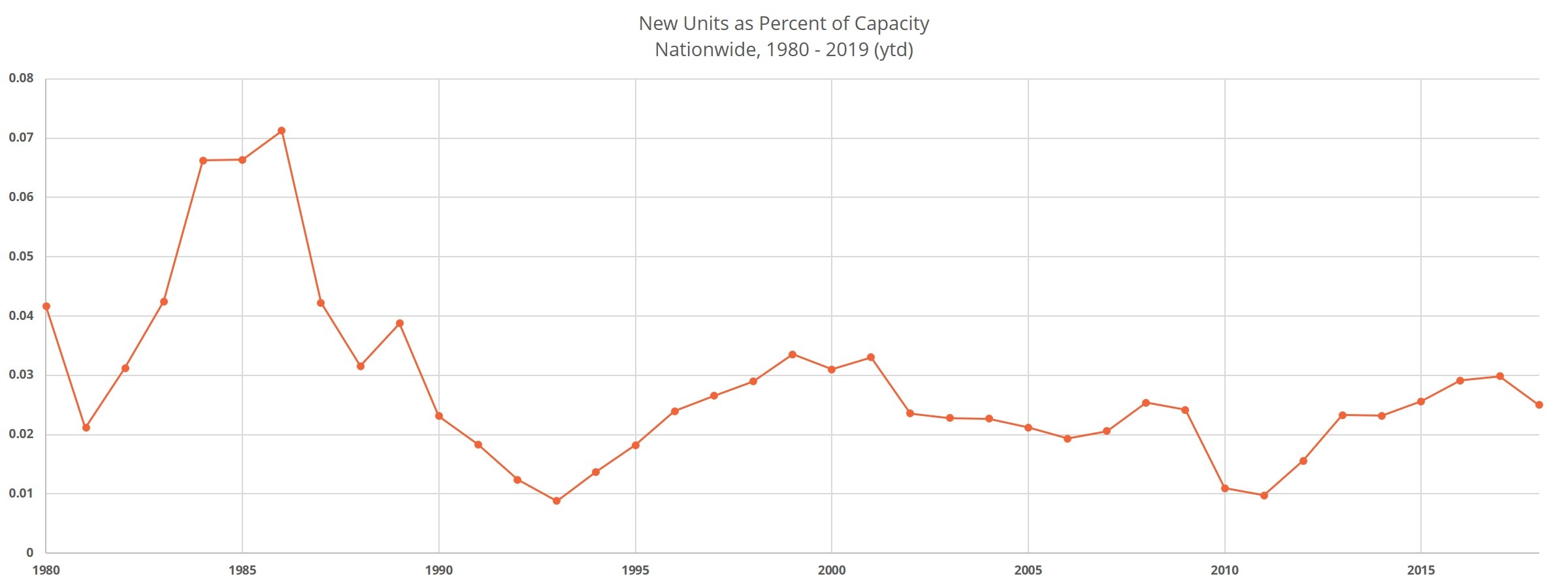

This decade, more than 2 million new multifamily units have been added across the US. In terms of raw numbers, this volume hasn’t been seen since the 2.4 million new units introduced in the 1980’s. However, if we consider annual new units as a percent of existing capacity, the annual average of 2% for this decade falls well short of the 5% average from the 1980’s.

What has been the effect of this new supply? Are we approaching an overbuild threshold? To examine these questions and others, we will look at vacancies within conventional properties with at least 50 units. We will look at the current new construction pipeline and its implications given recent net absorption* performance. Rather than just dealing with nationwide numbers, specific markets will be looked at.

View the full monthly Markets Stats PDF

Vacancies

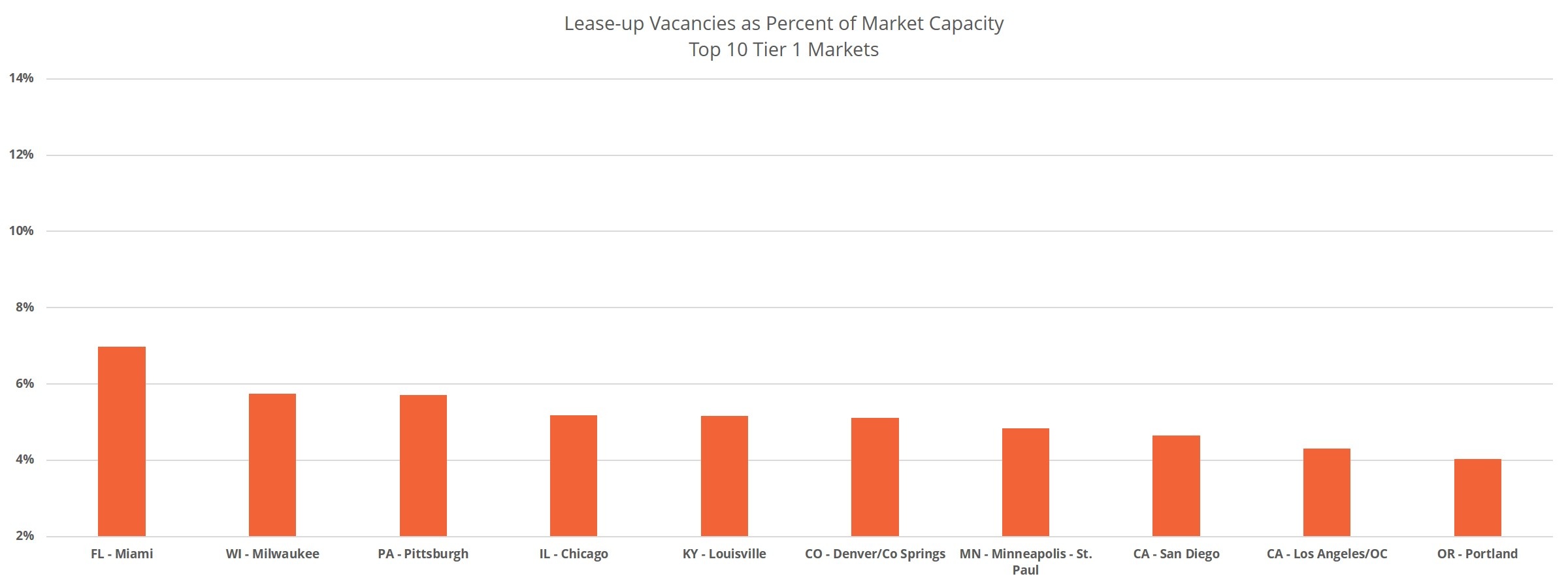

Before considering the new construction pipeline, it’s relevant to check in on how recently delivered new supply has fared. As recently as 15 months ago, only two markets had more than 10,000 vacant lease-up units. As of the end of July 2019 there are five. Of the 99 ALN markets with units currently in lease-up, the average market has about 3,300 vacant lease-up units.

The Los Angeles market has about 21,500 vacancies in lease-up properties, which about 5% of its existing capacity. The Dallas – Fort Worth market also has a little more than 21,000 vacant lease-up units, almost 3% of existing capacity. Other markets that stand out include New York City, Denver and Chicago – each with around 15,000 vacant lease-up units.

Vacancies are not necessarily a bad thing, lease-ups are not instantaneous. For an area like Dallas – Fort Worth, with an average of 18,000 units absorbed annually over the last three year-over-year periods, 21,000 vacant lease-up units isn’t a terrible number. For a market like Chicago, 15,000 lease-up vacancies represent more than two years of average absorption.

Los Angeles, with 21,000 lease-up vacancies is similarly situated with an average annual absorption of 10,000 units over the last three 12-month periods. These numbers reflect the backlog of new units, they don’t account for supply still on its way.

Under Construction Units

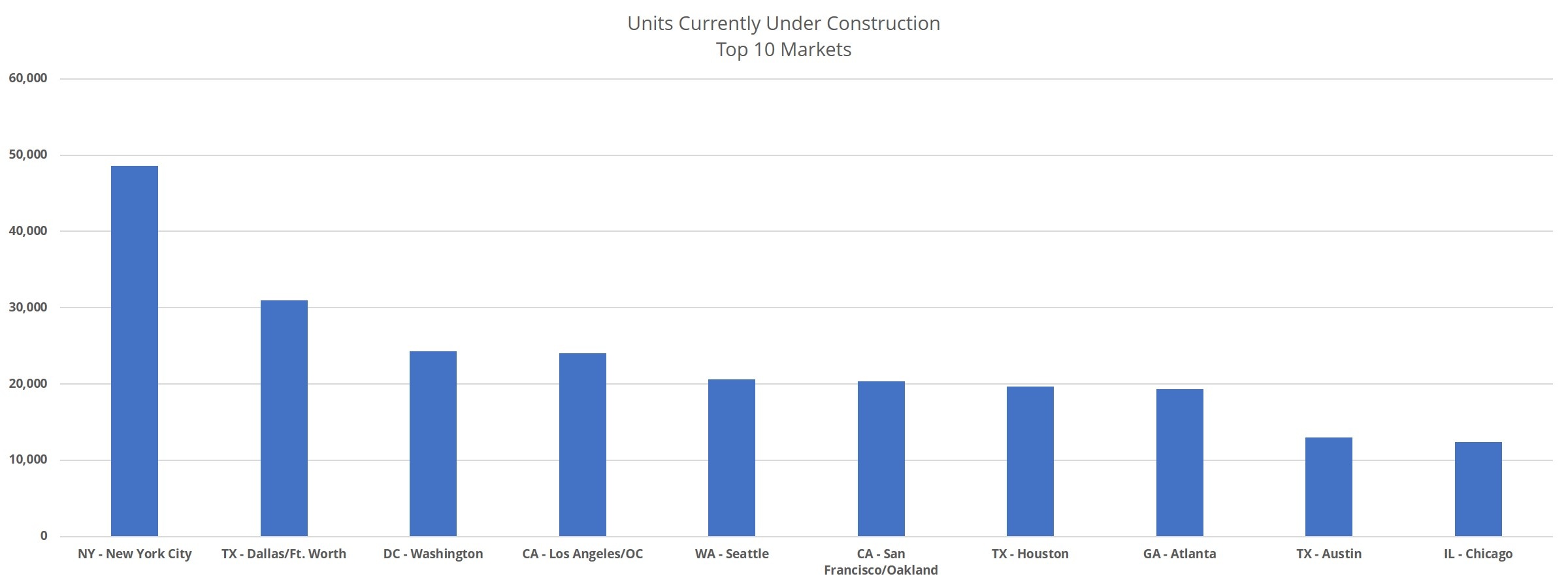

Under construction properties represent new multifamily units that will be delivered regardless of circumstance, whereas pre-construction projects can be delayed or cancelled if market conditions change. We typically expect new construction properties to enter the market within two years. In terms of units currently under construction, the top five markets contain some familiar names.

Did you read our recap from NAA in Denver?

The New York market has nearly 49,000 new multifamily units under construction. Dallas – Fort Worth has 31,000 units, Washington DC has about 24,000 units, Los Angeles also has about 24,000 units and Seattle has nearly 21,000 units currently being built.

Under Construction Units vs Absorption

In the case of Seattle, these units under construction are equal to almost 8% of the area’s existing capacity. Add to this the 7,100 vacant lease-up units in Seattle and factor in the average annual absorption for the last 36 months of about 8,300 units. What we get is a market that averages 8,300 newly rented units per year with about 28,000 new units to be filled in the next couple of years.

For New York, the picture is similar. 49,000 new construction units is in addition to almost 16,000 vacant lease-up units. Annual net absorption for the area has averaged about 13,600 units for the last three annual periods. This means that within the next two years, new supply will total almost five years of average annual absorption.

Another market that stands out is Detroit. The area has over 6,600 vacant lease-up units and another 7,000 new multifamily units currently being built. Combined, these account for almost 6% of market capacity. More worrying, the average annual absorption in Detroit over the previous 36 months was a meager 46 units.

Takeaways

All told, there are 18 markets across the country with more units currently under construction than have been absorbed in the prior three years. Once currently vacant lease-up units are added in, that number rises to 52 markets. This means for about 30% of markets, average occupancy will fall without an uptick in demand. Another 27 markets will need to maintain their current level of demand as these units hit the market to maintain current average occupancy.

Economic indicators like wage growth, job growth and unemployment have looked promising this year, but there are also causes for concern. The trade war is beginning to have an impact and equity volatility has ramped up.

Any notable macroeconomic change is likely to further darken the picture for the 40% or so of markets that are approaching, or already across, the overbuild threshold. While there doesn’t appear to have been much of a draw down in pre-construction units, we anticipate such adjustments in various markets across the country.

*Net absorption (or absorption) refers to net change in the number of rented units

Disclaimer: All content and information within this article is for informational purposes only. ALN Apartment Data, Inc. makes no representation as to the accuracy or completeness of any information in this or any other article posted on this site or found by following any link on this site. The owner will not be held liable for any losses, injuries, or damages from the display or use of this information. All content and information in this article may be shared provided a link to the article or website is included in the shared content.