Rent Growth Stumbles Toward the 2025 Finish Line

The multifamily market enters late 2025 at a clear turning point. Robust leasing activity lifted average occupancy for the first time since 2021, giving rent growth a modest but welcome boost. Yet a sharp slowdown at the start of the fourth quarter has cast doubt on whether 2025’s gains will ultimately outpace 2024.

All numbers will refer to conventional properties of at least fifty units.

View the full monthly Markets Stats PDF

Recent Context

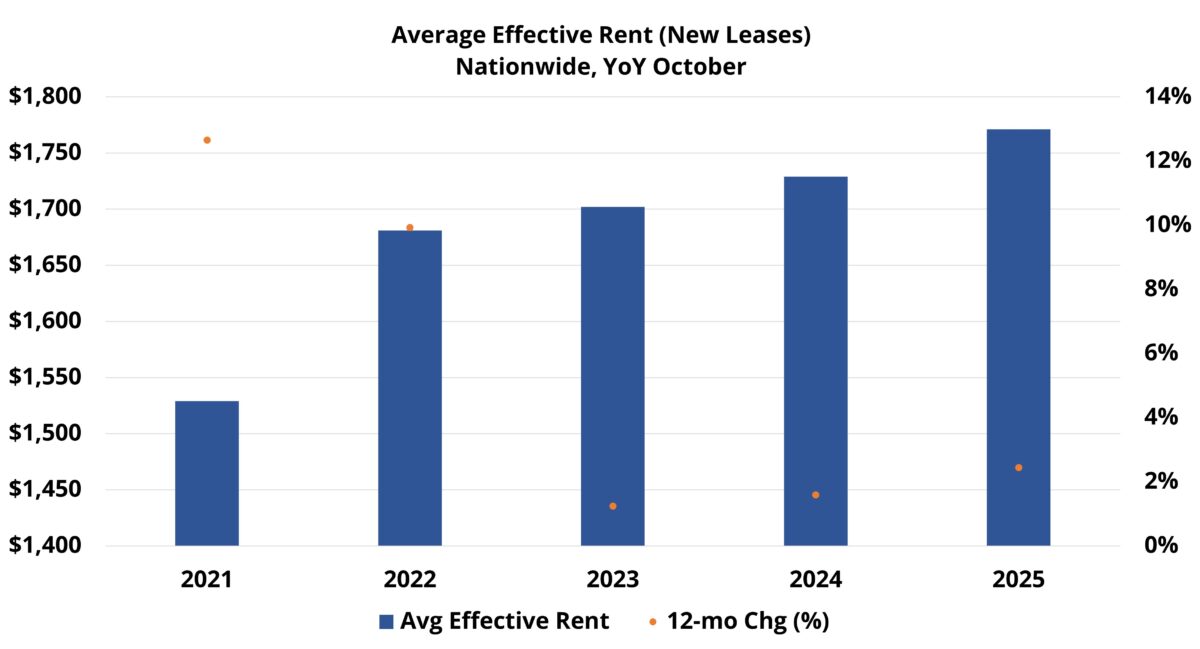

After the elevated rent growth period of 2021 and 2022, national average effective rent growth for new leases has been in the doldrums. Some progress was made in recent years, but annual rent growth remained below the 3-4% average that generally serves as a benchmark.

Rent growth improved modestly from 1.1% in 2023 to 2.7% in 2024. In the five-year stretch from 2020 through 2024, three years finished with rent growth below 3%. Of course, in the other two – rent growth soared to levels not seen in decades.

2025 National Developments

Through the first three quarters of 2025, rent growth was the strongest since 2022. By September, year-to-date effective rents were up nearly 3%, compared with roughly 2% gains in both 2023 and 2024.

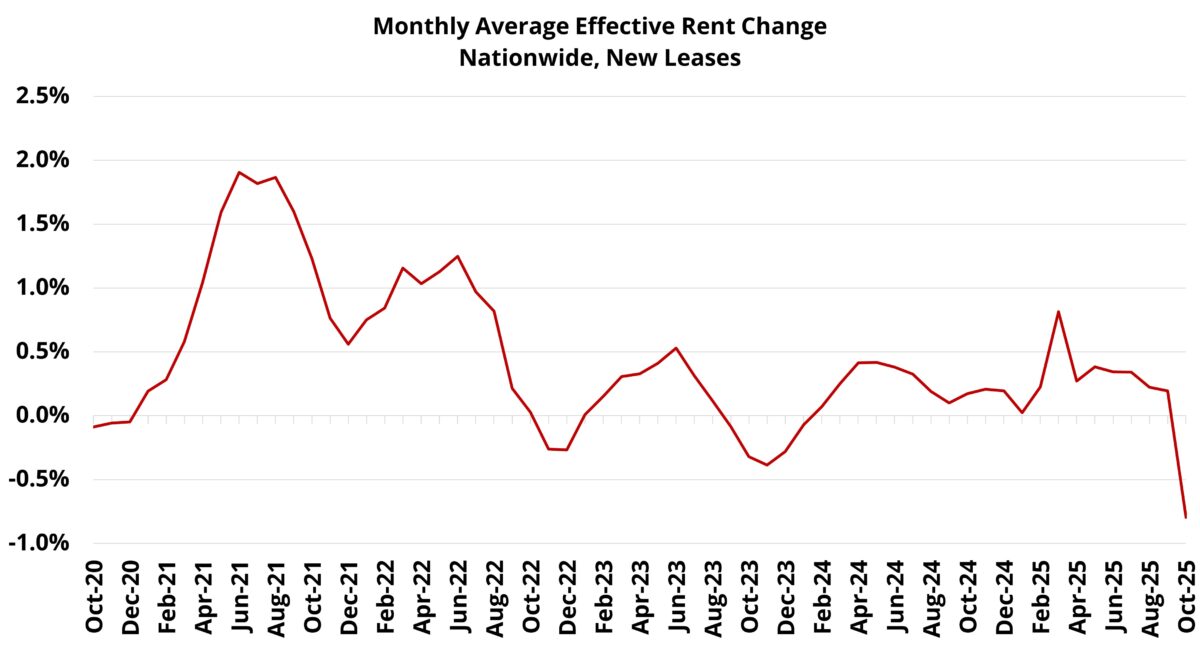

For the first time since 2021, rents increased every month through September. March’s 0.8% rise marked the peak, though steady gains continued into summer before momentum slowed. By August and September, monthly increases had narrowed to 0.2%, holding annual growth near 3%.

October’s 0.8% drop – the first monthly decline since January 2024 – was also the sharpest in more than five years. While monthly data are inherently volatile, the magnitude of this decline was striking and shifted the trajectory of 2025’s rent performance.

Net Absorption Less Impactful on Rent Performance

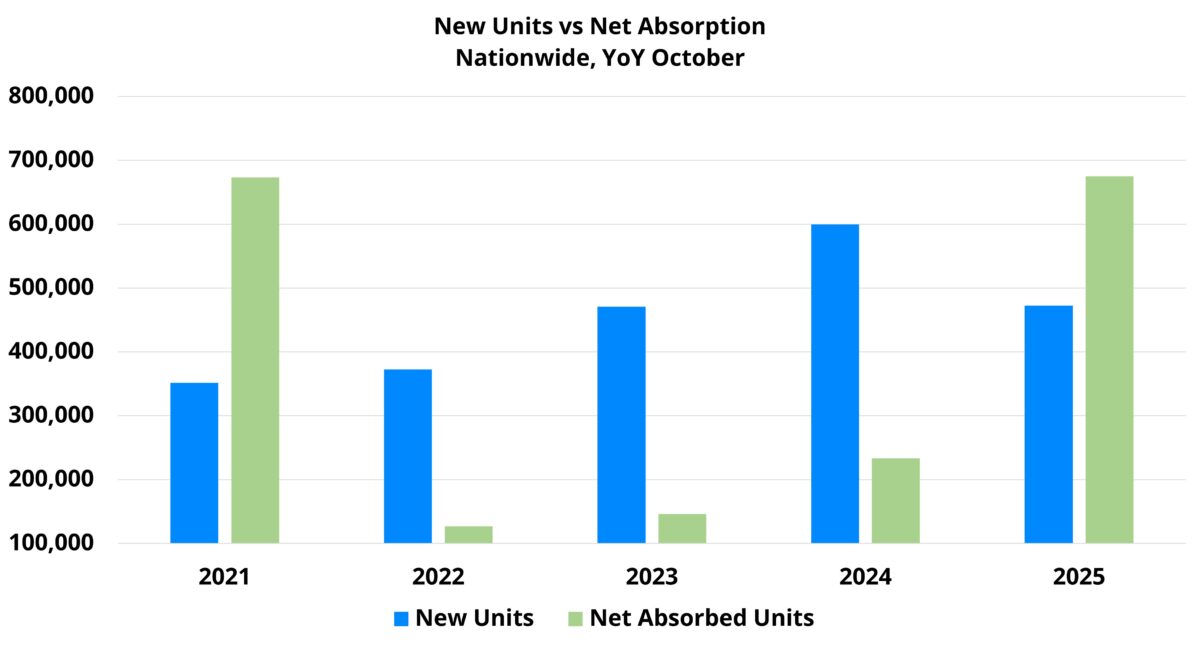

This volatility in rent growth has unfolded despite exceptionally strong apartment demand. Through three quarters, national net absorption nearly matched 2021’s historic pace.

In 2021, average occupancy began within its typical range, but unprecedented absorption – combined with limited evictions – pushed occupancy to record highs. Rent growth topped 1% per month for seven straight months, and lease concessions largely vanished.

In contrast, 2025 began with occupancy well below normal levels, due largely to the surge of new supply in recent years. Although this year’s absorption has reversed some of that decline, there remains much ground to regain. After another increase in availability this year, nearly one-quarter of conventional properties were offering rent discounts for new residents by October.

Demand strength has been remarkably broad-based. Net absorption has been strong for lease-up properties as well as for stabilized properties. The same has been true for all four price classes. Results have been positive across markets of all sizes and across geographic regions.

The key difference between 2021 and 2025 lies in occupancy and concessions: today’s rent performance is limited by elevated vacancy and the use of incentives to sustain demand. Beyond multifamily fundamentals, persistent affordability challenges and a softer labor market – revealed through 2024 and 2025 jobs revisions and rising layoffs – have also tempered rent growth.

The 2025 Finish Line

It is not unusual for monthly rent growth to decline at some point in the fourth quarter. 2021 and 2024 were outliers in that respect in recent years in that they did not feature a retraction at any point in the final quarter.

October’s decline, however, stood out for its scale. While monthly data can be volatile, this drop erased the previous three months of gains and shifted annual momentum.

If typical late-year softening continues, 2025 average effective rent growth is now on track to finish below the past two years, despite midyear projections that suggested a modest outperformance. A normal fourth-quarter pattern would place full-year rent growth near 1.5%.

Don’t miss out on the Multifamily 2025 Recap and 2026 Outlook webinar on December 2, 2025! Space is limited, so save your seat now!

Takeaways

The rent growth narrative has shifted in recent months. After a strong start to the year, momentum slowed in the summer and weakened further to begin the fourth quarter.

As of September, national net absorption had rivaled 2021’s record pace, occupancy had finally begun to recover, and rent growth was on a three-year upswing. This appeared to set the stage for a stronger 2026 for multifamily rent performance.

Despite the recent setback, apartment demand remains a clear success story for 2025. The early stages of an occupancy recovery – originally expected to take shape next year – has arrived sooner than anticipated. Rent performance tends to follow these fundamentals.

With a slowdown in new deliveries expected in 2026, strong demand should provide a solid foundation for rent growth to normalize. Still, continued late-year weakness could challenge that recovery outlook.

Disclaimer: All content and information within this article is for informational purposes only. ALN Apartment Data makes no representation as to the accuracy or completeness of any information in this or any other article posted on this site or found by following any link on this site. The owner will not be held liable for any losses, injuries, or damages from the display or use of this information. All content and information in this article may be shared provided a link to the article or website is included in the shared content.

Transform your budget season planning approach with comprehensive market intelligence. Schedule a personalized ALN OnLine demonstration and discover how data analytics can elevate your strategic decision-making.

Continue Your Strategic Planning Journey:

- Before the Year Begins: 5 Ways to Turn Your Budget into an Action Plan

- From Line Items to Strategy: How Executives Use ALN During Budget Season

- 5 Data Points Every Multifamily Budget Should Include (and How to Find Them Fast)

- What’s New in Your Submarket? 4 ALN OnLine Reports That Give You an Edge This Budget Season

- 7 Ways ALN OnLine Makes Multifamily Budget Season Less Stressful