New Deliveries Moderate, but Supply Headwinds Remain

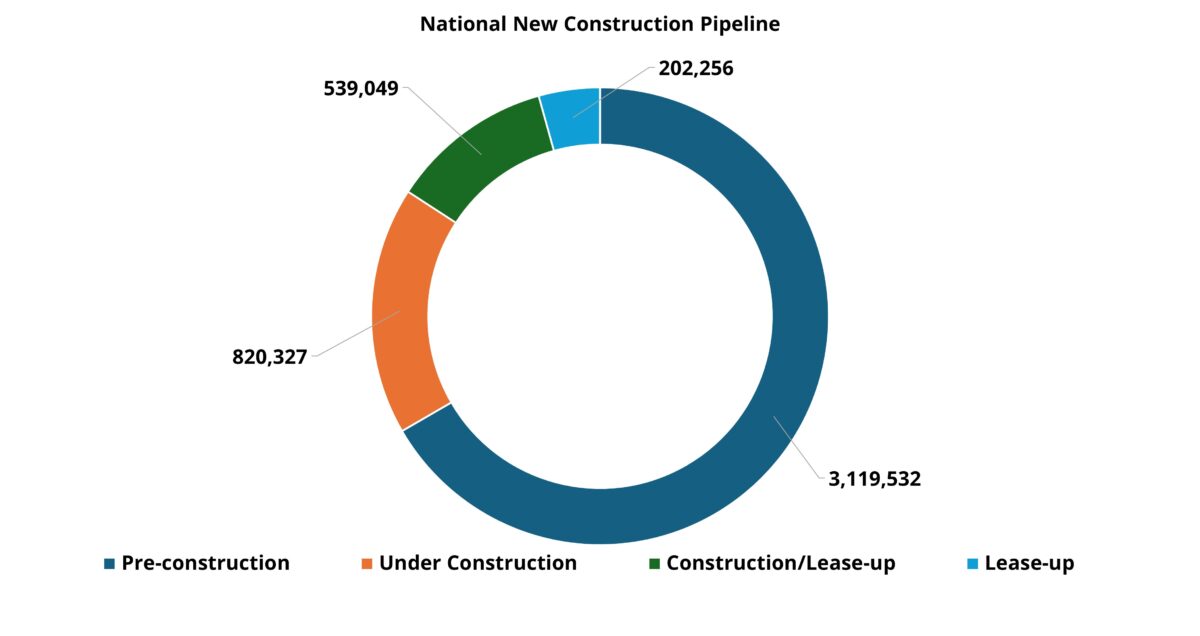

The new construction pipeline has been a defining force in multifamily performance in recent years. Annual new supply has remained historically elevated since 2020, peaking at nearly 600,000 units in 2024.

Early last year, it appeared that deliveries would slow meaningfully in 2026 – and even more so in 2027. However, as 2025 progressed, that outlook shifted. Entering this year, it became clear that new construction would continue to shape multifamily performance in the near term.

View the full monthly Markets Stats PDF

Backlog of Lease-Up Units

Discussions of supply often focus on future deliveries, but recent completions deserve equal attention. Following the historic surge in new construction, and amid uneven apartment demand, a substantial number of units remain in lease-up.

Nationally, approximately 740,000 units have begun leasing but have not yet stabilized. This inventory forms the competitive backdrop for upcoming deliveries.

The top 15 markets account for half of this national lease-up backlog. Twelve of those markets are in the Sunbelt – the region that has led the nation in new supply over the past five years.

Make informed decisions with up-to-date data from every U.S. market, available through ALN OnLine.

This lease-up inventory will influence rent performance in several ways this year. National occupancy has remained below its typical range since early 2023, creating a persistent headwind for effective rent growth – even as net absorption has steadily improved since its 2022 trough. The combination of lease-up inventory and new deliveries in 2026 sets a high bar for demand to drive meaningful additional occupancy gains.

Concessions remain another pressure point. Widespread lease discounts have constrained effective rent growth in recent years. A pullback in concessions would support stronger rent performance. However, properties still working toward stabilization, and new communities entering lease-up, are unlikely to lead that shift in the near term.

Upcoming New Supply

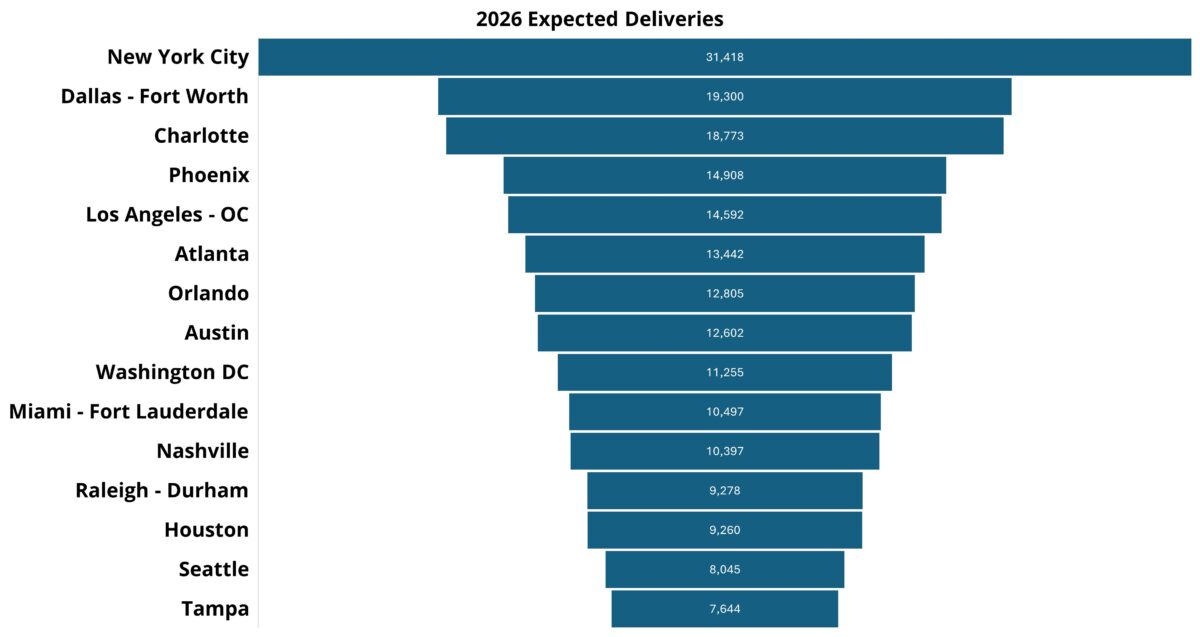

Approximately 415,000 units are projected to begin leasing in 2026. While still elevated by historical standards, that figure marks a decline from roughly 455,000 units last year and from the nearly 600,000-unit peak in 2024.

At the market level, familiar patterns persist. Twelve of the top fifteen markets for expected deliveries this year are in the Sunbelt. The remaining markets include major gateways – New York, Los Angeles–Orange County, and Washington, DC – as well as Seattle and Denver.

Because new supply remains concentrated in markets that have already absorbed significant deliveries, performance dispersion is likely to continue, and even widen, at the market level this year. Markets facing less supply pressure may lead in rent growth, even as the Sunbelt continues to post strong absorption.

The regional imbalance becomes even clearer when measuring upcoming units as a share of existing stock. Fourteen of the top fifteen markets by this metric are in the Sunbelt. Providence, Rhode Island is the lone exception. Each of these markets has at least 5% of existing inventory under construction. In Fayetteville and Fort Myers–Naples, that figure rises to 16% and 13%, respectively.

Among primary markets, Charlotte, Orlando, and Nashville stand out. All rank among the top fifteen on a size-adjusted basis. This is a notable distinction given that this metric often highlights smaller markets. Each has consistently ranked among national leaders in new supply in recent years.

It is also worth noting that projected deliveries for 2027 have increased compared to expectations in the first half of last year. While forecasts remain fluid, with nearly two full years before the end of 2027, current projections exceed 500,000 units. That suggests supply pressures may persist longer than previously anticipated.

Takeaways

After peaking in 2024 and declining last year, annual new supply in 2026 should provide some relief relative to the unprecedented wave of recent years. However, the combination of a sizable lease-up backlog and an active construction pipeline means supply pressures will not dissipate quickly.

This dynamic is particularly pronounced in the Sunbelt, where markets remain at the forefront of new deliveries – even where construction activity has begun to moderate.

The extraordinary net absorption recorded last year is unlikely to be repeated. Still, a moderation in deliveries offers incremental breathing room for an industry that has added nearly 2.5 million units over the past five years.

Disclaimer: All content and information within this article is for informational purposes only. ALN Apartment Data makes no representation as to the accuracy or completeness of any information in this or any other article posted on this site or found by following any link on this site. The owner will not be held liable for any losses, injuries, or damages from the display or use of this information. All content and information in this article may be shared provided a link to the article or website is included in the shared content.