Culmination of Multiyear Demand Trend Beginning to Unfold

2025 has gotten off to an unusually volatile start for apartment demand on a month-over-month basis. Despite these early fluctuations, longer-term trends are uniformly positive. Both over the last twelve months, and year-to-date through April, national net absorption has continued along an upward trajectory that began in 2023.

Encouragingly, the continued improvement has been widespread across price classes rather than being concentrated in just one subset of the market. The considerable gains in net absorption have also positively impacted rent growth nearly across the board.

All numbers will refer to conventional properties of at least fifty units.

View the full monthly Markets Stats PDF

Net Absorption Uniformly on the Rise

National net absorption over the last twelve months was approximately 80% higher than in the previous twelve-month period. Year-to-date through April, national net absorption was about 75% higher than in 2024.

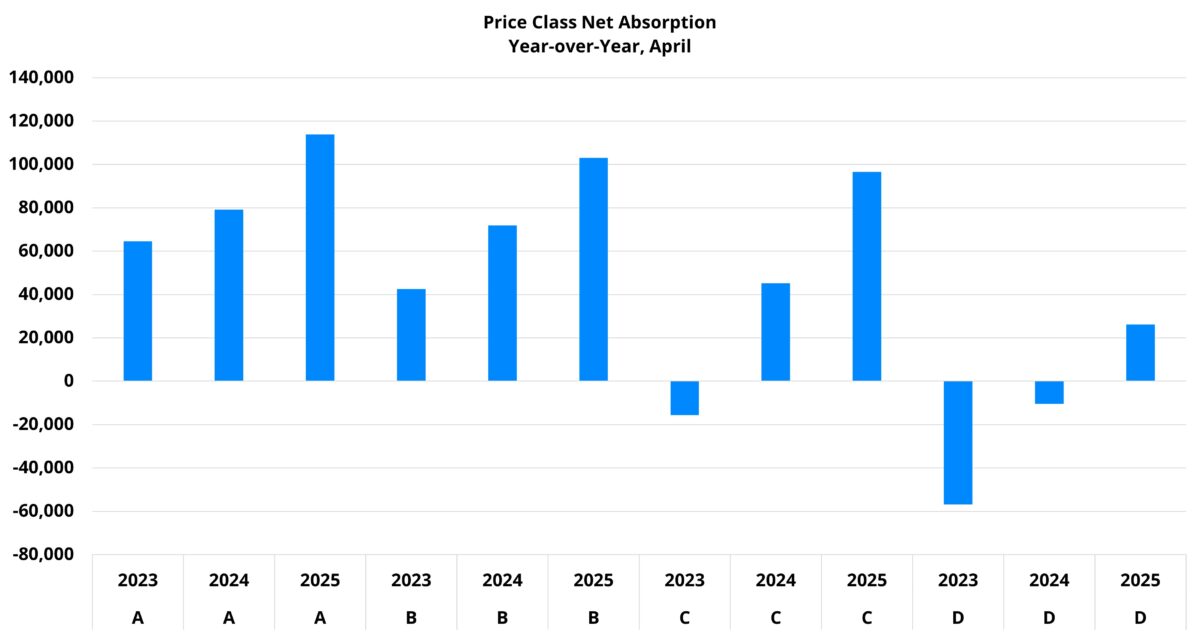

All four price tiers saw improvement, but the improvement was not equally distributed. The workforce housing segments led the way on a percent change basis.

The Class C and Class D subsets were slower to recover out of the 2022 trough and finally began to turn the corner last year. In ALN’s newsletter previewing expectations for 2025, further progress for Class D demand was specifically mentioned as an important piece of the puzzle for industry performance to continue its positive trajectory.

So far this year that progress has materialized. More than 23,000 net Class D units were absorbed through April compared to fewer than 8,000 net absorbed units in the same portion of 2024. This year has featured the strongest start to a year for Class D demand since 2021. In fact, almost all the net absorption for Class D over the last twelve months has come in 2025.

Class C has also seen a robust improvement in demand, but it has been less concentrated in the last handful of months. Net absorption of around 97,000 units over the last year was more than double the previous twelve months. Net absorption of about 30,000 units in the first four months of 2025 was about 5,000 units more than last year and the most for the period since 2021.

The gains in net absorption have been larger, but not unique, to the workforce housing segments over the last twelve months. Class A has made particular progress so far this year. Net absorption of approximately 41,000 units through April was slightly more than in the same portion of 2023 and 2024 combined.

Rent Performance More Mixed

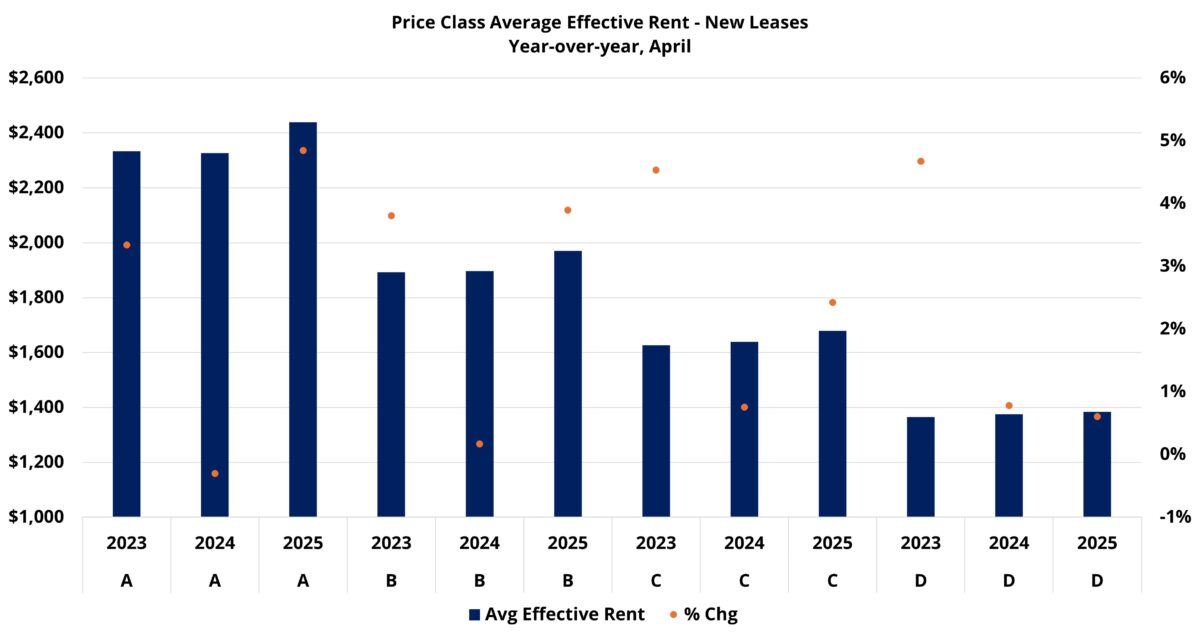

While apartment demand has been a tide lifting all boats, average effective rent performance has been less uniform across the price classes. It is helpful to first consider the last few years in broad strokes. National average effective rent growth for new leases bottomed out in 2023 after surging in 2021 and 2022.

Rent growth in 2023 was inversely associated with average effective rent. For Class A, annual rent growth was negative. Positives moves for Class B and Class C were negligible. Only Class D topped a 1% gain that year with 1.2% appreciation.

Last year, rent performance improved across the board. There was very little variance between the top three price tiers. All three saw average effective rent for new leases climb by between 2.2% and 2.5%. Class D lagged with a gain of 1.3%. Nevertheless, annual apartment demand and rent growth improvement in 2024 was a welcome sight after the inconsistencies of the previous two years.

Unlock the latest insights and rental market trends anywhere in the United States with ALN Online!

Through the first four months of this year, results have been more bifurcated – and in the opposite direction compared to the 2023 annual results. Along with a surge in apartment demand, Class A rent growth has taken off. A 2.7% average effective rent gain was leaps and bounds ahead of the 0.2% increase in the same portion of both 2023 and 2024.

For Class B, a 1.8% increase to start 2025 more than quadrupled the gains from the opening months of the previous two years. The 0.9% appreciation for Class C was higher than both 2023 and 2024, but by a much more modest margin. The 2023 and 2024 increases were 0.8% and 0.7%, respectively.

Class D average effective rent through April declined by 0.2%. While not ideal for operators, 2024 also got off to a slower start than 2023 before recovering by the end of the year. Also, the miniscule decline in average rent was paired with a strong bounce in demand.

Takeaways

The volatility of apartment demand to start 2025 has been unusual and does provide reason to avoid an excessively rosy outlook for the remainder of the year. However, demand has been steadily improving for more than two years now and net absorption through April was encouraging.

The consistency of progress across price classes, and especially the continued momentum for Class D, were especially promising. Class D had been the final piece to the puzzle to allow national multifamily net absorption to return to pre-pandemic levels. The year is still young but has gotten off to a fantastic start for multifamily demand from a price class perspective.

On the rent growth front, there has been much to like as well. Class A and Class B have managed to capture considerable rent growth earlier in the year than is typical and well outside the range for the last few years.

For Class C, further improvement in demand has not come at the expense of rent growth. However, this segment has been unable to make the same jump in trajectory as the top of the market. Class D has been alone in losing ground so far this year, though only marginally so – and the decline came with healthy demand growth.

With the traditionally stronger portion of the year now here for both multifamily demand and rent growth, momentum appears primed to continue short of a major disruption from outside the industry.

Disclaimer: All content and information within this article is for informational purposes only. ALN Apartment Data makes no representation as to the accuracy or completeness of any information in this or any other article posted on this site or found by following any link on this site. The owner will not be held liable for any losses, injuries, or damages from the display or use of this information. All content and information in this article may be shared provided a link to the article or website is included in the shared content.

ALN Apartment Data delivers industry-leading multifamily market intelligence, empowering thousands of apartment industry professionals with accurate, research-driven insights.

Owners and Management Companies

Leverage ALN OnLine for property search, rental market analysis, and competitor benchmarking—ensuring data-driven decision-making. Discover more about ALN OnLine here

Multifamily Suppliers & Service Providers

Supplier Partners nationwide trust Vendor Edge Pro to identify property management companies, target apartment communities, and optimize B2B sales strategies with our curated data and must-have features like sales routing. Get started with Vendor Edge Pro today

Enterprise-Level Multifamily Suppliers scale their business with Compass, the ultimate tool for nationwide property and management company insights, targeted prospecting, and market expansion strategies. Explore Compass now

Not sure how we can help you? Learn more about all of our services for Multifamily Professionals