Review: Multifamily Performance in 2018

Almost unbelievably, another year is gone. This month we’ll be looking at how multifamily performed for the year, a region at a time. Unless stated otherwise throughout this review, all numbers will refer to conventional units. Let’s jump in!

Nationwide Review

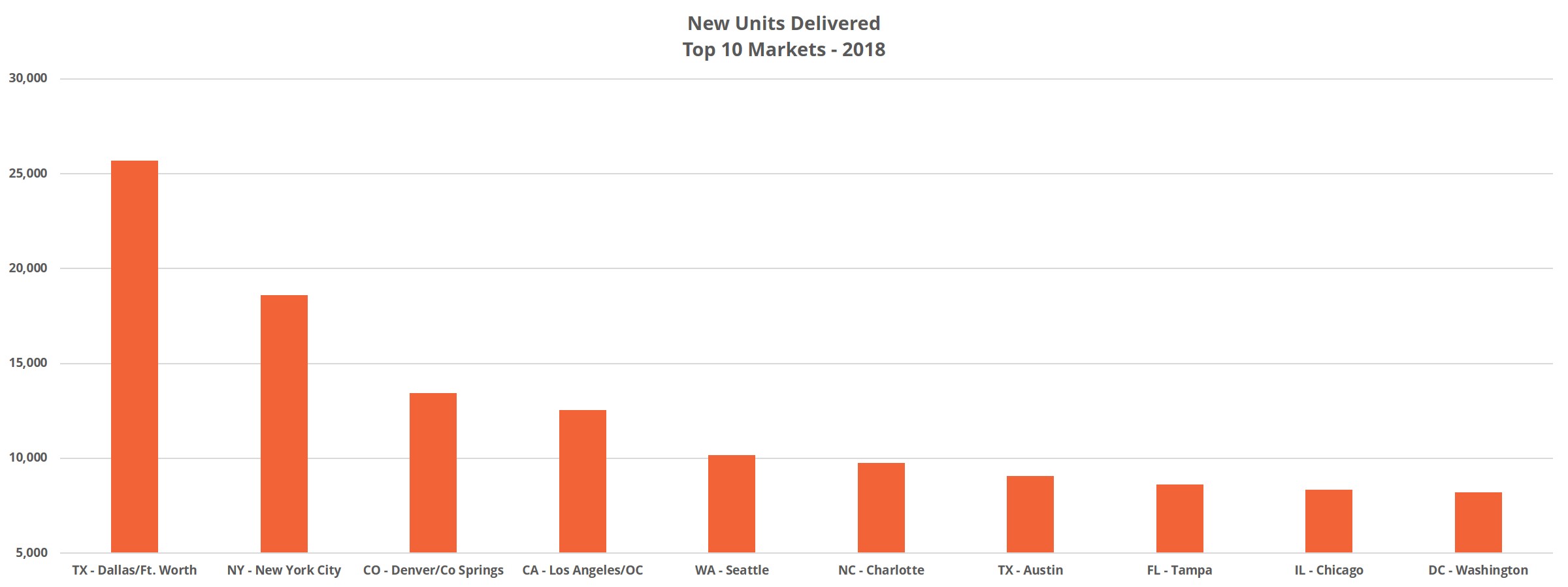

At a national level in 2018, the multifamily industry added about 300,000 new conventional units. That is an increase from the roughly 280,000 units from 2017. Fortunately, net absorption outpaced this new supply by an even greater margin than the previous year. There were about 340,000 newly rented units in 2018, beating the 2017 mark by a full 100,000 units. As a result, average occupancy managed a slight uptick of 0.5% despite the new supply and ended the year at around 92%.

View the full monthly Markets Stats PDF

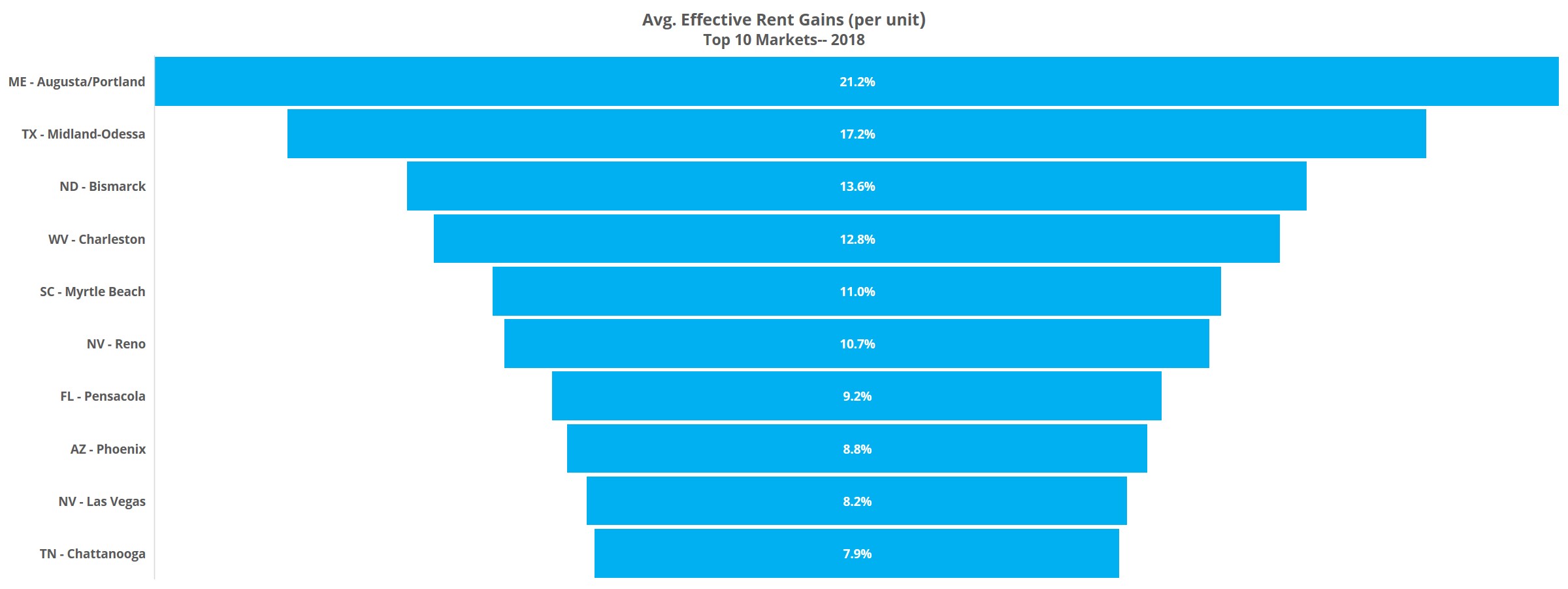

Average effective rent rose 5% in 2018. The resulting national average monthly rent was just over $1,300 per unit. That’s a slight underperformance compared to 2017 but is still a strong number this late in the business cycle.

Takeaway: The story at the national level review is the increase in demand. Absorbed units increased by 41% year-over-year.

Washington/Oregon

Once again, Seattle led the way in effective rent growth for this area in 2018. The 5.5% increase was above the national average of 5%, making it the only market in this region to meet that threshold. Portland realized a gain of about 3.6% and Spokane right at 3.5%. Unsurprisingly, Seattle and Portland saw the most new supply—around 10,000 and 3,100 units respectively.

Seattle and Southeast Washington both ended the year at around 92% average occupancy. Both Portland and Spokane managed to stay above the national average, with average occupancy ending 2018 at 94% and 95% respectively. Net absorption was strong in these markets, enough to counteract about 15,000 new units. Portland rented an additional 5,400 units, and Seattle absorbed 12,000 units.

Review Highlight: Average effective rent gains were down from 2017 throughout this region apart from Portland.

California

With about 12,500 new units, Los Angeles- Orange County market delivered nearly as many new units as the rest of the state combined. San Francisco- Oakland was the only other California market with more than 5,000 new units in 2018—delivering about 5,500. While each market in California ended the year above the national average for occupancy, Los Angeles- Orange County, San Bernardino- Riverside and Sacramento each lost ground for the year. The most significant occupancy loss in the state was about a 1.25% drop in San Bernardino- Riverside.

San Francisco- Oakland once again claims the top spot for average effective rent per unit nationally. 2018 saw a 5% increase in the area to end at about $2,700 per unit monthly. Both San Diego and San Bernardino managed to top 6% effective rent growth and every other market in the state matched or bettered the national average of 5% growth for the 12-month period.

Review Highlight: Despite featuring some of the most expensive rents in the US, average occupancies remain high across the state and effective rent growth kept pace with the rest of the country.

Arizona/Nevada/New Mexico

This region was a bit of a mixed bag when it comes to rent growth. Phoenix and Las Vegas checked in at about 8% annual effective rent growth. Areas like Flagstaff and Albuquerque fell short of the national average with growth right around 3.5% each. Tucson was in between, with a little over 6% rent appreciation.

Reno is an interesting example of a market where rent growth was affected a little more acutely by new supply. When looking at all conventional units, rent growth was nearly 11%. When we isolate only properties that were existing and stabilized prior to the start of 2018, the growth rate is about 8.5%. A fantastic number still, but this shows a fair bit of the appreciation is due to expensive new units coming online.

Each area in this group finished the year with average occupancy above 92%. Both Phoenix and Reno ended up at 93%. Tucson, Las Vegas and Albuquerque all ended December at 94%, and Flagstaff topped 95%. The smaller markets remained stable all year thanks to a relatively small amount of new supply. In terms of the larger markets, Phoenix added almost 8,000 new units and Las Vegas added about 2,500.

Review Highlight: This region, and Arizona and Nevada in particular, had a great 2018. Impactful new businesses like the Tesla Gigafactory will continue to affect Reno. This region added 4% to unit capacity in 2018 alone.

Idaho/Utah/Colorado

For this group, much of the new supply was in the Denver- Colorado Springs market where about 13,500 new units were introduced in 2018. Salt Lake City was also active, given its relative size in multifamily, with 4,000 new units. While average occupancy was mostly flat at 91% for the Denver- Colorado Springs area, Boise saw an increase of 1% to finish the year at around 93.5%. Salt Lake City suffered a slight decline of 1% to finish at approximately 91.5%.

These markets were just as homogenous when it comes to rent growth. Each surpassed the national average of 5%, with Boise leading the way at just under 7%. Denver- Colorado Springs saw the smallest gain, but still rose a little over 5% for the year. That is respectable growth considering the average effective rent per unit for the market is $300 more than Boise monthly, and $400 more than Salt Lake City. Salt Lake City was right in the middle, with an annual improvement of 6%.

Review Highlight: Removing properties that had not stabilized by the start of 2018 from the Salt Lake City numbers brings annual effective rent growth from about 6% to a little over 4%. New units were a major factor in driving the average rent up.

North Dakota/South Dakota/Nebraska/Iowa/Kansas

Only one market in this group saw rents outperform the national average. Effective rent in Bismarck climbed more than 13% in 2018, possibly due in part to the partial oil recovery. The Topeka- Manhattan- Lawrence region of Kansas was almost able to hit 5% growth, coming just short at about 4.7%. Another solid performer was Des Moines where prices went up by about 4.5% for the year. Effective rent in areas like Wichita, Fargo and Lincoln failed to reach 2% gains, but Omaha moved 2.6% higher.

New supply was predictably somewhat sparse in these markets. Des Moines introduced about 1,800 new units and Omaha added nearly 2,700. Other than that, no area added more than the 500 or so in Fargo. The new units in Des Moines were enough to push average occupancy down by almost 0.5%, ending the year at about 90%. Similarly, Lincoln lost ground to the tune of 1% to finish at 96% and Omaha fell just under 1% to end 2018 at a little over 91% for average occupancy.

Review Highlight: If we look at median effective rent gain rather than average, Bismarck moves from about 13% to around 10%. This shows there are a few properties at the top of the market that are skewing the numbers up.

Oklahoma/Louisiana/Arkansas/Missouri

Nearly 4,300 new units were delivered in the Columbia market in 2018. Another 2,000 were added in the St. Louis metropolitan area and Baton Rouge grew by about 1,500 units. These were the only areas in this region to add more than 1,000 units during the year. Despite the relative lack of new construction, average occupancy performance was mixed. Only Springfield, Columbia and New Orleans met or exceeded the national average—at 96%, 94% and 92% respectively.

The Northwest Arkansas region ended December at 90% average occupancy after a nearly 3% improvement in 2018. St. Louis average occupancy retracted by about 1% to finish at 90% and Baton Rouge also declined by 1% to finish at 86%. Both Oklahoma City and Tulsa gained around 2%, ending at approximately 90% and 91% respectively.

Eight of the 13 individual ALN markets comprising this region failed to exceed 3% effective rent growth. Columbia and Northwest Arkansas led the way with a little more than 5% gained each. St. Louis, New Orleans and Kansas City all rose between 4-5% for the annual period. Little Rock managed 3% appreciation, but markets such as Tulsa, Monroe and Lake Charles fell short of 1% growth.

Review Highlight: Columbia, Missouri had a strong 2018. However, many of the markets in this region were somewhat stagnant.

Texas

Once again, Midland- Odessa has the highest average effective rent in the state. A combination of previously low supply and the partial oil recovery sent prices in the already expensive market up 17% in 2018. The average unit now costs nearly $1,500 per month in the area. The Lufkin and Austin markets both saw prices rise by 5% during the year, making these three areas the only ones to meet or beat the national average. Dallas- Fort Worth managed a little over 4% growth, San Antonio rents rose by about 4% and Houston experienced a gain of only about 1.25%.

Texas has been one of the most active states for new construction over the last few years. As a result, all the large markets in the state are below the national average for occupancy. For example, the Dallas- Fort Worth metro area added nearly 26,000 new units during the 12-month span. The Austin area added around 9,000 units and both Houston and San Antonio delivered right around 6,000. Midland- Odessa delivered about 6,200 units during the year, a needed boost in supply.

The College Station, Lubbock and Victoria markets all suffered average occupancy declines of around 2.5%. Victoria still ended the year at 92%, but both Lubbock and College Station ended December below 90%– at 88% and 85% respectively. Of the four large markets in Texas, only Austin matched the national average of 92% for occupancy, Dallas- Fort Worth, San Antonio and Houston all finished the year at 90%.

Review Highlight: Dallas- Fort Worth has added more than 50,000 units in the last two years and has another 32,000 currently being built. With another 33,000 units in a pre-construction phase, demand in this market is worth keeping an eye on.

Minnesota/Wisconsin/Illinois

Despite adding more than 8,000 new units during the year, the Chicago metro area realized a 1% improvement in average occupancy thanks to nearly 10,000 units being newly rented. Minneapolis- St. Paul and Milwaukee each delivered more than 3,500 units, but both saw occupancy slide a little bit, led by a nearly 2% drop in Milwaukee. The only other market with more than 1,000 new units in this region was Madison. After adding nearly 1,200 units, average occupancy was just under 94% to end December.

With an average effective rent gain of just over 5%, Minneapolis- St. Paul led the way for 2018 in this group, bringing the average unit to about $1,250 per month. The Milwaukee and Green Bay- Appleton- Oshkosh markets were very slightly behind that at 5% growth. Chicago, already the most expensive area of this group, gained about 4.5% in 2018, bringing the average unit to a little more than $1,500 per month.

Review Highlight: Even after the addition of almost 4,000 new units and a slight occupancy decrease, Minneapolis- St. Paul ended 2018 with an average occupancy of 95%. The area also led this group in effective rent growth.

Michigan/Ohio/Indiana

Columbus and South Bend paced this region with a 6% average effective rent increase in 2018. Following just behind was the Grand Rapids- Kalamazoo- Battle Creek area with an improvement of around 5.5%. Fort Wayne and Toledo had more lackluster results, as both failed to gain 3% for the 12-month period. Detroit, with its 4.5% increase, is the first market in this group to knock on the door of $1,000 for an average monthly rent per unit. This after ending December at about $980 per unit.

Occupancy gains were hard to come by in these markets, but the overall average occupancy numbers were strong. 5,700 new units in Columbus contributed to an occupancy decline of around 1.5% to end the year at just over 92%. Cleveland- Akron introduced a little more than 3,000 new units and also suffered an occupancy decline of 1.5%. Indianapolis managed to remain right around 92% occupancy, with the 3,600 new units delivered there acting as a bit of a headwind for gains.

Detroit added slightly above 1,000 new units and average occupancy retracted, but by less than 0.5%. The metro area ended the year at 95% occupancy, so the new units were far from an issue.

Review Highlight: While rent gains fell short of the national average for many of the markets in this group, average occupancy remains at, or above, the national average across the board.

Kentucky/Tennessee/West Virginia

Even after taking almost 200 units offline during the year, Charleston experienced an average occupancy decline of 1.5%. The good news is average occupancy ended December at 94%, the highest in this region. Lexington ended the year at about 92.5% thanks to a 1.5% annual increase. In terms of new construction for these markets, most of the activity was in Nashville.

About 5,400 new units were delivered, more than the rest of the markets in this region combined. Thanks to strong demand, average occupancy in Nashville rose by 1.5% despite the new units and ended up back on the right side of 90% at around 90.5%. Knoxville and Louisville each added around 1,100 new units. Louisville added 1% to average occupancy, while Knoxville slid by nearly 3%.

Average effective rent increases were quite strong in these markets. Chattanooga’s average effective rent rose by 8%, Charleston even more. Both Knoxville and Memphis gained around 6% and Louisville almost managed a 5% increase. The only market with average monthly rent above $1,000 continues to be Nashville, coming in at just under $1,200, but Chattanooga and Knoxville both crossed the $900 threshold in 2018.

Review Highlight: An average effective rent gain of 6% in Knoxville moves to 3.5% when we look at only properties that were stabilized prior to the start of 2018. In Chattanooga, the average effective rent gain of about 8%, moves to 3.5% when looking at the median instead. A handful of properties at the top of the market drove much of the rent growth. This is more pronounced in Charleston, where the average increase was around 12%, but the median was only a little over 4%.

Virginia/DC/Maryland

Effective rent growth was below average for these areas in 2018, but many already had expensive rents relative to the rest of the country. Washington DC saw rents increase by just under 4% but ended the year with an average monthly rent of nearly $1,800. Richmond and Roanoke were the only two metro areas to achieve rent gains of about 5%– Roanoke just over, and Richmond just under that mark. Baltimore gained only 2% for the annual period but ended with an average rent of more than $1,300.

Average occupancy gains were also meagre in this group, but as with average rent, the overall numbers to end the year were strong. Richmond lost a little more than 1%, partially due to almost 3,100 new units. Roanoke, DC and Baltimore all gained around 1% and Baltimore’s 93% average occupancy was the lowest of the three.

Review Highlight: DC net absorption outpaced new supply by nearly 5,000 units. Norfolk, with strong occupancy but relatively low rent growth, may be able to be a little more aggressive with rents in 2019.

Mississippi/Alabama/Georgia/South Carolina/ North Carolina

The largest average occupancy gain in these states was the 7% jump in Myrtle Beach. That number being so high is due in large part to the small size of the overall market. Nonetheless, average occupancy climbed from 87% to a little over 93% during 2018. Gulfport- Biloxi ended December just shy of 94% occupancy thanks to a 3% annual increase.

Markets that fell that most were Augusta with a 6% loss and Mobile with a 2.5% loss. Atlanta gained about 1% after adding nearly 6,200 units and absorbing more than 10,000 units. Charleston added almost 3,000 units but absorbed around 3,500 for an average occupancy improvement of about 2%.

Effective rent performance was good in this region, with only a handful of markets out of nearly two dozen falling short of the 5% national average gain. Areas like Greenville-Spartanburg, Huntsville, Wilmington and Atlanta all realized improvements of around 6%. Gains in Charlotte fell just below that, at around 5.5%. Interestingly, both Savannah and Myrtle Beach crossed the $1,000 per unit monthly rent threshold during the year.

Review Highlight: Demand in Atlanta was strong, easily outpacing the volume of new supply. Effective rent gains for this region were healthy, with many surpassing the national average.

Florida

There are two remaining Florida metro areas where average effective rents remain below $1,000 per unit per month. Those markets are Gainesville and Tallahassee—and both realized gains of 6.5% in 2018 to bring them to just under that threshold. Melbourne, Orlando and Jacksonville also performed well, also achieving increases of 6.5% each.

The only markets that failed to reach 5% growth for the year were generally the more expensive Florida metros. Areas like Fort Lauderdale, Miami, Palm Beach and Fort Myers- Naples all saw rents climb between 4- 4.5%.

Florida, maybe more than any other state, had a fairly even spread of new construction activity across the state. Seven of the 11 markets added at least 900 units. Leading the way were Tampa and Orlando with about 8,600 and 5,800 units respectively. Miami and Jacksonville each added nearly 4,000 new units while Palm Beach and Fort Lauderdale both added more than 2,000 units.

Because of the new supply, average occupancy movement was mixed. Fort Myers- Naples dropped 4% to end the year with an average occupancy of 90%, the lowest in the state. Other areas to lose ground were Melbourne and Jacksonville, each with a loss of about 1.5%. Gainesville and Tampa both lost ground as well, but by less than 1%. On the flip side of the coin, Pensacola jumped 5% to finish at nearly 95% occupancy and Tallahassee improved by more than 3%.

Review Highlight: Florida added about 30,000 new units in 2018, but occupancies remain around the national average. Effective rent growth, while helped by the new units, was strong amongst only stabilized properties as well.

Pennsylvania/New York/New Jersey

After adding about 23,000 new units, the metropolitan area of New York City absorbed almost 30,000 units in 2018. The result was a 2% occupancy improvement to end the year just below 91%. The Philadelphia market added about 5,200 units and nearly 8,900 units were newly rented. The result was a 1% average occupancy increase, up to 93%. The State College- Altoona area added no new units despite beginning 2018 at 99% occupancy and finishing at 98%.

The New York City market led this group in effective rent growth despite already being the most expensive area by far. Rents rose about 5.5% over the last 12 months, bringing the average monthly rent to about $2,600 per month. Buffalo- Rochester- Syracuse, Harrisburg- Lancaster and Pittsburgh all managed about 5% rent growth for the period. The Albany and State College- Altoona areas were a little softer, with appreciation of just under 3% and about 1% respectively.

Review Highlight: Let’s repeat that: The metropolitan area of New York City absorbed almost 30,000 units in 2018.

Connecticut/Rhode Island/Massachusetts/New Hampshire

Once again, the most expensive market of the group led the pack in rent growth. Average effective rent in the Boston area rose a little more than 6% in 2018. That brings the average monthly rent to about $2,200 per unit. Concord, Hartford and Springfield all realized gains of around 4% and Concord nearly reached 3% rent growth.

Most of the new units delivered during the year were in the greater Boston metro area, but Hartford also added almost 1,000 units. While Boston absorbed those new units and then some for a 3% average occupancy improvement, Hartford fell by 1%. Both finished December with occupancy around 93%. The Augusta- Portland market added about 1.6% to average occupancy while Springfield and Concord came in just shy of a 1% annual gain.

Review Highlight: Four of the six markets in this region ended 2018 with an average occupancy above 96%.

Takeaways from the 2018 Review

2018 was another productive year for the multifamily industry. New construction activity was high, and both average occupancy and average effective rent growth were strong for this late in the cycle. It is apparent though, that some areas are showing some signs of softening conditions. Occupancies remain very high in various smaller markets, with little new supply while some of the large markets are seeing new units begin to exert some pressure.

As we look ahead to 2019, there don’t appear to be many red flags short of a significant macro event, but the gaudy performance of recent years will be hard to match.

Disclaimer: All content and information within this article is for informational purposes only. ALN Apartment Data, Inc. makes no representation as to the accuracy or completeness of any information in this or any other article posted on this site or found by following any link on this site. The owner will not be held liable for any losses, injuries, or damages from the display or use of this information. All content and information in this article may be shared provided a link to the article or website is included in the shared content.