Looking Ahead to 2026

With only the final few weeks of the year remaining, focus has turned to 2026. A fuller analysis of 2025 multifamily performance will be the topic of this newsletter next month.

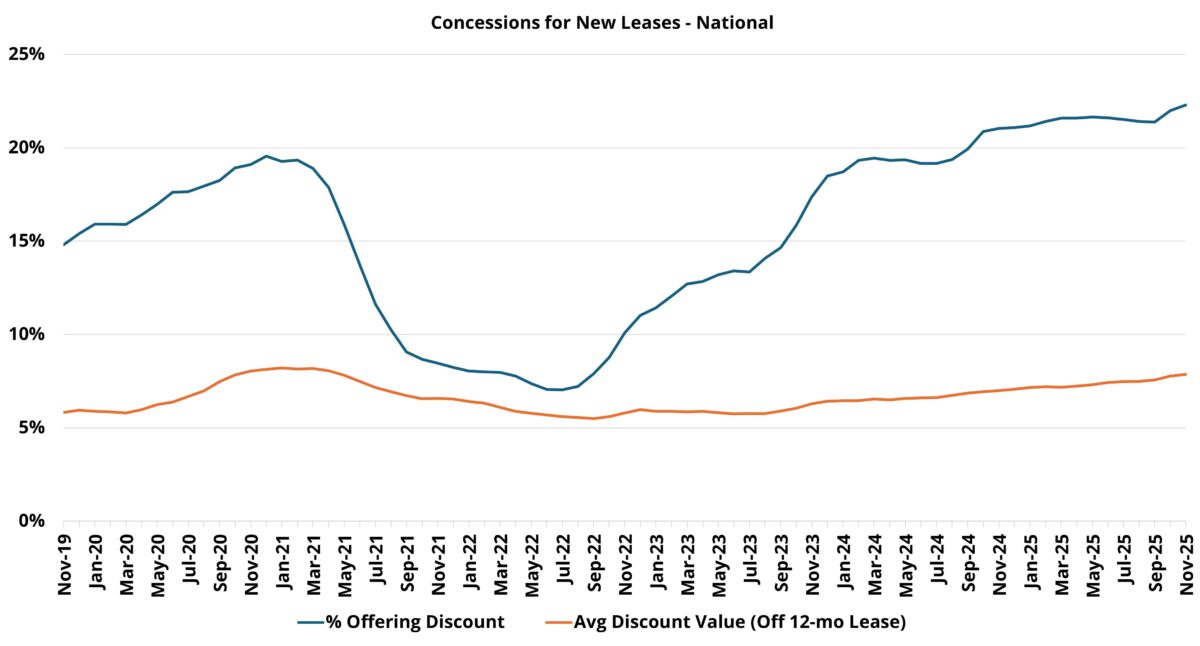

However, this year saw vast improvement in the supply and demand relationship. This was due partially to a decline in new supply but was due mostly to a surge in apartment demand. The result was the first gain in national average occupancy since 2021. Rent growth did not make the same progress, but nonetheless held serve from 2024. Encouragingly, lease concessions continued to proliferate but at a lower rate.

The question now is what all of this means for 2026.

All numbers will refer to conventional properties of at least fifty units.

View the full monthly Markets Stats PDF

Upcoming New Supply Remains Significant

In the first half of the year, there were widespread reports of a significant slowdown in multifamily starts. That picture started to change in more recent months. ALN is tracking more than 820,000 units currently under construction. Those units are in addition to nearly 900,000 units in some phase of lease-up. Those lease-up units are an important facet of the supply picture, in addition to upcoming deliveries.

That makes about 1.7 million multifamily units either under construction or currently trying to stabilize. Early in 2024 that number was close to 1.9 million. There has been a decline, but not a particularly precipitous one. Another three million units are currently in a pre-construction phase – equal to the number from early 2024.

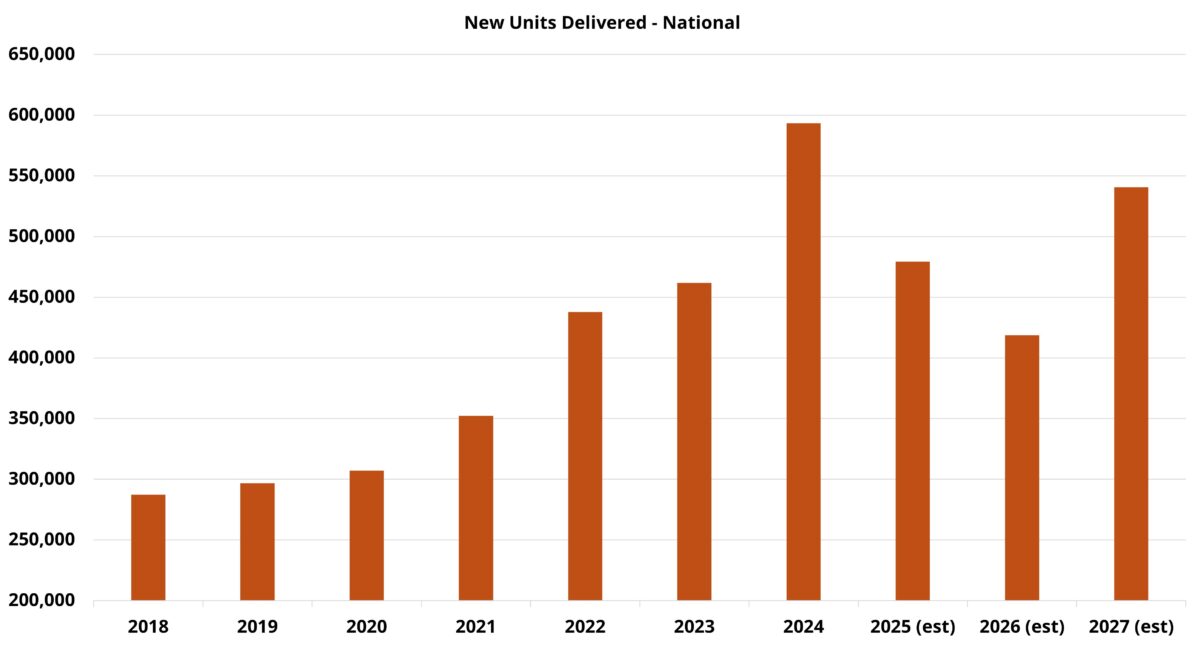

New deliveries next year are expected to be lower than in recent years. New supply in the neighborhood of 420,000 units nationally would be the lowest total since 2021 and roughly 30% below the 2024 peak. It looked at one point as though 2027 might be another year with relatively lower deliveries. Starts this year have been sufficient to make that eventuality unlikely. More than 500,000 new units are currently anticipated to begin leasing in 2027.

Net Absorption Trajectory Murky

Net absorption surprised to the upside this year and the effects rippled throughout the industry. Because realized apartment demand beat expectations – and was on pace through November to beat 2021 – national average occupancy managed an outright gain rather than just a smaller decline for a third consecutive year.

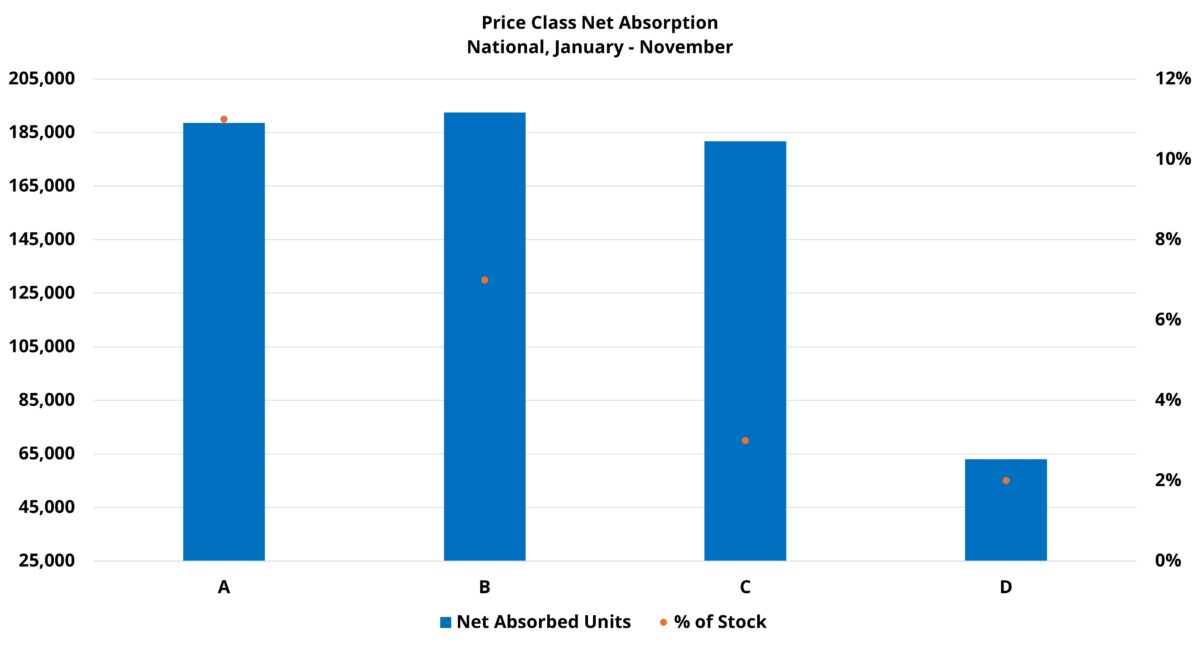

Rather than being concentrated in one subset of the multifamily sector, net absorption improved essentially across the board. This bodes well for 2026. On the other hand, there are some crosswinds that make the apartment demand picture somewhat murky.

Outlier years for apartment demand are generally followed by a reversion to the mean. Also, while net absorption has been robust for stabilized properties this year, most of the leasing activity has occurred in the lease-up segment. Normally, a decrease in deliveries as is expected next year could have some effect on net absorption. However, plenty of lease-up backlog remains, which should continue to fuel leasing activity in 2026 even as new deliveries moderate.

Lease concessions should be mentioned here as well. Unlike in 2021, this year’s surge in net absorption came alongside significant lease concessions – both in terms of availability and average value. Lease concession availability has been above the pandemic-era peak for fifteen straight months and counting. One question next year will be whether apartment demand can maintain momentum without the same help from discounts.

Influences on Absorption Outside Multifamily

One reason the net absorption picture is somewhat murky for 2026 is that factors from outside the industry are not all clear cut. The single-family for sale side of residential real estate will have a role to play next year.

Class A net absorption was particularly strong this year. The relationship between multifamily absorption and single-family sales is not one of clear opposition as is often assumed. Nevertheless, the frozen single-family market this year likely contributed to additional households remaining in multifamily.

In many markets, both prices and interest rates have come down from their post-pandemic peaks. Further decline in both could be necessary to meaningfully unlock demand for single-family sales.

An unlocking of the for‑sale sector would likely signal a healthier economy and stronger household formation, which can support multifamily demand, although some renters would transition into ownership.

Set yourself up for your best year yet. Accurate multifamily data is only a few clicks away, and a quick conversation can show you how it fits your goals.

The jobs market has shown signs of softening in recent months. Announced layoffs in 2025 rose substantially year-over-year and were the highest since 2020. Earlier in the year those layoffs were offset in the aggregate by added jobs and monthly gains were still occurring.

More recently, those monthly gains have winnowed significantly. In August, the net change was slightly negative. A mix of economic cooling, corporate restructuring, and some technology and efficiency-driven changes have contributed to a discernible cooling in the jobs market.

That softening is not guaranteed to continue, or worsen, in the new year, but it does provide some downside risk for net absorption in 2026.

Further cooling of the labor market could imperil further gains in real wage growth. After inflation ran well ahead of wage growth coming out of the pandemic, real wage growth has broadly returned over the last few years. That may well continue through 2026, but further softening in the labor market or an unexpected increase in inflation could reverse that progress.

Modest Rent Growth Likely in 2026

Average effective rent for new leases failed to build further momentum this year after an annual improvement in 2024. This year appears set to end with rent growth equal to, or slightly below, the 2024 gain of about 2.5%.

Broadly, effective rent growth failed to improve despite much stronger net absorption largely due to the aforementioned lease concession environment and to the unusually high vacancy from a very active new construction pipeline from 2022-2025.

The anticipated drawdown in deliveries next year should help rent growth. New units will still be coming online, many at the top of the market for rent, but the reduced quantity should help with supply pressure.

As already mentioned, it remains to be seen whether apartment demand can be sufficiently maintained while also turning the dial back on lease concessions. This year, operators appeared to prioritize occupancy over rent growth. Next year, improved fundamentals could lead to more aggressiveness on the rent front – particularly in certain markets.

For that to materialize, net absorption would have to outpace deliveries and allow for further occupancy recovery. Overall average occupancy stood at 89% nationally at the end of November and stabilized occupancy finished the month at 93%. Both were too low to support substantial rent growth.

Aside from the supply-demand relationship, the depth of any further labor market slowdown would also limit potential rent gains next year. Given an expected decline in both new supply and net absorption, and a labor market that is flashing some warning signs but that remains relatively solid – rent growth in 2026 marginally better than in 2025 seems reasonable. However, there appears to be more downside risk to that view than upside risk.

Takeaways

There is reason to be encouraged about the outlook for the multifamily industry in 2026 despite some potential concerns. An expected decline in deliveries would provide some respite for an industry that has been dealing with a sustained wave of new supply for the last few years.

Net absorption is riding a three-year uptrend that surged beyond most expectations this year. While a normalization seems extremely likely next year, annual net absorption could still finish above 400,000 units. That would make 2026 only the third year to do so in the last decade.

Unless net absorption similarly exceeds expectations next year, average occupancy is unlikely to recover in a dramatic fashion. More slow and steady progress seems more probable given the level of new supply due to deliver, but progress is by no means guaranteed.

Occupancy below its long-term range for another year would be a headwind to strong rent growth in addition to potential trouble from the broader economy. Even so, next year could see average effective rent growth for new leases finish above 3% for the first time since 2022.

One feature of 2025 that appears set to continue in 2026 is considerable variance at the market level. In general, markets that were leaders this year in rent growth led not because of outsized net absorption, but because they faced below‑average new supply. The new construction pipeline may well continue to be a main driver of performance in 2026 as well.

Disclaimer: All content and information within this article is for informational purposes only. ALN Apartment Data makes no representation as to the accuracy or completeness of any information in this or any other article posted on this site or found by following any link on this site. The owner will not be held liable for any losses, injuries, or damages from the display or use of this information. All content and information in this article may be shared provided a link to the article or website is included in the shared content.