Texas Markets: Rent Growth Receding

Texas has repeatedly been in the top handful of states for absorption and occupancy over the last decade. So far in 2017, the absorption numbers are still holding up. The Lone Star State ranked first in absorption from July 2015 to July 2016 with a net gain of 36,000 rented units. In addition, Texas markets rank second only behind California for rental absorption, with a net gain of over 41,000 rented units from this time last year.

Effective Rent

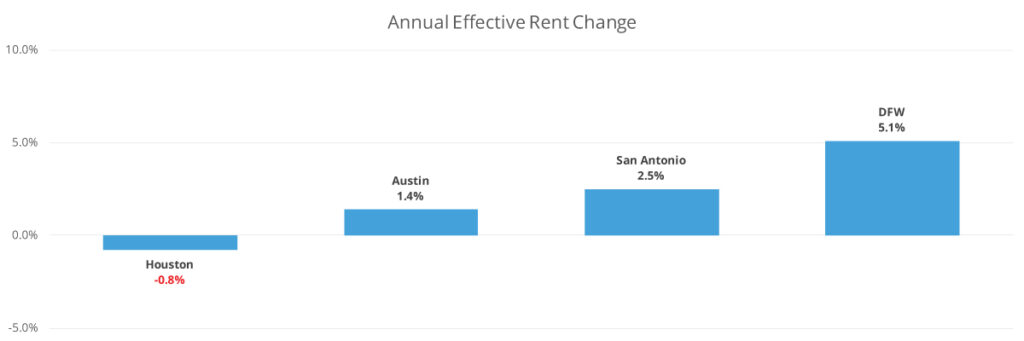

Despite these rankings, effective rent growth has tapered off significantly from the middle of the decade. In 2014, Texas saw July annual effective rents rise more than 7%. In 2015 they rose almost 6%. By July of 2016, annual rent growth diminished to only 3.8% higher, and this year they are up a meager 2.2% statewide from a year ago.

View the full monthly Market Stats PDF here

As for the major Texas markets (Dallas/Fort Worth, San Antonio, Houston & Austin) effective rents are up 5.1% in the DFW market from this time last year. Houston effective rents have dropped for the first time in nearly a decade and are down 0.8% per unit to an average of $1011.

In San Antonio, they are up 2.5% and in Austin they are up 1.4% from the summer of 2016. In the smaller markets, Midland-Odessa has seen prices rebound over the last year with double digit rent growth. The other small Texas markets mostly saw modest growth in the 2-3% annual rent gain.

Absorption

Dallas/Fort Worth lead the way with almost 14,000 net rented units over the last 12 months. Austin did well with more than 6,000 net rented units and San Antonio absorbed almost 3,800 net rented units, both great numbers for markets of their size. As for the smaller Texas markets, the East Texas markets and Wichita Falls stumbled a bit in absorption but the rest had pretty good numbers. Houston may have been helped by concessions, absorbing more than 12,000 net rented units. As a result, this boosted absorption numbers closer to what they were before the oil pricing plunge.

Occupancy

Houston is still hovering in the high 80’s with an average of 88.5%, down 0.6% from last summer. Also, Midland-Odessa has recovered somewhat from the oil price plunge and saw occupancy get back over 90% in the last year. New construction and new unit supply are starting to adversely affect average market occupancy, however. San Antonio was the only large Texas market to outpace new supply and have occupancy rise in the last year. Occupancy in San Antonio rose 0.4% to an average of 90.1% market-wide.

Dallas/Fort Worth is down 1% to 91.5% in average occupancy over the last 12 months. Austin, meanwhile, is down 0.8% to 90.7% from July 2016. Unit growth in Corpus Christi and Lubbock kept those markets from seeing average occupancy rise, though, even as they absorbed several hundred net rented units each.

New Supply in Texas Markets

Statewide in Texas over the next 4 quarters, about 90,000 total units will be coming onto the market. Dallas/Fort Worth is leading the pack with anticipated new supply. Through the 3rd quarter of 2017 to the end of the 2nd quarter of 2018, DFW is anticipated to have almost 40,000 total units start leasing. Houston has less than half of that with about 16,000 units coming onto the market – a virtual tie with Austin.

San Antonio has somewhat shown restraint with right at 10,000 units starting to lease over the next year. Furthermore, another 10,000 units will begin leasing in the smaller Texas markets, mostly in El Paso and Central Texas.

Looking into the future it seems that the Texas markets have only modestly curtailed new supply heading into 2018. That may further competition so that annual effective rent growth in 2018 may finally diminish to negative territory statewide.

Nationwide Multifamily Data

Occupancies, New Construction, Trends and more!

For more on the markets ALN covers, make sure to go to the Market Reviews page on our website. ALN offers multiple platforms designed specifically to empower your Multifamily research.