A Mid-Year Check Up on Multifamily Performance

The second half of 2025 has arrived and there has been plenty of action in the multifamily industry so far this year. In addition to checking in on the various performance metrics at mid-year, now makes for an opportune time to return to the January newsletter. That month we laid out expectations for 2025. Now, it’s time for a little expectation versus reality with the caveat that plenty can change in the final half of the year.

All numbers will refer to conventional properties of at least fifty units. Rent data reflects rents for new leases.

View the full monthly Markets Stats PDF

New Supply Has Matched Expectations

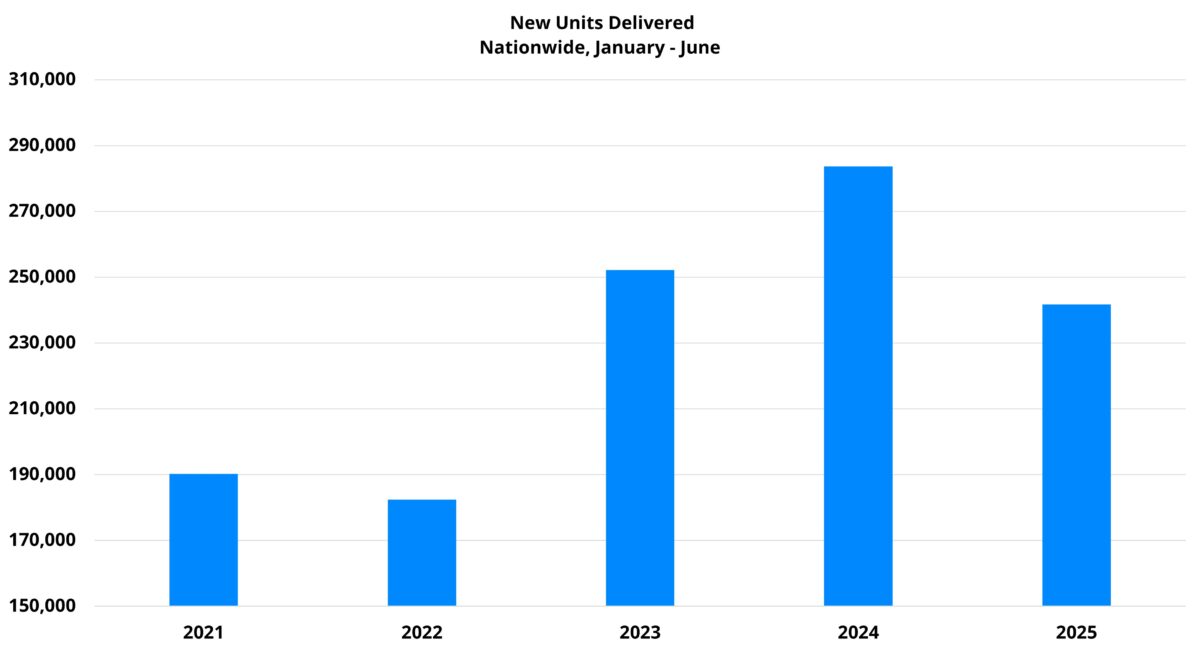

The January newsletter began with expectations for new supply in 2025. It was mentioned that new supply would likely be lower in 2025 than in 2024 but that deliveries would remain at the higher end of the recent range. Specifically, the forecast was for about 465,000 new units to be delivered nationally this year.

Through the first half of the year, those expectations have held up. Around 242,000 new units have been introduced across the country – fewer than the approximately 284,000 units from the same portion of 2024. This year’s new supply was also lower than the total from the first half of 2023 while remaining well above the level of any other recent year.

An updated look at likely lease starts for the rest of the year combined with the actual lease starts that have already occurred returns a total expected new supply value of about 473,000 units for 2025. That would be less than 2% off from the prediction to start the year.

Explore tools, tips, and insights to help you plan, build, and optimize your multifamily budgets with confidence.

The January newsletter also mentioned some specific markets that were expected to see changes in new supply this year. Atlanta, Austin, Dallas – Fort Worth, Houston, Las Vegas, Orlando, Nashville, San Antonio and Tampa were identified as Sunbelt markets where new supply would likely be declining notably.

Through the first six months of the year, that slowdown has materialized in each market except for Austin and Las Vegas. For those two areas, new supply has so far held serve with 2024.

Los Angeles – Orange County, New York, Sacramento, San Bernardino – Riverside, San Diego, and San Francisco – Oakland were mentioned as markets where new supply would probably increase. Only San Diego has not seen an uptick in deliveries compared to the same portion of 2024. That market has seen new supply roughly on par with last year.

Apartment Demand Has Surprised to the Upside

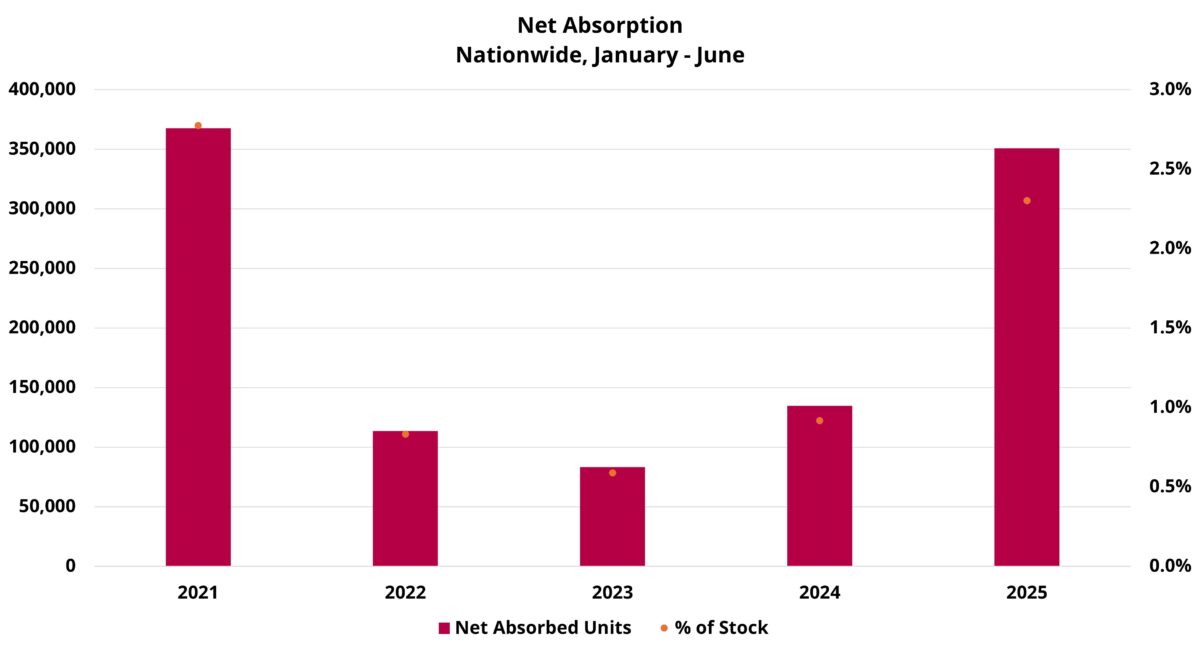

So far, 2025 has played out almost exactly to expectations on the supply side of the equation. The demand side of the equation has presented more of a mixed bag. The newsletter in January cited a few different reasons why the apartment demand outlook for 2025 was encouraging. We also wrote that apartment demand had been trending up for two years and should continue to do so in 2025.

This was correct, but the scale of the jump in net absorption has been more than anticipated. As a result, although we outlined a scenario in which new supply would outpace net absorption this year – that has not materialized.

Approximately 351,000 net units were absorbed across the country in the first half of the year. This more than doubled the total from the same period in 2024 and was fewer than 20,000 net units short of the dazzling 2021 total. We expected further moderate improvement but what materialized was a surge.

We also called attention back in January to the broad-based nature of the positive demand trends across price classes. All four price tiers showed improved demand from 2023 to 2024 and that has continued so far this year.

Class D net absorption was identified in January as an area where further gains would help overall national demand continue to strengthen. Despite the improvement in 2024, demand in that subset had lagged the others for the last few years. Through June of this year, Class D has led all price classes in demand improvement compared to last year on a percentage basis.

The geographic composition of market leaders in demand has also been a bit different than anticipated. The Sunbelt was expected to be, and has been, well represented among the top markets in net absorption. But markets like Washington DC, Denver – Colorado Springs, Philadelphia, and Minneapolis – St. Paul have also been among the leaders.

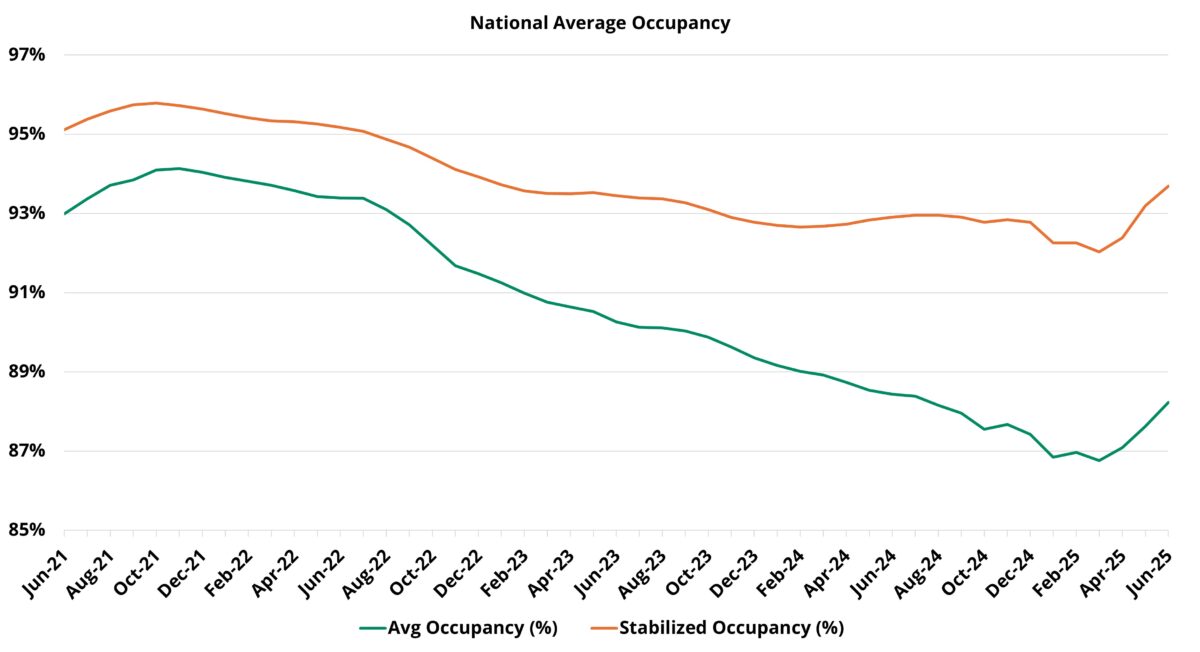

Average Occupancy Has Gained Ground Ahead of Schedule

The case was made in the January newsletter that a decline in new supply paired with a moderate gain in net absorption would result in a winnowed national average occupancy decline for the fourth consecutive year. 2026 was pegged as the target for an outright occupancy gain.

Due to unexpectedly high apartment demand propelling net absorption beyond new supply, average occupancy has managed not only to pare losses as anticipated but to gain ground for the first time since 2021.

National average occupancy closed June at just over 88% after a 100-basis point gain from the start of the year. An average occupancy turnaround arriving a year sooner than appeared likely coming into the year is certainly a welcome sight for an industry that had seen the national average fall 650 basis points in three years from 2022 through 2024.

Surging apartment demand was also enough to propel the national average occupancy for stabilized properties upward by about 125 basis points back to 94%. Stabilized properties gained ground in the same portion of last year as well, but only by a margin of about 30 basis points. Of particular note, a handful of Sunbelt markets have been among the leaders in average occupancy growth so far this year among primary markets. Atlanta (2.3%), Las Vegas (1.9%), Houston (1.2%), Tampa (1.2), and San Antonio (1.1%) have each managed gains in average occupancy larger than the national gain.

Average Effective Rent Performance Has Matched Expectations

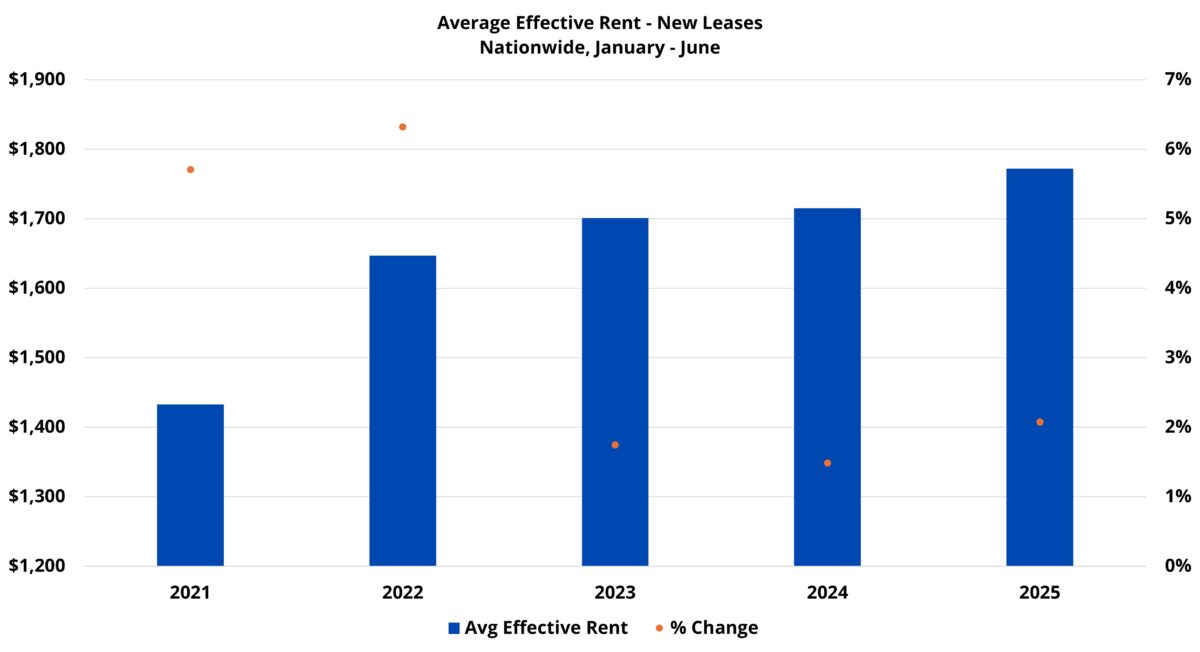

The January newsletter laid out a case that average effective rent growth for new leases should continue to improve in 2025 after a step in the right direction in 2024. Through the first half of the year, that prediction has held up.

A 2.1% average effective rent gain was the highest for the opening half of a year since 2022 and was comfortably ahead of last year’s 1.5% increase. Given everything else already mentioned, this robust performance should be no surprise. New supply has declined, apartment demand has increased significantly, and average occupancy is climbing for the first time in years.

It was mentioned in the January newsletter that the top two price tiers as well as stabilized properties had been the epicenter of rent growth in 2024 and that conditions appeared poised to drive further momentum for those subsets of the industry. Rent growth has outperformed the first half of 2024 for all three of those categories in 2025.

It was also mentioned that the workforce housing segments had in many ways been about a year behind the top two price tiers for both apartment demand and rent performance. There was good reason to think rent performance would improve for those portions of the industry this year on the back of the demand recovery last year. That held up for Class C properties, but not so for Class D yet this year.

National average effective rent growth in 2024 was 2.7% for new leases. A 2.1% gain in the first half of 2025 bodes well for the prediction that rent growth this year would exceed last year’s mark. It is not uncommon for fourth quarter rent growth to be negative, but the third quarter should provide enough runway to allow 2025 to close with the strongest annual rent growth since 2022.

Takeaways

The first half of 2025 is in the books, and there was a lot to like for the multifamily industry. The drawdown in deliveries that was expected to occur has begun to materialize. Apartment demand improved for a third straight year, and by a huge margin. The net result was the first national average occupancy improvement for the period since 2021 and another step in the right direction for rent growth.

Much uncertainty remains in the broader economy with various signals flashing warnings and others looking quite positive. There is plenty of time for the picture to shift, but as it currently stands, 2025 is shaping up to be a strong year for industry performance.

As for expectations versus reality, the expectations for 2025 set out back in January have held up quite well to this point. Where we were off, the results have been better than expected – which removes some of the sting. The final report card will come at the end of the year.

Disclaimer: All content and information within this article is for informational purposes only. ALN Apartment Data makes no representation as to the accuracy or completeness of any information in this or any other article posted on this site or found by following any link on this site. The owner will not be held liable for any losses, injuries, or damages from the display or use of this information. All content and information in this article may be shared provided a link to the article or website is included in the shared content.

ALN Apartment Data delivers industry-leading multifamily market intelligence, empowering thousands of apartment industry professionals with accurate, research-driven insights. Don’t wait, request a live demonstration today!

Owners and Management Companies

Leverage ALN OnLine for property search, rental market analysis, and competitor benchmarking—ensuring data-driven decision-making. Discover more about ALN OnLine here

Multifamily Suppliers & Service Providers

Supplier Partners nationwide trust Vendor Edge Pro to identify property management companies, target apartment communities, and optimize B2B sales strategies with our curated data and must-have features like sales routing. Get started with Vendor Edge Pro today

Enterprise-Level Multifamily Suppliers scale their business with Compass, the ultimate tool for nationwide property and management company insights, targeted prospecting, and market expansion strategies. Explore Compass now

Not sure how we can help you? Learn more about all of our services for Multifamily Professionals