A Closer Look at Rent Growth in 2024

Throughout 2024, the ALN blog and monthly newsletters have closely tracked industry performance. A particular focus has been on the effect of new supply as well as the steady and consistent improvement in apartment demand that has been ongoing since the beginning of 2023.

How supply and demand, and the associated movement in average occupancy, have impacted rent growth has been covered – but not in as much detail. With the end of the year rounding into view, it is a perfect opportunity to spend some time evaluating recent rent performance.

All numbers will refer to conventional properties of at least fifty units. Average rents will refer to rents for new leases.

View the full monthly Markets Stats PDF

Background Context

Historic apartment demand in 2021 drove net absorption of more than 650,000 units nationally. The picture shifted dramatically and suddenly in 2022. The demand glut of 2021 itself, surging rent growth, the disappearance of stimulus payments and myriad other factors led to the shift. The result was a national net absorption total in 2022 of less than 75,000 units.

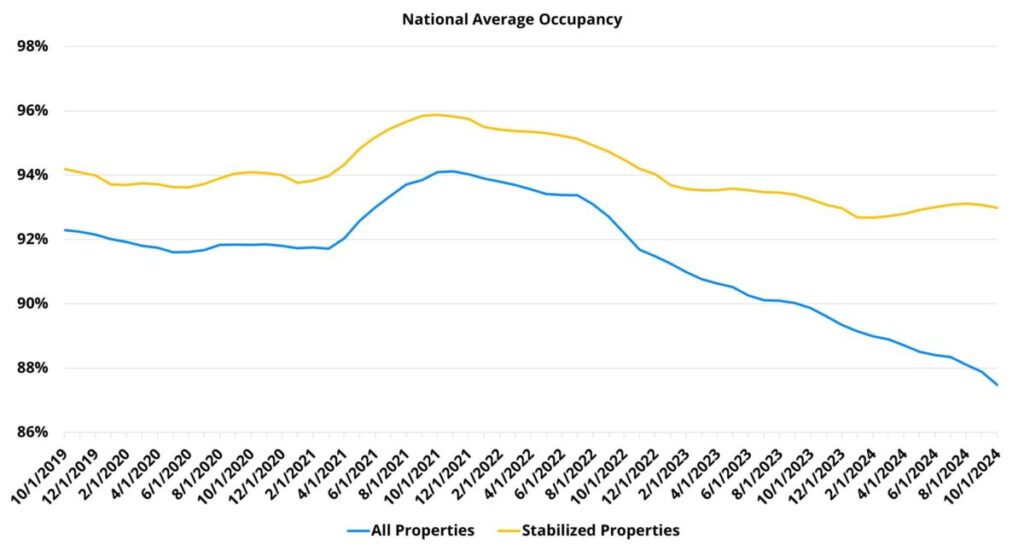

At the same time that apartment demand was swinging widely between extremes, the new construction pipeline was already outputting more new units than usual. The development cycle that is currently at its zenith was already moving steadily to its current deliveries heights back then. The result of surging new supply and cratering apartment demand in 2022 was a 270-basis point decline in national average occupancy.

However, despite both average occupancy and apartment demand moving in the wrong direction, the national average effective rent for new leases increased in 2022 by 8%. This was thanks, in large part, to the unusually high starting point for average occupancy to begin the year.

Thanks to rent growth being buoyed by falling, but-still-high average occupancy in 2022, the trough in rent growth did not occur until 2023. By that time, the consistent deluge of new units had pummeled average occupancy enough to take the remaining wind out of the rent growth sails. Average effective rent growth managed a paltry 1.1% in 2023.

National Rent Growth in 2024

The improvement in apartment demand that has been achieved this year has been dwarfed by the simultaneous increase in new deliveries. The result has been a continued slide in average occupancy. Within that environment, rent growth in 2024 has closely resembled last year.

The national average effective rent for new leases rose by 2.3% through October of this year, modestly surpassing the 1.8% gain from the same portion of 2023. Interestingly, the improvement over last year was attributable to just the most recent couple of months. In fact, monthly average effective rent change underperformed or equaled last year’s result in six of seven months from January through July of this year.

The difference has been the late summer and early autumn period. Last year, national monthly average effective rent growth turned negative in September and remained in negative territory for the remainder of the year. This year, monthly rent growth for both September and October managed to remain above zero. Moreover, the October 0.2% gain bettered the 0.1% improvement from September.

Too much should not be made of an unusual month-over-moth improvement from September to October. The reversal is likely to materialize imminently. However, the ground gained over the last few months on the rent front may well be enough to allow 2024 to finish comfortably ahead of the 2023 annual rent growth figure.

Below the National Data

Rent growth has remained challenging to capture this year, but certain subsets of the national multifamily data have stood out. Firstly, there has been a clear difference across price classes.

All price tiers except for Class D have seen year-over-year improvement in rent performance, but the top of the market has been where the growth has been most concentrated. A 2.7% increase in the average Class A effective rent from the start of the year through October more than tripled last year’s gain for the same portion of the calendar. A 2.5% increase for Class B properties roughly doubled last year’s change in the period. Rent growth for both price tiers has been notably higher than the overall national average gain.

Another subset of the national data where rent growth has been robust relative to the nation has been in the Midwest, and most particularly in the Great Lakes region. Apartment demand in this part of the country has been a little bit of a mixed bag. The positive rent growth performance has appeared more to do with a lower rate of new supply which has allowed average occupancy to remain higher than in the Sunbelt and Mountain West regions, for example.

Specific markets where rent growth has been significantly more robust than the national average include Cleveland – Akron, Chicago, Kansas City, Columbus, Cincinnati – Dayton, Indianapolis, and Detroit. Each of these markets saw the average effective rent increase by between 4% and 6% so far this year.

Let’s Talk About Multifamily Data for Your Business

Unlock the power of multifamily data with insights tailored to drive your business forward—schedule a call with our experts today!

Takeaways

With new supply reaching a historic level this year, and national net absorption underwater by a massive margin, much attention has rightfully been paid to supply and demand metrics – along with a beleaguered average occupancy. There has been less movement year-over-year in the rent performance data. Nonetheless, some important nuggets are to be found.

For one, steady improvement in apartment demand has been enough to stop the freefall in rent growth that occurred last year, and even slightly reverse the trend. For another, positive rent growth managed to persist later into the year than was the case in 2023, or even in 2022. This bodes well for the sustainability of the march toward more typical annual rent growth.

The national average effective rent is likely to dip into negative territory on a monthly basis in the coming months, but there seems to be visible light at the end of the tunnel. The flood of new supply that has been significantly affecting multifamily performance over the last few years will not be disappearing next year. However, some measure of decline in deliveries paired with continued recovery in apartment demand could be enough to propel annual rent growth back above the 3% mark next year if 2024 fails to reach that threshold.

Disclaimer: All content and information within this article is for informational purposes only. ALN Apartment Data makes no representation as to the accuracy or completeness of any information in this or any other article posted on this site or found by following any link on this site. The owner will not be held liable for any losses, injuries, or damages from the display or use of this information. All content and information in this article may be shared provided a link to the article or website is included in the shared content.