A Year in Review: 2019

Almost unbelievably, 2019 is gone and it’s time for another year in review. This month we’ll be looking at how multifamily performed for the year, a region at a time. Unless stated otherwise, all numbers will refer to conventional units. Let’s jump in!

Nationwide Year in Review

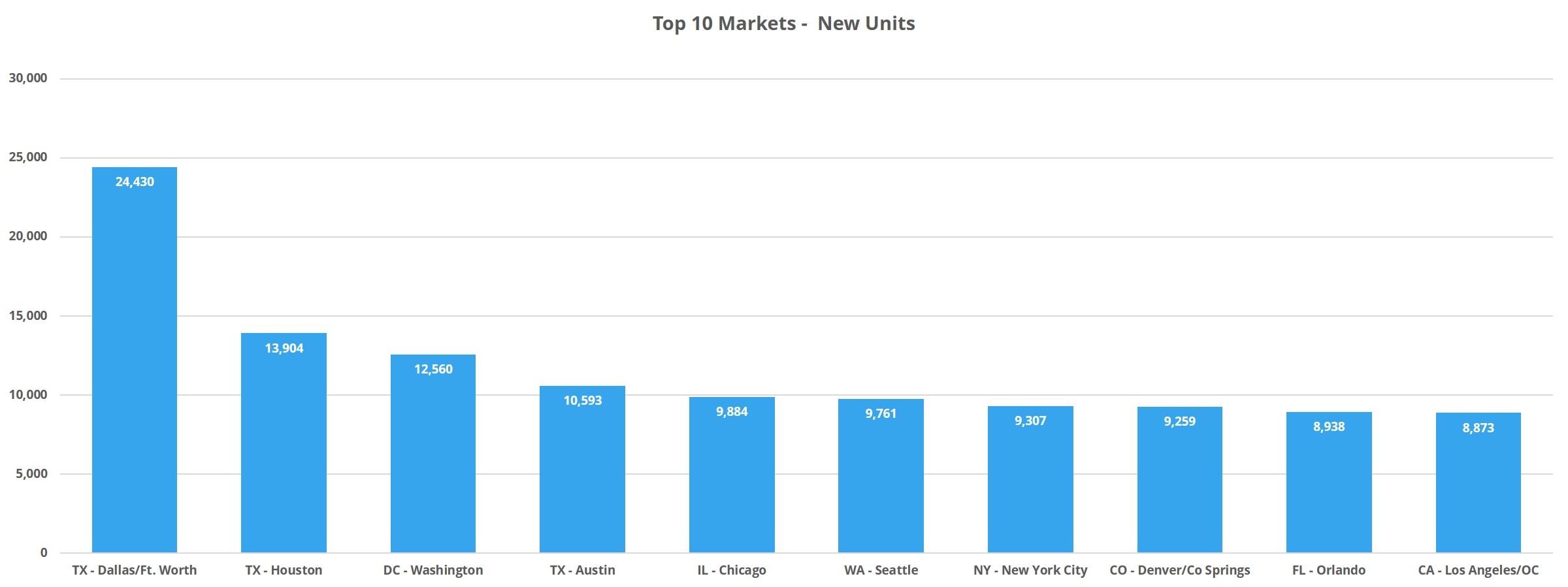

The multifamily industry added around 285,000 new conventional units in 2019. This is about the same volume seen in 2018 and a few thousand units less than in 2017. Although net absorption of 300,000 units surpassed the level of new supply, demand was stronger in 2018 when almost 330,000 formerly vacant units were rented. Net absorption of 300,000 is still a very strong result though, and easily outpaces the demand we saw in 2017.

View the full monthly Markets Stats PDF

National average occupancy remained above 92% to close 2019, albeit by just a hair. This marks the second year in a row national occupancy has been above 92% after a brief decline below that threshold in 2017.

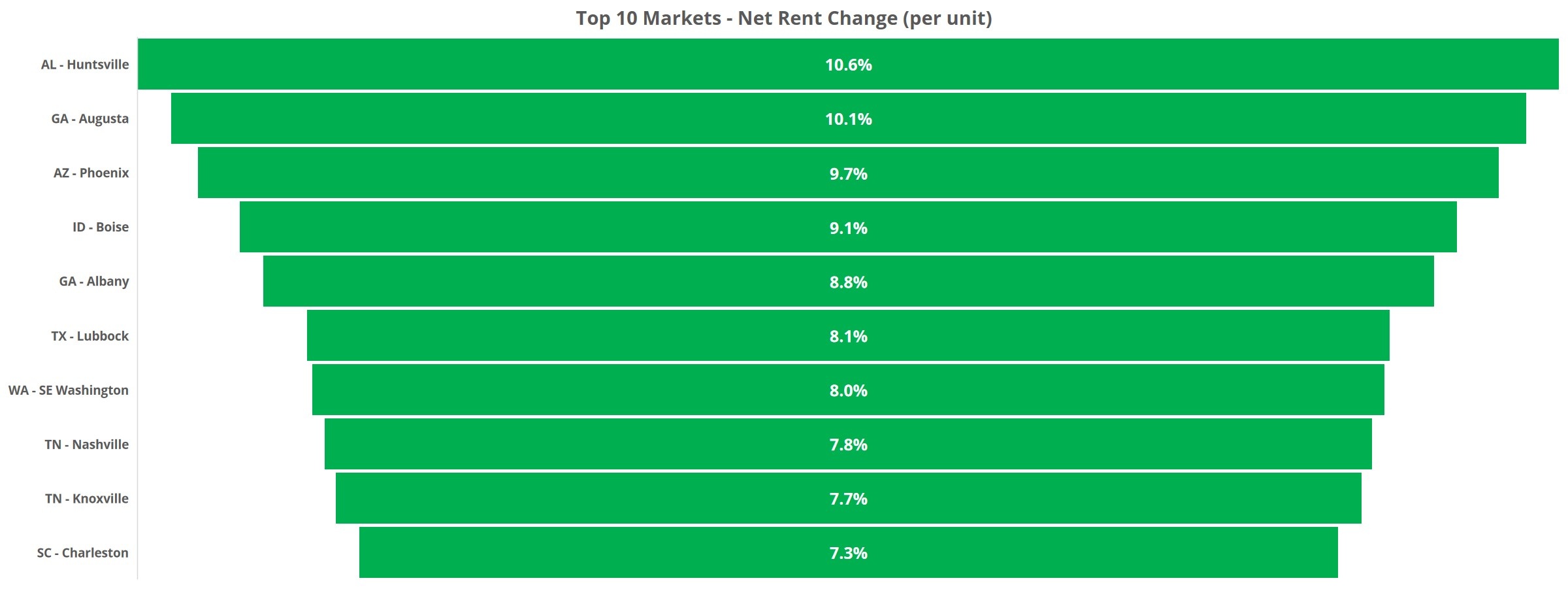

Average effective rent rose by just less than 4% nationally in 2019. The resulting average monthly rent was approximately $1,350 per month to end the year. This appreciation continues the trend of the last few years, where the rate of growth has continued to gradually slow. Rent growth in 2018 was 5% after an 8% gain in 2017.

Highlight: Approximately the same number of new units were delivered in 2019 as in 2018, but overall demand declined by 30,000 units.

WA/OR

The Seattle market had another great year. Not only did the 9,800 new units put the area in the top 10% of markets for new supply, but absorption of the more than 12,000 net units during the year was also in the top 10%. The strong demand led to a 1% increase in average occupancy to finish the year at just over 93%. Average effective rent rose by 4%, a little more than the national average. The average unit was renting for $1,800 per month to end 2019.

Portland added just over 5,000 new units but absorbed only about 4,100 units. Average occupancy fell by 0.75% to finish just above 93%, still above the national average of 92%. Average effective rent gained 3.5%, so below the national average but just barely. The average unit ended the year at $1,400 per month.

Highlight: Demand in Seattle continues to climb. Annual net absorption was less than 5,000 units in 2017. In 2018 that increased to 10,000 units before the 12,000 absorbed units in 2019.

CA

The Los Angeles – OC market delivered almost 9,000 new units in 2019 while absorbing just below 8,000 units. That is enough to put LA in the top 10% of markets for each metric. Average occupancy fell 0.4% to end the year slightly below 93%. The area underperformed the national average in rent growth by gaining just 3%, but this isn’t unexpected for a market already so far above the national average for rent. To end the year, the LA area average effective rent per unit was just over $2,200.

The Bay Area had a rougher time of it in 2019. Roughly 8,200 new units were brought to market but only 3,600 previously vacant units were rented during the year. This led to a 1.4% decline in average occupancy to about 92%. Average effective rent in the San Francisco – Oakland market rose a little more than 2% to bring the average unit to nearly $2,800 per month.

The Sacramento, San Bernardino – Riverside and San Joaquin Valley markets all beat the national average in effective rent growth while maintaining occupancies above the national average. Leading the way was the 7% rent appreciation in the San Joaquin Valley area.

Highlight: The Bay Area managed less than a 1% increase in average net rent in 2019 thanks to a decline in average occupancy and underwhelming rent growth.

AZ/NV/NM

Phoenix added more than 7,200 new units in 2019 while absorbing 8,600 units. As with the Seattle and Los Angeles – OC markets, both the new units and net absorption are in the top 10% of markets for 2019. Average occupancy rose marginally to end December at 93%. The story in Phoenix was average effective rent. Thanks to a 9% annual improvement, average rent ended the year at almost $1,200 per month.

The Las Vegas area suffered a 0.4% decline in average occupancy down to a little above 93% due to 2,000 new units coming online. About 1,300 previously unoccupied units were rented during the year, almost offsetting the new units. Rent growth in this market was strong as well. A 7% gain led to an average effective rent of $1,100 to conclude 2019.

Average occupancy in Albuquerque almost hit 95% in 2019 after a 1% gain thanks to net absorption more than doubling new supply. About 300 new units were introduced during the year, but the market absorbed more than 800 units. As with every ALN market in this region, Albuquerque also bettered the national average for effective rent growth by gaining 6% to $900 per month.

Highlight: This region followed up a strong 2018 with an even better 2019. Phoenix particularly stands out, landing in the top 10% of markets for new units, net absorption, effective rent growth and net rent growth.

ID/UT/CO

The Denver – Colorado Springs area added 9,300 new units during 2019 but absorbed more than 15,000 units. Each metric is in the top 10% nationally. Average occupancy ended the year above 91% on the back of this strong demand. Average effective rent growth was less impressive, with average rent finishing the year at almost $1,500 per month after a gain of around 2.5%. Partially to blame for the lackluster rent growth is the reemergence of rent concessions. About a quarter of conventional properties in the market were offering a rent discount at the end of December.

The star of this group in terms of rent growth was Boise. After a 9% gain, the average unit ended 2019 at about $1,100 per month. The area added about 700 new units while absorbing more than 1,200 and average occupancy finished at 94%.

Salt Lake City had a less impressive 2019. Average occupancy fell to slightly below the national average to just over 91% due to a nearly 1% annual decline. About 4,200 units were newly rented during the year, but nearly 5,000 new units were brought online at the same time. Rent growth was also a little below the national average at about 3.25%. The average rent per unit as of the end of the year was almost $1,200 per month.

Highlight: Denver – Colorado Springs continued its hot streak in 2019 and with strong rent growth, high occupancies and an increasing tech and start-up presence, Boise is a market to watch.

ND/SD/NE/KS

The Omaha market stands out in this group after a strong 2019. About 1,500 new units entered the market, by far the most of any in this region. The headline is that net absorption was just short of 3,000 units. This brought average occupancy up more than 2% to end December at 93%. Rent growth on the other hand, was less stellar. A gain of under 2% was well short of the national average and the average unit finished the year at about $910 per month.

Wichita also had a good 2019. Just under 1,000 new units were delivered and average occupancy rose 1.5% to 92% thanks to almost 1,700 newly rented units during the year. Average effective rent rose by almost 5%, a full 1% above the national average.

Average occupancy finished the year in Des Moines at 91.5% after an annual increase of almost 2%. The improvement came as more than 600 new units entered the market due to strong demand in the area. Almost 1,200 previously vacant units were rented during the year, easily outpacing new supply. Average effective rent growth, like Omaha, wasn’t quite as solid. A 1% annual gain brought the average unit to $900 per month.

Highlight: Five of the nine ALN markets in these states lost ground in 2019 in average occupancy, and Wichita was the only market to exceed the national average for rent growth.

OK/LA/AR/MO

Demand was strong in St. Louis in 2019 with more than 3,600 units absorbed. The new construction pipeline was also active, delivering almost 2,700 new units. Average occupancy improved by 1% to end the year at a little above 91%. Rent growth was even better. After a 5% gain, the average unit ended December renting for $980 per month. St. Louis was in the top 10% of markets in 2019 for new units, net absorption and effective rent growth.

Baton Rouge began the year with an average occupancy of 86%, one of the lowest market averages in the US. The area absorbed nearly 1,700 units while delivering about 600 new units, resulting in an occupancy gain of 1.6% up to just under 88%. However, those gains were partially fueled by an increased reliance on rent concessions, and average effective rent decreased slightly to $905 per month.

Oklahoma City had a year in many ways the reverse of Baton Rouge. About 1,300 newly rented units were not enough to keep pace with more than 1,700 new units. Average occupancy declined by about 0.5% to finish the year just under 90%. The positive news in the OKC market came on the rent side, where a more than 4% gain left the average rent at about $770 per month to finish the year.

Highlight: In a region with some lackluster 2019 results, rent performed better than occupancy. St. Louis was the only market in this region to have an above-average year across the board.

TX

First things first with Texas, the Dallas – Fort Worth market continues to be the most active in the country. More than 24,000 new units were delivered in 2019, a full 10,000 units more than any other market. Net absorption topped 23,000 units, also good for number one in the country and well ahead of the second-place market, New York City. Average occupancy rose slightly to 90.5% and average effective rent grew by a bit under 4%.

The Houston market added the second most new units in 2019, with 14,000 new units delivered. Demand was strong here as well, with almost 12,000 formerly vacant units rented during the year. Average occupancy fell by 0.25% to a little above 89% due to the pressure from new supply. Average effective rent grew a tepid 2% to end 2019 at about $1,100 per month.

Like Houston, the Austin area absorbed less units than were added to the market during the year. After absorbing roughly 8,700 and delivering close to 11,000 new units, average occupancy declined by about 1% to just under 91%. Unlike Houston, rent growth was comfortably above the national average for 2019, at 5%. After that increase, the average unit was renting for just over $1,300 per month to end December.

Another Texas market worth mentioning is Midland – Odessa. After multiple years of skyrocketing rents and high occupancies, the area corrected a bit in 2019. Net absorption was negative by almost 500 units and nearly 400 new units were brought online during the year. The result was a 4% average occupancy loss down to 90%.

Average effective rent also declined, though more precipitously than occupancy, with a 7.5% retraction. The average unit as of the end of the year was renting for a little below $1,400 per month. This is still enough for Midland – Odessa to be the most expensive Texas market at the average.

Highlight: Dallas – Fort Worth continues its expansion unabated with strong results across the board. Houston is showing some signs of pressure from the new construction pipeline in conjunction with the headwind of flagging oil prices.

MN/WI/IL

Chicago added about 10,000 new units in 2019 and absorbed about 9,800 units. Average occupancy fell 0.1% to settle right at 90%. Average effective rent gained a little more than 3%, slightly below the national average, to conclude the year at $1,600 per month.

Minneapolis – St. Paul suffered a retraction of 0.7% in average occupancy after the introduction of about 3,900 new units during the year. Despite the loss, occupancy remains above 94%, so this isn’t much of a concern. The area absorbed 3,000 in 2019, so while not able to keep pace with new supply, demand was healthy. Effective rent growth was right at the national average and the average unit finished the year at $1,310 per month.

Milwaukee has a solid 2019. Average occupancy rose by about 1% to reach 92%, the national average. Aiding in that occupancy improvement was demand, Milwaukee managed to rent 2,700 previously unoccupied units during the year. On the rent side, a 3.9% gain was slightly above the national average and the average monthly rent for the area ended the year at around $1,100.

Highlight: The Chicago area led this region in new supply and in demand, but it was only the Molina and Milwaukee markets that beat the national average for effective rent growth.

MI/OH/IN

This group of markets was a mixed bag in 2019. On the positive side, Columbus added 3,900 new units during the year but absorbed almost 5,000 units. Average occupancy rose by about 0.4% to finish December just below 93%. Despite falling slightly short of the national average for annual effective rent growth, the area realized a gain in excess of 3% to $980 per unit per month.

A market that had a rockier 2019 was South Bend, Indiana. Average occupancy declined by more than 4% during the year to settle at just above 88%. The occupancy loss and the final average occupancy are in the bottom 10% of markets for each metric. The average occupancy decline is attributable to the nearly 450 newly delivered units as well as the net loss of 500 previously rented units. The predictable increase in rent concessions cut into effective rent growth, though South Bend did manage to hit 3% annual appreciation.

The largest market in this region is Detroit. Average occupancy fell 0.75% after annual net absorption totaled less than 25% of the 2,100 new units introduced. However, average occupancy remains above the national average of 92% at nearly 95%. Average effective rent climbed almost 3.5% during the year to finish up at around $1,000 per unit per month.

Highlight: Fort Wayne and South Bend, two of the smaller markets in this group, were the only areas out of 10 ALN markets in these states to finish below that national average in occupancy.

KY/TN/WV

Nashville continued to stand out as a booming market in 2019. After the introduction of 3,800 new units, the area rented 5,500 previously unoccupied units during the year. Both the new supply and the absorption were in the top 10% nationally. The result of such strong demand was a nearly 2% jump in average occupancy to close December at just over 92%.

Even better, rent growth easily outpaced the annual national mark. The average unit was renting for around $1,250 per month at the end of the year, an almost 6% annual improvement.

The Louisville region suffered an occupancy loss of 1.5% to 90%, due in part to the more than 2,500 new units that entered the market. Absorption was solid at about 1,700 units, but not enough to prevent the occupancy decline. Rent growth was strong though, closing 2019 up by more than 4% to around $920 per month.

The Charleston market had a more lackluster year. Average occupancy fell 0.5% after a net decline in occupied units of 40 units. Average effective rent gained about 1% to hit $900 per month, but this is obviously well below the national average.

Highlight: Nashville is the highlight in this region. The area had another great year after posting solid results the last few years.

VA/DC/MD

Not very many markets added more new units in 2019 than the almost 13,000 new units delivered in the DC area. Average occupancy declined by about 0.5% in the face of this new supply, but net absorption of 9,500 units reflects robust demand. Despite the decline, average occupancy finished the year slightly above 93%, 1% above the national average. Average effective rent per unit continues to creep toward the $2,000 threshold. After an annual increase of a little more than 3%, the average DC unit was renting for $1,850 per month to end December.

Baltimore also finished the year at 93% average occupancy, though, in this case after a gain of about 0.2%. The market took advantage in a drawdown in new supply compared to 2018 and annual net absorption was a healthy 2,800 units. Rent gains were harder to come by than in DC and Baltimore fell just short of 3% growth. The average unit was renting for around $1,350 to finish the year.

Highlight: The DC market continues to be very active, with strong demand and a high volume of new supply. Each of the five ALN markets in this region finished the decade above the national average in average occupancy.

MS/AL/GA/SC/NC

Myrtle Beach was unable to keep up with new supply in 2019. About 1,800 new units were brought online and there was only a 500-unit net increase in the number of rented units. As a result, average occupancy fell 13% to 81%. The large movement is due to the small size of the market, but this is significant nonetheless. Rent growth was a tepid 2%, especially given the relative high volume of new supply.

On the other side of the coin, Atlanta had a strong 2019. Almost 9,000 new units were introduced and around 8,400 previously unoccupied units were rented. Average occupancy did slip slightly to end the year at 92%, but rent growth was strong. The average unit was renting for a little more than $1,250 per month as-of the end of December, a nearly 5% annual gain.

The Charlotte area added around 8,000 new units while net absorption topped 8,300 units. After a negligible increase in average occupancy, the market ended 2019 at 91%. Effective rent growth here was stronger even than the Atlanta result. Average effective rent rose by almost 6% to about $1,200 per unit monthly.

On a percentage basis, the market in this region with the highest annual rent growth was Huntsville. After close to a 10% increase, average effective rent reached $825 per unit. Occupancy remains high as well, crossing 95% after a gain of almost 1%. When looking at net rent per unit change, which accounts for occupancy and rent, the annual increase for Huntsville was almost 11%.

Highlight: Only three of the 22 ALN markets in this region failed to meet or exceed the national average for rent growth. On the occupancy side there is a little more softness, with nine of 22 markets below the national average.

FL

In Orlando, 9,000 new units were introduced during the year, easily the most of any area in the state and enough to put Orlando in the top 10% of markets nationally. Demand was not able to keep pace with that new supply, but net absorption was a respectable 6,500 units. Average occupancy dipped by around 1.5% to a little above 91%. A 3.5% average effective rent gain wasn’t enough to match the national average but was one of the stronger results in the state.

Tampa performed a little better. Average occupancy didn’t really move from the start of the year to the end, finishing at a little above 91%. The stasis was a result of net absorption totaling about 95% of the 6,800 new units delivered. There was more movement on the rent side, where a 4% improvement left the average unit renting at a monthly cost of $1,250 to close the year.

Of the smaller markets in Florida, the Fort Myers – Naples region stood out, unfortunately, not positively. Only about 2,000 previously unoccupied units were rented in the same period that 4,200 new units were delivered. The result was a decline of 7% in average occupancy down to around 84%.

The area began 2019 with less than 3% of conventional properties offering a rent concession. By the end of the year, 18% of properties were offering a discount. This was a headwind for rent growth and average effective rent rose by less than 3%.

Highlight: Overall, 2019 was not a strong year for Florida. Six of eleven ALN markets in the state failed to match the national average for effective rent growth and five of eleven suffered average occupancy retractions.

PA/NY/NJ

The New York City market had a strong 2019. The area added more than 9,000 new units and absorbed in excess of 16,000 units. That level of demand was second only to the Dallas – Fort Worth market nationally. Average occupancy rose by 2.5% to close the year just under 93%. Average effective rent growth was 3%. This was short of the national average but not necessarily troubling for a market already so pricy. The average unit as of the end of December was renting for about $2,700 per month.

The other large market in this group is Philadelphia. Nearly 4,500 new units were added, and 5,800 units were absorbed. Average occupancy finished at 94% and average effective rent rose by 3.5% to almost $1,400 per month.

Highlight: With the exception of the New York City market, no market in this group had a great year. Average occupancy remains above the national average throughout this region, but none of the seven ALN markets hit the national average for rent growth and three gained less than 3%.

CT/RI/MA/NH

The Boston area added 6,700 new units and managed to rent about 4,900 previously unoccupied units. This was not enough to maintain average occupancy, but after a decline of more than 1% to just above 92%, the market remains right around the national average. Effective rent growth was also right at the national average, with a gain of just under 4% to around $2,300 per unit.

Concord provides a picture of a small market that wasn’t quite able to absorb its new supply within the year. Two new properties were opened, totaling a little less than 300 units in a market that began the year with about 4,300 conventional units. Net absorption was negative, to the tune of 300 lost rented units. Adding that to the 300 new units led to an average occupancy decline of 14% to just over 85%.

Annual average effective rent growth, thanks in large part to the relatively high volume of new units, was almost 10%. However, because of the lack of absorption, net rent per unit declined by 6%.

The Hartford area added 800 new units. After renting a little more than 1,300 previously unoccupied unit, average occupancy finished the year at 93%. Rent growth was tepid, with only a 2% annual gain to bring the average unit to $1,350 per month.

Highlight: This region, apart from Concord, continues to maintain high occupancies. Effective rent growth was more of a mixed bag, with three of five ALN markets beating the national average and the remaining two markets failing to hit 3% annual growth.

Year in Review Takeaways

Overall, 2019 was another solid year for multifamily. Average effective rent growth of nearly 4% after a handful of years with even stronger rent growth is a positive result. Average occupancy has remained stable after multiple years with some of the highest volume of new supply in decades.

We are seeing some growing separation in performance across markets and regions though, a continuation of a situation observed in 2018. There are still great opportunities in certain secondary and tertiary markets like Boise, ID and Augusta, GA where new sources of employment and population growth are strong. Other small markets with more stagnant local economies continue to under perform. Most primary markets performed well in 2019, with a few exceptions.

New construction volume is expected to decrease some in 2020 compared to recent years. Combined with an an economy that continues to post strong results, especially relative to other areas of the world, there is little reason to expect a rocky 2020 outside of certain pockets of the country.

Disclaimer: All content and information within this article is for informational purposes only. ALN Apartment Data, Inc. makes no representation as to the accuracy or completeness of any information in this or any other article posted on this site or found by following any link on this site. The owner will not be held liable for any losses, injuries, or damages from the display or use of this information. All content and information in this article may be shared provided a link to the article or website is included in the shared content.