Empowering Multifamily Professionals with Unmatched Data Insight

At ALN Apartment Data, we blend innovation with over three decades of industry expertise to deliver the most comprehensive multifamily data and analytics platforms.

Keep reading to learn more about our data and methodology.

Our responsibility to our clients is to deliver the most accurate and up-to-date information possible.

We go beyond the norm to ensure you receive the most precise and current multifamily data available. Unlike other providers who rely on market sampling, our approach is different. We undertake comprehensive primary research for every property that meets our rigorous standards.

Proprietary Collection Methods

From our Research Team call centers in Dallas/Fort Worth, Texas and Mayfield, Kentucky, each completed survey has gone through a number of proprietary data checks that assure the information collected is correct.

Publicly Accessible Data

We continuously track publicly accessible data from a variety of sources including corporate websites, job listings, news outlets, and more, offering our clients a holistic view of market movements and emerging trends.

Direct Feeds

We work with Owners and Management Companies to feed information directly to our database in order to ensure the most timely and accurate data set available for all of our clients.

Strategic Partners

ALN Apartment Data works with several highly acclaimed and trustworthy third party sources to supplement certain data sets. By forging these partnerships, we’re able to give a more comprehensive and reliable picture of the apartment market.

Update Schedule

Information is updated during all business hours, every business day. However, data points are updated on various schedules.

Dynamic Data

Properties are contacted every 25 business days for property-level data, including rents, occupancy, floorplans, use of a RMS, renovation status, Property Manager, Area Supervisor (Regional Manager) and Management Company.

Semi-Static

Attributes not likely to change as often, such as amenities, unit mix, lease terms and hours of operation are updated as part of a rotation quarterly and annually.

New Construction

New Construction data is gathered both through primary research and 3rd party sources deemed reliable by ALN. The New Construction subset of ALN’s database is updated daily, with individual projects updated according to their progress schedule.

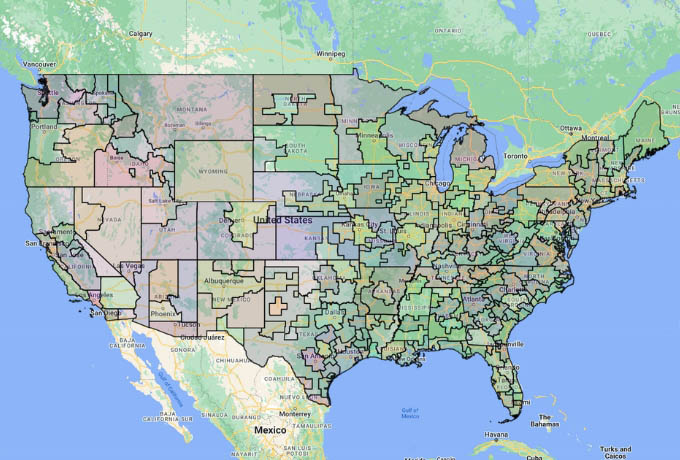

How Markets Are Defined

ALN markets are geographic areas within states whose boundaries are defined by ALN. While markets are based on MSAs (Metropolitan Statistical Areas) as defined by the US Bureau of Statistics, multiple MSAs are often included within one ALN market.

Each US state will have a non-contiguous ‘Outlying’ market comprised of properties within the state that are not assigned to a metropolitan ALN Market.

Markets can be further broken down into the following:

City – The area within any city proper located within a given market.

Submarket – Areas within cities that are based on US Census Bureau census tracts. Other factors are taken into consideration, such as concentration of properties and major infrastructure like an interstate highway.

Zip Code – Properties included within a zip code, or multiple zip codes.

Street Address – Any properties located on a specific street of interest.

Custom Area – Any area as defined by the user on an interactive map of the market.

Calculated Data Points

ALN uses weighted averages for all averaged fields.

Rents

Rents are reported based on the rents for each unit type on the day of update.

Average market and effective rent for a property are calculated by averaging the rents weighted by the unit mix of the property.

Average rents for geographic areas (submarkets, cities, markets, etc) are similarly weighted by unit count.

Concessions

ALN reports 3 different metrics regarding concessions.

- The percentage of properties in a market that are currently offering concessions

- The average concession package for the market

- The average concession package amongst properties offering concessions in the market

Both average concession fields are weighted by number of units.

Price Classes and Percentile Rankings

ALN Property Classifications

Classifying multifamily properties as A, B, C & D is a traditional practice but is fraught with subjective tendencies. Beauty is in the eye of the beholder. Therefore, ALN uses the far less subjective concept of ‘Price Class’. While still using the A, B, C, D terminology, ALN price class is based on the percentile ranking by price per square foot for the property within the market.

Percentile Ranking

Percentile ranking is the percentage of properties in the market that are equal or below the subject property in the ranked statistic. For example, if a property has a price per square foot of $1.50 and ranks in the 90th percentile in the market, 90 percent of the properties in the market area will have a price per square foot of $1.50 or less. The property therefore ranks in the top 10% in the market for price per square foot.

ALN Price Classes

ALN delineates its price classes using the percentile rank for price per square foot in the market area.

Price Class A: 88 – 100th Percentile (top 12%)

Price Class B: 68 – 87th Percentile (next 20%)

Price Class C: 30 – 67th Percentile (next 38%)

Price Class D: 0 – 29th Percentile (bottom 30%)

ALN tracks percentile rankings for properties in the Market and submarket for all conventional properties, i.e. non-Senior, Student, or Affordable. Non-Conventional properties are not assigned a price class.

Note: in some larger ALN markets like Dallas-Ft. Worth with multiple metropolitan areas, the ‘market’ ranking may be based on the Metropolitan market within the larger ALN market (i.e., Dallas or Fort Worth)

Market Surveys

Properties Included

Properties to be included as comps can be stabilized, or not, and can include conventional property types or specialty property types.

Pseudo properties can also be created as the subject property in cases where the property is not yet built.

Specific properties can be selected as comps, or properties within a geographic range can be chosen from.

Submarket statistics are based on conventional properties within the submarket.

|

Term |

Definition |

|---|---|

|

% Occupied |

The percentage of property units currently occupied. |

|

% Leased |

The percentage of property units occupied, with signed leases and move-out notices accounted for. |

|

W/D |

Washer/Dryer connection included. |

|

NR Fee |

Non-refundable administration fee paid by prospective resident. |

|

Asterisk (*) |

Any asterisk means ‘some units’. This typically applies to amenities in units. |

|

New Construction |

New construction projects for all multifamily product types. Project statuses range from pre-construction to properties that are in lease-up, but not yet stabilized. Properties that have started pre-leasing will be updated every month until stabilized. Please refer to ALN’s New Construction Report for various types of construction. |

|

Affordable Housing |

These are properties with an income cap for prospective residents to be eligible to lease. |

|

Accepts Section 8 |

These properties accept HUD vouchers. The government pays part of the rent, generally as a voucher, to offset the cost of living. Rent is set by the property. |

|

All Bills Paid |

Standard utilities such as water, electricity and trash are included in the rent for these properties. |

|

Stabilized |

A property that has reached at least 85% occupancy. |

|

Asking/Market/Quoted Rent |

The monthly rate residents are charged for a 12-month lease without adjustment for concessions. |

|

Effective Rent |

The monthly rate residents are charged for a 12-month lease, accounting for the available concession package. This is the amount a property collects in rent per unit each month. |

|

Net Absorption |

The net change, positive or negative, in the number of rented units in a given geographic range. |

|

Occupancy |

The percentage of units on a property that are rented. |

Glossary of Terms

Property Types

|

Term |

Definition |

|---|---|

|

Total Listings |

All properties in the ALN database including all property types, sizes and market segments. |

|

Active Listings |

Multifamily properties with 50 or more units that are not HUD subsidized and are not an assisted living property. Property types include Conventional, Mixed Residential, Senior Affordable and Independent Living, Affordable Housing, and Student Housing. Only these properties are contacted for updates on ALN’s 25-business day cycle. Apart from absorption and occupancy, only conventional active listings are included in market metric calculations released by ALN. |

|

Conventional |

Multifamily properties charging market rates and are not Student, Senior, Affordable or Military housing. |

|

Condos or Individually Owned |

Properties that ALN knows to be fully individually owned condos, and do not lease. ALN does list condo units available for lease if operated as a group by a fee management firm, but units fitting that description are not included in this property type. A notation in a property’s unit mix would denote condo units for lease. |

|

New Construction |

New construction projects for all multifamily product types. Project statuses range from pre-construction to properties that are in lease-up, but not yet stabilized. Properties that have started pre-leasing will be updated every month until stabilized. |

|

Less than 50 Units |

Properties with less than 50 units. Properties that pay commissions to apartment locators are updated on ALN’s normal update schedule, those that do not pay locator commissions are updated less frequently. |

|

Affordable Housing |

These are properties with an income cap for prospective residents to be eligible to lease. |

|

Accepts Section 8 |

These properties accept HUD vouchers. The government pays part of the rent, generally as a voucher, to offset the cost of living. Rent is set by the property. |

|

Senior Independent Living |

Age-restricted properties. Generally, these properties require residents to be above 55 years old, or 62+ years old. |

|

Student Housing |

Properties that rent by the bed, rather than by unit. These properties are open to the public per current Fair Housing laws, but mostly target students for their residents. ALN reports pricing both by the bed, and per unit. |

|

All Bills Paid |

Standard utilities such as water, electricity and trash are included in the rent for these properties. |

|

Independent |

Properties owned and managed by an individual investor. Generally, the investor will own only one property for this designation. |

|

Mixed Use |

Properties with a blend of residential and commercial, retail or industrial use. |

|

Senior or Disabled Assisted Living |

Properties that are age-restricted and provide generalized or specialized medical care or monitoring of residents. |

|

Subsidized Housing |

These properties are subsidized housing properties, via HUD vouchers, where rent is based on a percentage of the prospective resident’s income. |

|

Refuse to Update |

Properties that ask not to be included in ALN’s database, or that consistently update outside of our 25-business day contact window. |

|

Onsite Student Housing |

Properties owned and/or operated by an academic institution. Only students are eligible to rent at these properties. |

|

Military Housing |

Housing for military related personnel only. Generally located on military bases and privately developed. |

|

Property Closed |

Properties that have closed within the past two years remain visible in select programs for the continued inclusion of their historical data. |

|

Garden |

A property with 3 or fewer floors. |

|

Mid-Rise |

A property with 4-7 floors. |

|

High-Rise |

A property with 8 or more floors. |

|

Build-To-Rent |

Communities of single family homes that are built and managed for rent. |

Other Terms

|

Term |

Definition |

|---|---|

|

Stabilized |

A property that has reached at least 85% occupancy. |

|

Asking/Market/Quoted Rent |

The monthly rate residents are charged for a 12-month lease without adjustment for concessions. |

|

Effective Rent |

The monthly rate residents are charged for a 12-month lease, accounting for the available concession package. This is the amount a property collects in rent per unit each month. |

|

Net Absorption |

The net change, positive or negative, in the number of rented units in a given geographic range. |

|

Occupancy |

The percentage of units on a property that are rented. |

|

Leased Rate |

Projected occupancy based on notices to vacate and signed leases. |

FAQ’s

Subscribe for our free Newsletter

Don’t miss our free monthly article on topics like apartment demand, rent growth, quarterly and annual reviews, and more.