Are New Construction Deliveries Balanced with Demand?

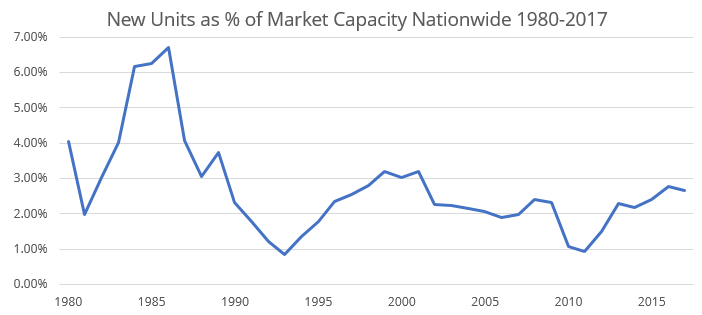

It’s been about seven years since the overall national multifamily market bottomed out during the Great Recession. While we’ve been in a construction boom of sorts in the time since, by historical standards, the industry is still within the normal range of production.

View the full monthly Markets Stats PDF

From 1980 until the present day, the median number of units added nationwide as a percentage of the current total unit count in the market has been 2.4%. Aside from the zealous overbuilding in the mid-80’s, the only time that the new unit percentage has surpassed 3% was at the turn of the century. In 2017, nationally, new units accounted for 2.7% of the current inventory. While not too far from the historical median, the numbers are trending upward and there are some areas of the country that are showing signs of overbuild.

Vacancies vs Market Capacity

Construction pipeline notwithstanding, a few markets are already having some vacancy issues in lease-up properties. Miami/Ft. Lauderdale had nearly 8,000 new vacant units to end February 2018, which is slightly over 4% of the market’s total capacity. By market capacity, we mean the current total number of units in the market. Boston had over 6,500 vacant lease-up units at the end of February 2018, representing just under 4% of the total market capacity.

Vacant units aren’t necessarily a terrible thing, as lease-ups aren’t instantaneous. And yet, over the last two years, Miami/Ft. Lauderdale has averaged an annual net absorption of about 3,300 units and Boston has averaged about 6,000 units. Were there to be no further deliveries in these markets, there is a supply of new units in lease-up that would take almost 2 and one-half years, and about one year, respectively to be absorbed.

Fortunately for Boston, the number of units under construction is currently less than the average number of units absorbed annually. On the other hand, Miami/Ft. Lauderdale has over 11,000 units currently being built and are yet to start leasing.

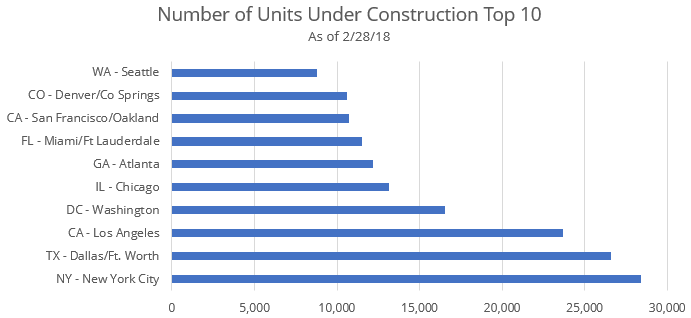

Under Construction Units

Under construction properties represent units that will be delivered regardless of circumstance. Pre-construction projects, in theory, can be delayed or cancelled if market conditions aren’t right. In terms of units currently under construction, the top three metro areas nationally are New York City, Dallas/Ft. Worth and Los Angeles. All have more than 20,000 units under construction.

When looking at current lease-up vacancies as a percentage of market capacity, all three of these markets fare better than Miami/Ft. Lauderdale and Boston. DFW, however, has crept above 3% with about 23,000 new unit vacancies. That number leads the nation, but so does the inventory of at nearly 750,000 units in that market.

Under Construction Units vs Absorption

The difference between markets like Boston or Miami/Ft. Lauderdale and areas like New York, DFW or LA comes from average absorption. Over the last two years, the New York metro area has averaged over 10,000 annual net units absorbed. DFW has averaged almost 16,000 units and Los Angeles has averaged about 8,500 units.

Accounting for current new unit vacancies, units under construction and average annual absorption, even these areas are above the median for Tier One markets of 2.4 years’ worth of units. The New York metro area has 3.3 years’ worth of supply, DFW 3.2 years’ worth and Los Angeles 2.25.

The large markets most at risk from the perspective of this metric include areas like Chicago, Detroit and Baltimore. The Chicago metro area has over 13,000 units currently under construction and another 7,500 vacant lease-up units while absorbing about 4,600 net units annually on average. Baltimore has about 3,000 vacant lease-up units with nearly 2,000 under construction while absorbing only about 1,100 units annually on average over the last two years.

Like Baltimore, Detroit suffers less from the magnitude of new units, and more from lackluster average annual absorption. With only about 5,000 units under construction or vacant in lease-ups, the situation really isn’t on the same scale as some other markets.

Takeaways

Despite the national numbers looking somewhat benign, there are definitely some areas where new construction deliveries are not balanced with demand. This is not a regionalized phenomenon, as there are markets showing signs of overbuild from coast to coast.

We expect to see fairly sharp downside revisions in the quantity of pre-construction projects in many markets as a response to these changing conditions. In at-risk markets where the construction continues unabated, there will be trouble.