Multifamily Floorplan Distribution

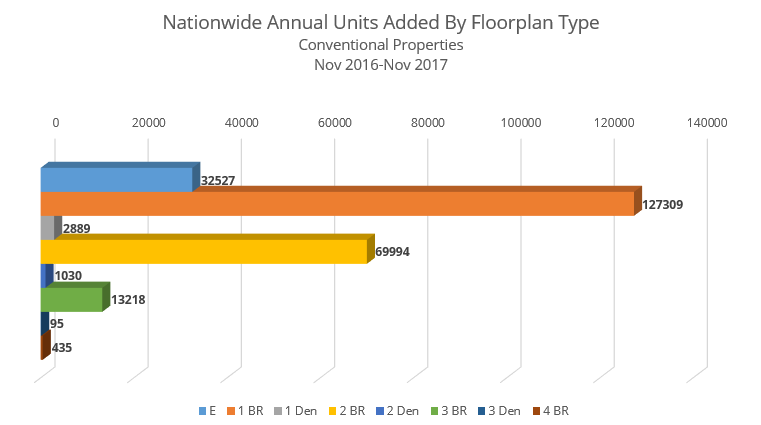

In the last year about 250,000 new conventional units were added to the market in the United States. Of those, about 50% were one bedroom floorplans. This is well beyond the historical norm that has been developed over the last 50 years, as we’ll discuss with more detail later.

Another 13% of units built were efficiency units. Around 28% were two bedroom floorplans, and three bedroom units only accounted for 5% of the total units added. The remaining 4% were comprised of units with four bedrooms floorplan or more, or units with an extra den.

View the full monthly Markets Stats PDF

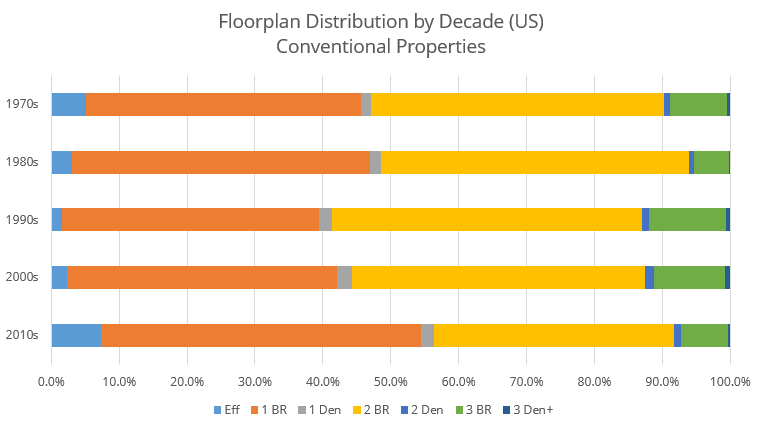

Prior to the Great Recession, aside from the building boom from 1983-1986, the long-term trend in multifamily had been an increase in the supply of two and three bedroom units. Efficiencies and one bedrooms traditionally made up a smaller share of the new supply. Since then, we have seen efficiencies and one bedrooms make up an increasingly larger portion of new units as a response to decreasing two and three bedroom unit rentals.

The percentage of new units with a den has largely remained steady over the last 40 years, with one bedrooms with a den making up just under 2% of units and two bedrooms with a den representing about 1% of units.

Prior to 2010, one bedroom units reached a peak of 43.8% of units during the construction boom of the mid 1980’s. Since 2010, however, one bedrooms have represented more than 44% of units. As noted, this past year they breached the 50% mark of new units. For more in-depth information new construction, see our article Multifamily New Construction.

Why the Shift to Small Floorplan Units?

Numerous reasons are possible for this shift to smaller units during the past decade. Millennials are getting married and buying homes at a lower rate than preceding generations. This means young adults are staying in one bedroom units longer than previous generations. Increased student debt may also be a factor for the downsizing, as renters choose smaller units and add roommates to reduce living expenses.

Additionally, more older Americans are single today than at any time in the past, and retirement savings rates for the boomers are low compared to prior generations. This creates increased demand for an efficiency and one bedroom floorplan, as they meet both the financial and the space needs of aging singles.

Moving forward, some of these trends may not remain constant. There has finally been a start toward home ownership amongst millennials, with those rates beginning to rise. The oversized baby boomer generation may soon be aging into specialty housing, leaving conventional units behind. The younger boomers who have the means and are entering the empty nest phase may downsize from single family housing to multi-bedroom units as a preference.

While talk of a multifamily bubble is not out of the question, there are hopes for a soft landing from the recent boom. However, the distribution of floorplan types might present a more immediate concern for properties that are concentrated towards smaller units. An overcorrection toward one bedroom floorplan units over the past decade makes stable demand for those units important for the whole industry.

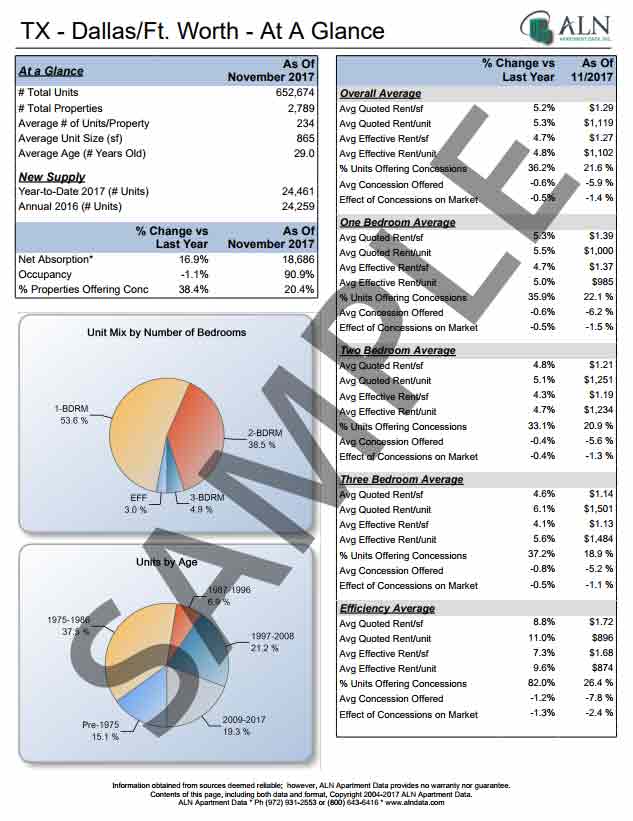

ALN OnLine offers an “at a glance” report for each of the markets we cover nationwide, which includes floorplan breakdown statistics and much more. Contact ALN Apartment Data, Inc. today to see this report and the data available from coast to coast.

Need reliable Multifamily data? Learn more about the data, reports, and benefits of ALN OnLine here.