Multifamily New Construction

As we get well into five years of a boom multifamily market in most US markets, we are finally starting to see some dips in year-over-year absorption. While still relatively strong compared to prior eras, in most markets we are seeing absorption trend slightly downward since peaking in 2015 and 2016.

View the full monthly Markets Stats PDF

As we get to minimal unemployment, there will naturally be less job growth from previous years. Consequently, going forward, US markets that improve will likely come at the expense of other markets.

New Construction Tapping the Brakes

During the recovery, it seemed like each year more cranes were going up and that there was no end was in sight. However, we have seen a peak in new construction activity in most markets, and it couldn’t have come at a better time. There are, to be certain, a lot of new construction projects currently going on and many more slated to begin construction.

Multifamily construction is beginning to tap the brakes for the most part – and for several reasons. The entitlement and approval stages are taking longer to complete in many localities. Lenders are being more diligent and selective about financing. Single family projects are starting to pick up and labor is becoming scarcer. Projects themselves are more intricate than even 10 years ago, so completion times are being pushed back by 6 months or more.

While this may bode well for some markets, with the closing of the chapter on the latest boom, some markets may be in for a harder landing.

What’s in the Pipeline

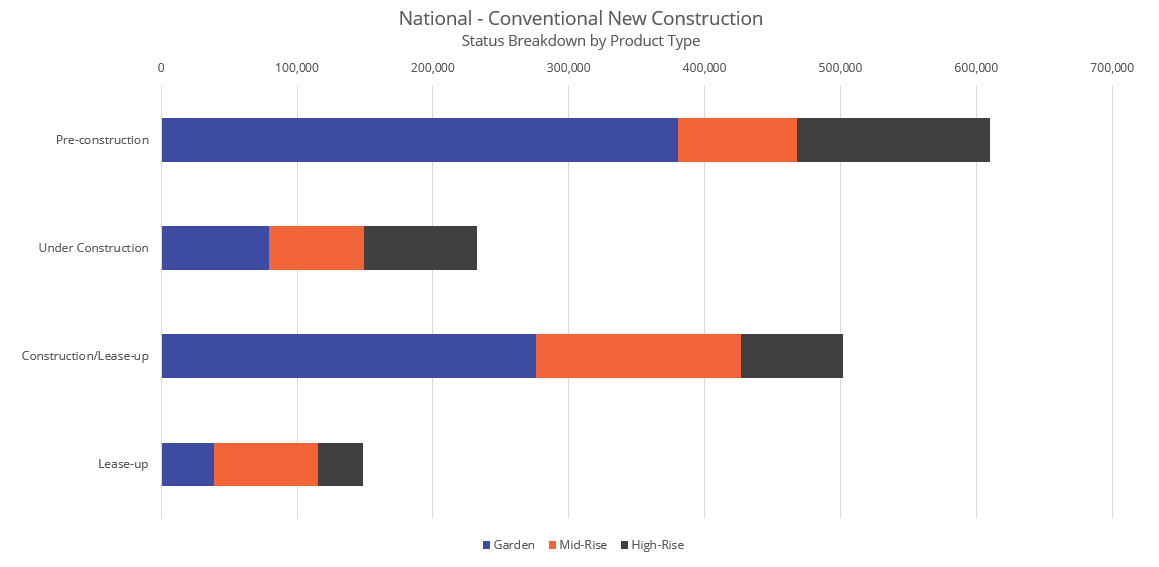

If we look at the last five years of average new construction “pipeline” for conventional properties (projects under construction and not yet leasing or slated to begin construction in the next 24 months), the United States topped out at about 1.5 Million units in October of 2015. By the beginning of this year, the number of units in the future pipeline dropped to about 900,000 units. However, that still leaves 700,000 units that are currently in Construction/Lease-up or Lease-up.

There has been an average of about 180,000 net rented units per year absorbed throughout the US over the last three years. Therefore you could say that the future pipeline consisted off about 5 years of current absorption that are slated to begin construction by 2019. With build out times being pushed back to nearly 3 years in many cases, on average many markets should be able to avoid precipitous drops in occupancy levels market wide.

There are a few markets that have a significantly higher ratio of new units coming to the market as compared to their recent absorption levels. For example, The Miami/Ft. Lauderdale area has almost 10 years’ worth of absorption in new supply coming onto the market by 2019. Chicago, Atlanta and New York City each have more than 7 years’ worth. Houston, on the other hand, even prior to losing units to Harvey, had only 2.3 years’ worth of absorption slated for construction.

To be sure, any major drop in absorption levels will drastically impede occupancy gains and, as mentioned above, there are already factors in play to lower absorption figures somewhat in the near future in most markets.

Our Newest Report

ALN released our newest report, a New Construction Summary, last month. This two-page PDF is similar to our Market Reviews with a concentration solely on new construction data, and is available exclusively within ALN OnLine in any market available nationwide. Ready to research multifamily new construction? We’re here to help!