California Love

The multifamily industry continues to perform well, although signs of an aging business cycle have been appearing for some time. With the NAA Conference being held in San Diego this year (where ALN will be in Booth 2315), we thought it an appropriate time to look under the hood in California. To do this, we’ll be looking at year-over-year performance metrics in the seven major ALN markets in California.

View the full monthly Markets Stats PDF

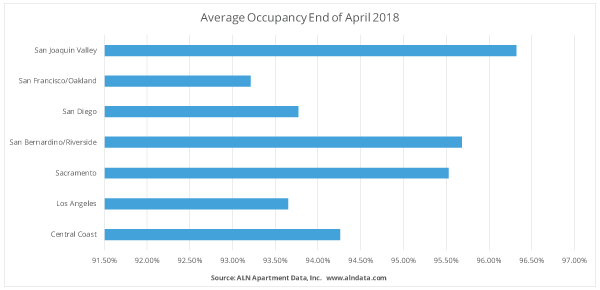

California Average Occupancy and Net Absorption

While average occupancy is solid across all seven markets, a few lost some ground over the last 12 months. The Central Coast market suffered the largest drop, nearly 1.9% to finish April at about 94.25%. The San Diego market lost around 0.7%, and Sacramento declined slightly by 0.1%. On the positive side, the metro Los Angeles area saw occupancy climb by just under 1.5% during the 12-month span.

Smaller movers include the San Bernardino – Riverside market, as well as San Joaquin Valley. San Joaquin Valley’s average occupancy to end April was over 96%, good enough for top 10% in the nation. San Francisco – Oakland led the way with a gain slightly above 1.6% to end April with an average occupancy of just over 93%.

Unsurprisingly, the vast majority of the year-over-year net absorption* in the state happened in the Bay Area and in LA. The Los Angeles market absorbed over 12,000 units, and the Bay Area saw an increase of over 10,000 net rented units. The only other California market to absorb more than 1% of its capacity** was San Diego. More than 1,800 additional net rented units were not enough to offset the introduction of over 3,000 new units over the last 12-months, however.

At the bottom end of the spectrum, areas like San Joaquin Valley and San Bernardino – Riverside managed to add around 800 and 600 net rented units respectively over the past year. Central Coast once again fared least positively, with an anemic 80 net units absorbed after adding more than 900 new units.

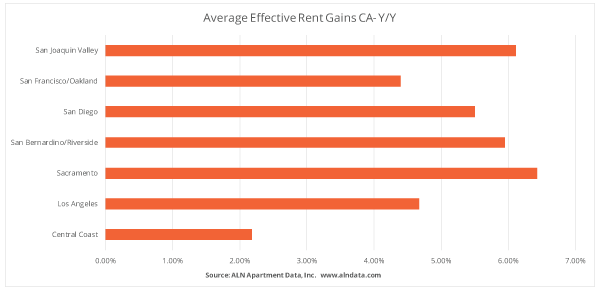

Average Effective Rent

It’s no secret that California has some of the highest average effective rents in the country. Despite this, rent gains have been above average over the last year when compared to the rest of the country. We’ve seen effective rent growth slow over the previous few quarters, so few markets are gaining to the degree they were just a couple of years ago. Having said that, the Central Coast market was the only ALN California market to realize average effective rent gains of less than 4%- with an increase of 2.2%.

The San Francisco – Oakland area saw average rents climb by 4.4%, and the LA market just managed to surpass 4.6% growth. Even stronger performers were San Bernardino – Riverside, San Joaquin Valley and San Diego with gains of 5.9%, 6.1% and 5.5% respectively. Leading the way for California over the last 12-months, the Sacramento area saw average effective rents climb by nearly 6.5%.

Takeaways

With most areas of the country seeing rent and occupancy growth slow to some degree over the last few quarters, it’s no surprise California hasn’t realized sizable gains across the board over the last 12 months. However, average occupancy remains over 93% in every major market, and absorption in the largest markets remains strong. Average effective rent gains were above average for the period nationally, and in most cases, well above average.

For a state with existing rents amongst the highest in the country, this is no small feat. We do see some downside looking ahead due to inflow of new units into markets already experiencing occupancy and absorption slowdowns. But overall, on the eve of San Diego hosting the 2018 NAA Conference- there is still a lot to love about in California multifamily.

Need more information about the California markets? Get overall market analysis with our Market Reviews.

*Net absorption is the net number of units newly rented units

**Capacity refers to the total number of existing units in a market

Going to NAA in San Diego? Top Industry Suppliers are hosting a fantastic evening on the U.S.S. Midway Aircraft Carrier in San Diego. Enjoy premium cocktail bars, 25 Casino Tables, amazing cash and prizes totaling $5000, a live performance by the Spazmatics – and that’s just the start! Find out more and register by clicking the picture above!

This amazing night is sponsored by the following companies. Make sure to thank them by checking out their websites! ALN Apartment Data, Inc., ApartmentSEO, Asset Essentials, CORT Furniture, Deans & Homer, Engrain, Ferguson Facilities Supply, FSI Construction, J&C Carpet, KingsIII Emergency Communications, PERQ, RentPath, Stealth Monitoring, The Liberty Group, The Phoenix Staffing