Mid Year – The Pulse of Multifamily

We’ve recently covered the California markets and Atlanta for our monthly editorial, but as we enter the second half of 2018, it’s an opportune time to take the pulse of the multifamily industry through a national and a regional lens.

View the full monthly Markets Stats PDF

Nationwide

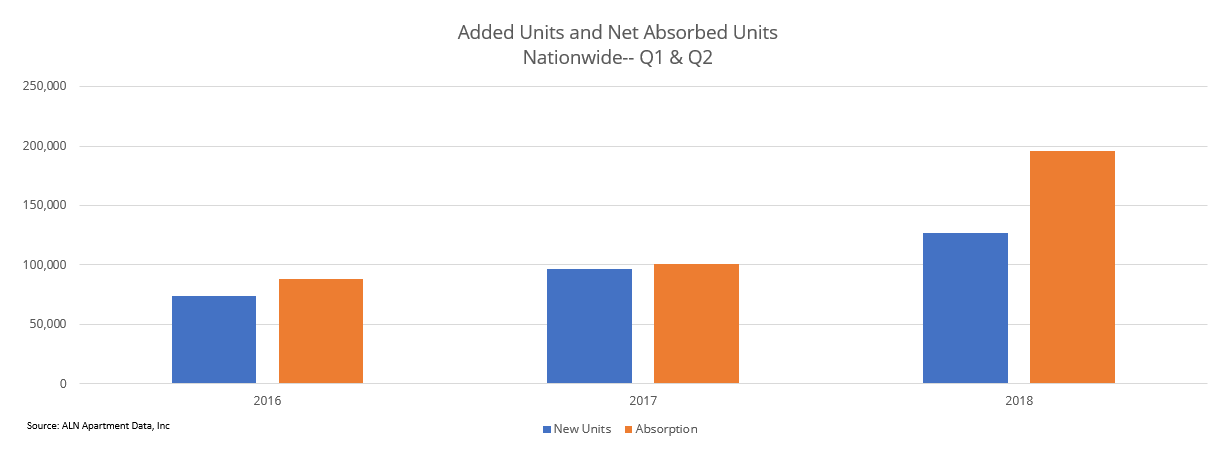

On a national scale, 2018 has gotten off to a strong start. What is immediately apparent after looking at the same period in 2016 and 2017 is the massive increase in newly delivered units. In the opening half of 2016, just under 61,000 units were delivered nationwide. In 2018, that number was more than 123,000. Even more pronounced has been the corresponding increase in net absorption* in the face of this new supply.

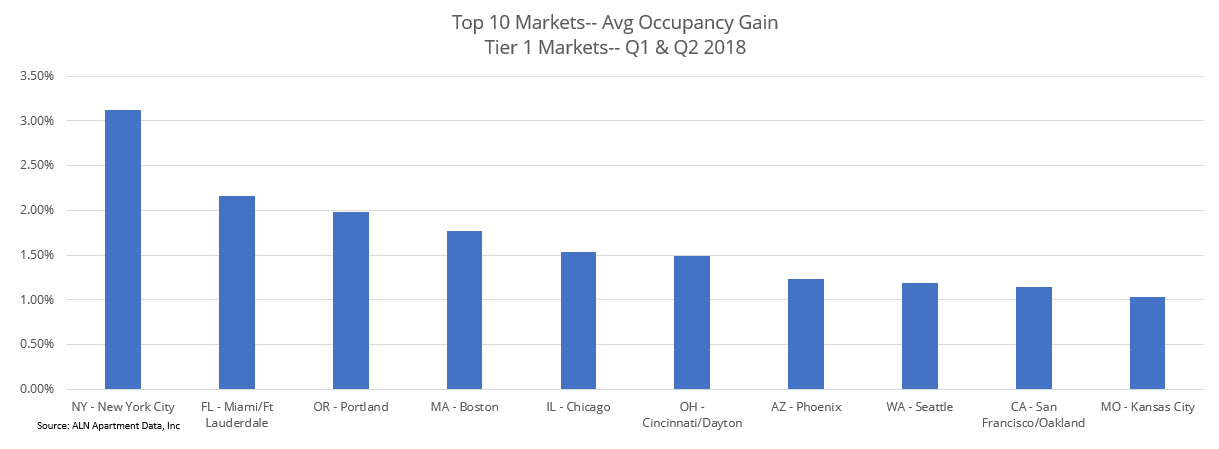

In the first two quarters of 2016, net absorption was slightly below 75,000 units. This year, in those same six months, there were over 126,000 newly rented units. As a result, despite the flood of new supply, average occupancy ended June at 92% – up around 0.75% for the period. That increase in average occupancy was more than triple the gain from the same period in 2017, and more than double the 2016 figure.

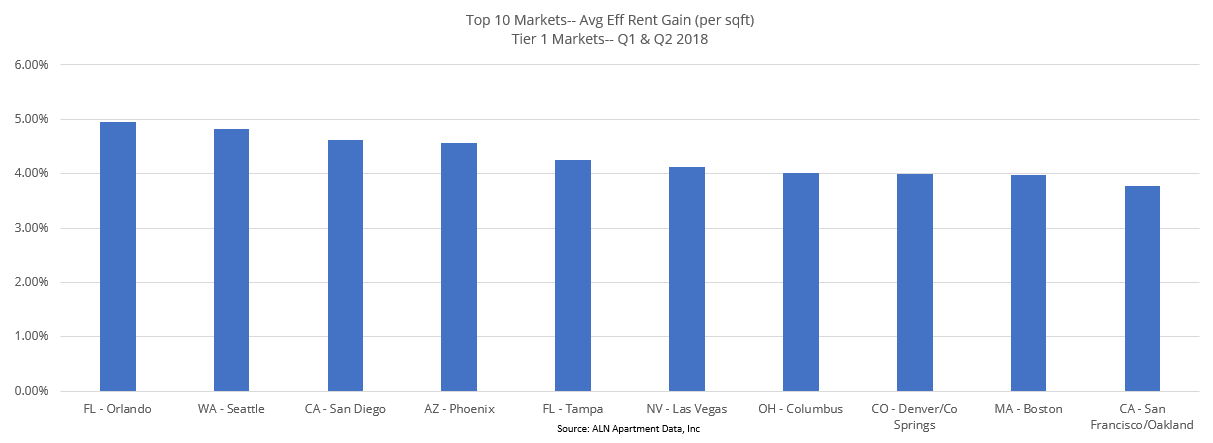

Whereas both occupancy and absorption have been trending positively, nationwide average effective rent growth has been slowing the last few years. After the first half of 2017 saw effective rent gains of about 6%, 2018 managed a 3% gain. Still a solid result, but a significant reduction from recent years.

Oregon/Washington

One of the more active markets for new construction in the first half of 2018 was Seattle. Nearly 3,700 units were delivered, and almost 6,200 units were newly rented. This combination brought average occupancy for the area to about 93% after a 1.2% gain. Thanks to net absorption more than doubling that of new supply in the period, Spokane managed an average occupancy gain of 1.6% to end June just above 96% occupied.

The largest average occupancy increase in the region was Portland. After newly rented units climbed by more than 6,100 units in the first two quarters of 2018, average occupancy rose by 2% to around 94%. All of this while introducing about 3,700 new units.

Regarding average effective rent growth, the larger markets in the region fared better. Both Portland and Seattle realized increases more than 3%, with Seattle leading the way by almost reaching 4.5% growth. Spokane came in at 2%, below the national average of 3%.

California

Unsurprisingly, the Los Angeles, California market was amongst the nationwide leaders in new supply in the first half of the year. With around 5,500 new units added, only about 2,500 net units were absorbed. The result was an average occupancy loss of a little more than 0.3%, ending June at 93%.

The San Diego market performed better. Almost 1,000 new units were introduced and average occupancy rose almost 1% thanks to over 2,000 newly rented units during the period. The best performing market in the state was San Francisco-Oakland. 2,700 new units were brought to market, and more than 5,200 units were absorbed. The result was an average occupancy improvement of slightly more than 1%. The Central Coast market stayed essentially flat with an average occupancy increase of approximately 0.25%.

Sacramento and San Bernardino-Riverside each had a negative ratio of newly rented units to newly supplied units. Sacramento delivered over 600 new units, and absorbed less than half that number for an occupancy loss of a quarter of a percent. San Bernardino-Riverside had about 400 new units enter the market, and net absorption failed to touch 150 net units. Average occupancy remained flat only because a handful of properties were taken offline.

Despite already having some of the highest rents in the country, every major California market managed to beat the national average for effective rent growth in the first half of 2018, apart from the San Joaquin Valley market. On the high end, the Central Coast market achieved a 5% increase and both San Diego and San Francisco-Oakland realized gains above 4%. On the low end, San Joaquin Valley saw an increase of 2.75%. Los Angeles, Sacramento and San Bernardino-Riverside all fell between a 3-3.5% increase.

Arizona/Nevada/New Mexico

Almost 2,700 new units added in the first half of the year put Phoenix in the top 10% in the country during that span. Absorption was also in the top 10%, with over 5,600 newly rented units bringing average occupancy up by 1.2% to end June at about 92.5%. Despite having no new units to contend with, Flagstaff suffered an occupancy loss of nearly 1% and Tucson only managed a gain of less than 1%.

The pulse on Nevada was much the same, though with more new construction. The Las Vegas market added more than 1,200 new units, while Reno added just under 1,200 and the Albuquerque market added about 250 units. Albuquerque had no movement in average occupancy, but Las Vegas managed an improvement of 1% thanks to the absorption of over 2,500 net units. Reno, like Flagstaff, suffered a loss of nearly 1%.

While this region largely underperformed the nation from the perspective of average occupancy gain and absorption, average effective rent movement was mostly very positive. The lone exception was Flagstaff, with a decline in average effective rent of over 2% in the first two quarters of 2018. Reno led the way for the area with an increase of 7%, mostly thanks to the influx of new units. Las Vegas also started off the year well, with an increase of a little over 4%. The Phoenix market checked in a little under 5% up, and Tucson just missed hitting a 2.5% gain.

Idaho/Utah/Montana/Wyoming/Colorado

The flow on new units in the Denver- Colorado Springs market hasn’t slowed. In the first half of 2018, almost 5,500 new units were delivered. The only other market in this region to deliver at least 500 units was Salt Lake City, with just under 2,000 new units. Due to all the new construction activity in the Denver- Colorado Springs market, average occupancy has lagged the national average. The area realized an occupancy gain of less than 1% after an increase in net rented units of more than 6,500.

Average occupancy in Wyoming rose 11% in the first six months of 2018, to end June at about 91.25%. Boise saw occupancy rise by nearly 3%, and Montana managed a nearly 2% gain. Only Salt Lake City failed to gain ground, staying flat for the year and ending June at 92% occupancy.

The Denver- Colorado Springs market also led the way in effective rent gains. Thanks to all the new units being brought into the market, average effective rent rose 4% in the first half of 2018. Boise almost equaled that, with a gain of 3.75%. Salt Lake City saw a nearly 3% increase and Wyoming toped 1.5%. Only Montana lost ground, with a decline of about 0.4%.

North Dakota/South Dakota/Nebraska/Iowa/Kansas

With fewer new construction units than many other regions, the markets in this area mostly experienced positive net absorption and occupancy movement. Most new units were added in the Des Moines market, at just over 900. Net absorption totaled almost 1,000 units for an average occupancy improvement of about half a percent. This was enough to push the average back to 90%, though still down from just under 95% in June of 2016.

The only other market to add more than 50 new units in the first half of the year was Omaha, with about 250 newly delivered units. Unlike Des Moines, net absorption significantly outpaced this new supply, resulting in occupancy rising by around 1.5% to just over 93%. With a loss of 0.5% Lincoln was the only market in the region where average occupancy declined.

Rapid City and Sioux Falls in South Dakota both performed strongly. Rapid City managed a 2.25% average occupancy improvement, and Sioux Falls touched 7%. Unfortunately, Sioux Falls still ranks in the bottom 10% of all markets nationwide with an average occupancy of 89%. The North Dakota markets, Bismarck and Fargo, both ended June above 90% occupied thanks to gains of about 1.5% in each market. Wichita ended June 90.6% occupied, after beginning the year at 90%.

Just about all the markets in this area experienced average effective rent increases between 1-2% in the first six months of the year. The exception on the good side of that threshold was Bismarck—at 11%. This brought average effective rent per unit from below $850 per month, to above $925 per month. On the other end of the spectrum, Sioux Falls suffered a decline of 0.75% in effective rents.

Oklahoma/Louisiana/Arkansas/Missouri

Most of the activity in this region was in Kansas City. More than 2,000 were added, and almost 3,200 net units were absorbed. This was enough to push average occupancy up 1% in the market to end June at 91.5%. The rest of the region was a mixed bag. Some markets, like Northwest Arkansas, Baton Rouge, New Orleans and St. Louis added around 500 new units. Each market managed to barely surpass that new supply with newly rented units, except for New Orleans. The area only absorbed half the number of units that were added. The result was a loss of 0.25% in average occupancy—hardly a crisis.

Other markets in the region had little to no new construction deliveries in the period. Most took advantage and occupancies rose. Little Rock nearly hit 2% in occupancy growth, Columbia came in just under 3%, Tulsa rose almost 2% and Oklahoma City rose 1.25%. But, Shreveport remained flat to open the year and Monroe dropped by 0.67% despite no new units.

Average effective rent growth underperformed the national average for the period in each market in this region, other than Lake Charles. The increase there, of more than 5%, is mostly attributable to the new supply. As a reference point, Lake Charles added new units equaling 5% of the total market capacity** in the first six months of the year. The state of Missouri performed well, as each of the four main markets in the state surpassed 2% effective rent growth. Springfield led the way, barely falling short of a 3% gain.

Arkansas was similarly homogeneous, as both Little Rock and Northwest Arkansas achieved increases above between 2-2.5%. Oklahoma City ended June with a solid 1.25% improvement, but Tulsa managed only a 0.25% increase. New Orleans couldn’t match the Lake Charles leap, but nonetheless experienced an impressive 2.4% climb. Only Monroe lost ground in this region, losing 0.5%.

Texas

The Dallas-Fort Worth market was the only market nationally to both add and absorb at least 10,000 units. After adding about 10,250 units, there was an increase in net rented units of about 12,700 units. The delta between introduced units and newly rented units is a good sign, because in the same six-month period in 2017, it was essentially zero.

Austin added more than 4,600 units, but occupancy inched up only 0.33%. San Antonio added about 2,800 units and managed a 0.81% average occupancy improvement. Houston added around 2,500 units. Thanks to net absorption north of 5,300 units, Houston ended June 90% occupied.

Of the smaller Texas markets, only the college towns of Lubbock and College Station added more than 100 units, with 192 and 386 units respectively. Neither market could absorb the new supply before June ended, and average occupancy losses of less than 1% resulted. The largest occupancy change for the state was the 4.5% jump in Texarkana—ending June at 93.6%. On the low end, occupancy in Victoria fell by around 2.6% despite there being no new supply in the period. Midland-Odessa ended June with the highest average occupancy in Texas, at 95.4%.

The largest average effective rent gain in the first half of 2018 for any market in the US was Midland-Odessa. Thanks in part to the resurgence of the energy sector, and the relative lack of new supply, effective rents rose more than 15% in the opening two quarters of the year. This area began 2018 already having the highest average effective rent of any Texas market thanks to leaps beginning in early 2017. Other markets with rent increases above the national average of 3% were Abilene, Austin, Beaumont, Dallas-Fort Worth, Lufkin and San Angelo.

Minnesota/Wisconsin/Illinois

More than 4,200 units were added in Chicago in the first half of 2018. Despite this, average occupancy rose about 1.5% to end June at 90.5% thanks to more than 7,300 net units being newly rented during the same span. The rest of Illinois added less than 150 combined units, with Springfield adding none. Unfortunately, Springfield saw occupancy decline even so, and ended Q2 at just over 91% after a drop of nearly 1.5%. Peoria ended June up just over 1%, and Moline gained 0.75%.

The other markets in this region with notable new supply were Minneapolis-St. Paul and Madison, each with about 1,200 new units. Minneapolis-St. Paul absorbed almost 2,000 units, while Madison managed less than 500. The Milwaukee and Green Bay-Appleton-Oshkosh markets added new units as well, about 600 and 300 respectively. Net rented units in the Milwaukee market increased by more than 3,100 units in the initial six months of the year, for an occupancy gain of almost 4%.

The Green Bay-Appleton-Oshkosh market dealt with the new supply less successfully. After adding just over 300 new units, there was a decline in net rented units of more than 100. This led to an average occupancy decline of just over 2% in the period. However, this area was already one of the most highly occupied in the country. Even with the loss to open 2018, average occupancy ended June at 96%.

For the most part, average effective rent performance in this region was strong. Chicago, Springfield, Minneapolis-St. Paul and Madison all crossed the 3% gain threshold. The Milwaukee market surpassed 2% growth, and both Green Bay-Appleton-Oshkosh and Moline did better than 1.5%. The lone regression was Peoria, with a loss of about 0.35%.

Michigan/Ohio/Indiana

The Columbus market led the way in this region with new supply in the first two quarters of the year with 2,100 new units delivered. Thanks to the absorption of just under 2,500 units, average occupancy climbed almost 0.5% despite the new supply. For the most part, the markets with sizeable jumps in average occupancy did so with no newly delivered units in the period.

Cincinnati-Dayton managed a 1.5% gain though, while adding over 1,100 units. The biggest occupancy movers in the region were the South Bend and Fort Wayne, with increases of about 4.6% and 2.25% respectively. No other market reached even 1% occupancy growth, but the closest were Evansville and Grand Rapids-Kalamazoo-Battle Creek—both around 0.8%. Toledo was the only area to decline in average occupancy, with a loss of 0.8%.

Average effective rent gains were right around the national average of 3% for the markets in this region apart from the 1% gain in Fort Wayne. Columbus led the way with a 4% increase, while Evansville was not far behind at 3.5%. South Bend was the only other market to touch a 3% improvement. Indianapolis, Grand Rapids-Kalamazoo-Battle Creek, Cincinnati-Dayton, Cleveland-Akron and Toledo all realized increases between 2.5- 3%.

Kentucky/Tennessee/West Virginia

Looking at the pulse moving toward the east, nearly all the new supply in this region was delivered in the Nashville market to begin 2018. But still, average occupancy gains were hit-or-miss. Bucking the overall regional trend, Louisville and Charleston added a little more than 3%, and about 2% respectively to their average occupancy rate. Neither market had any new construction deliveries in the period.

Nashville added approximately 3,100 new units while absorbing 3,500 units to bring occupancy up 0.7% to just under 90% as of the end of June. Occupancy rose 0.8% in the Lexington market despite adding two new properties, but both the Chattanooga and Memphis markets lost ground—though less than 1% in each.

Three markets in this region met or exceeded the national average for average effective rent growth—Chattanooga, Knoxville and Louisville. Chattanooga and Knoxville both increased by 4%, while Louisville came in at 3.5%. Effective rents rose in the 2% range in the Memphis, Nashville and Lexington markets, with Memphis leading the way at just below 2.9%. Charleston performed least favorably, with an increase of 0.3%.

Virginia/DC/Maryland

The Washington DC market predictably led the way in new construction activity for this region, but only Roanoke had no new supply in the period. DC added 4,500 units, Baltimore nearly 1,600, Richmond added 1,100 and Norfolk just under 1,000 units. Net absorption was strong in the markets that added units. Only Richmond came close to adding more units than were newly rented. The DC market rented an additional 8,000 units during the first two quarters, and Baltimore absorbed almost 2,500 units.

Even the smaller Virginia markets of Richmond and Norfolk gained more than 1,000 newly rented units. The new construction units prevented average occupancy gains from reaching 1% in the period everywhere other than Roanoke, which had no new units. Roanoke saw occupancy rise by right at 1% thanks to the absorption of around 200 units.

DC, Richmond and Roanoke all achieved more than 2% growth in average effective rent, Richmond led the way at about 2.7%. Norfolk fell just short of the 2% threshold with an appreciation of 1.9%. Baltimore brought up the rear with 1.6% rent growth. Each market in this region failed to meet the national average for rent growth in the first half of the year, but specifically with the DC market, rents were already amongst the highest in the nation.

Mississippi/Alabama/Georgia/South Carolina/ North Carolina

Outside of a few of the larger markets, there wasn’t as much new construction activity in this region as some others. Charlotte led the way in new units with a little over 3,500. Thanks to absorption topping 4,200 units, Charlotte managed a 0.8% average occupancy gain even with those new units. Atlanta added about 1,800 units and absorbed almost 3,500, good enough for a 0.5% occupancy improvement.

The only other market in the region to add at least 1,500 units in the period was Charleston, with about 1,650 new units. Like the larger markets, net absorption outweighed new supply, but barely, in this case. The result was an occupancy bump of 0.5% to just under 85%. Two markets that really stood out for occupancy gains were Myrtle Beach and Asheville, with improvements of 5.8% and 4.4% respectively.

There were also some areas that lost occupancy ground in the first half of 2018. Huntsville, Mobile, Montgomery and Savannah all declined, but each by less than 1%. Even worse, Columbus dropped by 1.5%, and Augusta dropped by more than 2.5%. However, all those markets remain at, or slightly below, 90% for average occupancy.

Effective rent performance was a little rosier, with nearly half of the markets in this region above the national average for rent growth. Leading the way were two smaller geographies—Huntsville and Savannah. Each gained 4.9% in average effective rent in the first half of the year. Fayetteville, Augusta and Myrtle Beach were right behind, at 4.5% and 4.4% and 4.4% respectively.

Markets with between 3-3.85% rent growth were Asheville, Charlotte, Charleston, Greenville-Spartanburg and Atlanta. Atlanta represented the bottom of that group with a 3% gain. Worst performers included Montgomery and Columbia. By failing to reach 1.75% growth, each was in the bottom 10% nationwide for effective rent growth.

Florida

The Florida markets were a mixed bag to open 2018. There has been an imbalance between new supply and apartment demand in a couple of markets going back a year or more, and that is still playing out. Orlando added 5,000 new units and managed net absorption of only about 3,700 units. Palm Beach added more than 1,300 new units, but absorption was just under 1,300 units. Similarly, Gainesville added 300 new construction units while losing almost 250 net rented units. Jacksonville added about 1,400 net newly rented units, but delivered almost 1,300 new ones.

The Florida markets where absorption comfortably outpaced new supply were Tampa and Miami-Ft. Lauderdale. Tampa added about 3,500 units while absorbing over 4,600. Miami-Ft. Lauderdale absorbed better than 5,600 units while adding about 2,900 units to the market.

In Pensacola, where less than 500 new units were delivered, occupancy jumped 4% to end June at 93.7%. Melbourne also enjoyed a healthy 2.5% gain to end Q2 at 96% occupancy after adding no new units to the market. The 2.2% improvement for Miami-Ft. Lauderdale was the only other Florida market to rise more than 2%.

Melbourne paced the state with a 5% upward movement in average effective rent for the six-month period, and was trailed by Orlando at 4.85%. Pensacola and Tampa both accomplished appreciation of more than 4%. Meanwhile, Miami-Ft. Lauderdale, Palm Beach and Fort Myers-Naples each failed to hit 2% – though none were lower than 1.6%.

Pennsylvania/New York/New Jersey/Delaware

Much of the share of new units delivered in this region were delivered in the New York City market, but Philadelphia and Pittsburgh both had a good amount of new supply as well. New York added about 6,700 units, but absorbed over 18,000 for an occupancy gain of 3%. An increase of 18,000 net rented units in the first two quarters of the year is the highest figure of any market in the country in the last three years.

Philadelphia added just under 2,000 new units, while the number of net rented units grew by 4,100 units. Less gaudy was Pittsburgh, with about 1,300 new units and 1,800 units absorbed for an average occupancy improvement just over 1%. Albany managed a 3% occupancy gain thanks to less new construction and strong absorption. Meanwhile, The Buffalo-Rochester-Syracuse and State College-Altoona markets failed to reach 1% occupancy growth.

New York City, with rents already amongst the highest in the country, the outlying Delaware area and State College-Altoona were the only markets in the region below 2% average effective rent growth. Philadelphia led the way with gains of 3.7%. Albany followed at a growth of 2.6%, and the Buffalo-Rochester-Syracuse market came in at 2.1% up for effective rent.

Connecticut/Rhode Island/Massachusetts/New Hampshire/Vermont/Maine

Boston was the only market in this region to have any new construction activity of note, adding around 3,000 new units in the period. Net absorption topped 4,600 units, and the result was an uptick in average occupancy of 1.8%. Hartford added a little less than 400 units, and average occupancy rose 0.5% to end June at 94%. Concord led the way in occupancy improvement for the region, with a 2.1% jump to just below 97%. The Providence market managed 1% growth thanks to the introduction of only about 80 new units in the period.

Effective rent growth was all over the board here, with half the markets below the national average, and half at, or above. Boston paced the field with a 4.1% appreciation in the period, while the outlying Vermont areas rose just over 3% and Concord just managed to touch 3%. Underperforming the national average were the Hartford, Springfield and Providence markets, with gains of 2.75%, 1.9% and 1.8% respectively.

What’s the Pulse

Our pulse here is that 2018 is off to a strong start. While the business cycle is undoubtedly long in the tooth, positive metrics are still to be found. New supply in the first half of 2018 was 70% more than the new supply in the same span in 2016. That is an incredible amount of activity at this stage! But, net absorption to open this year was 123% higher than the same span in 2016. At some point, new demand will taper off, but it hasn’t yet.

There are signs pointing to a relative slowdown in demand coming sooner rather than later. One of those signs is what has happened to effective rent growth. After performing even better in the first two quarters of 2016, average effective rent slowed to 6.2% last year during the same period, and now 3% this year. That is a precipitous decline. Price increases can’t happen into perpetuity, especially with a decade of stagnant wage growth.

So, the decline in effective rent growth is not, on its own, an alarm bell. The percentage of properties offering a rent concession to new tenants has remained flat, and, so too has the average concession package value. Those will be additional multifamily metrics to watch moving forward.