Despite Volatility, 2025 Off to Strong Start

Despite a hiccup in January demand, the last three months have been encouraging for the multifamily industry and provide some early cause for cautious optimism looking forward. The new year is young, but recent months have tracked with previous expectations for 2025 across a variety of metrics.

All numbers will refer to conventional properties of at least fifty units.

View the full monthly Markets Stats PDF

Lower Supply and Higher Demand

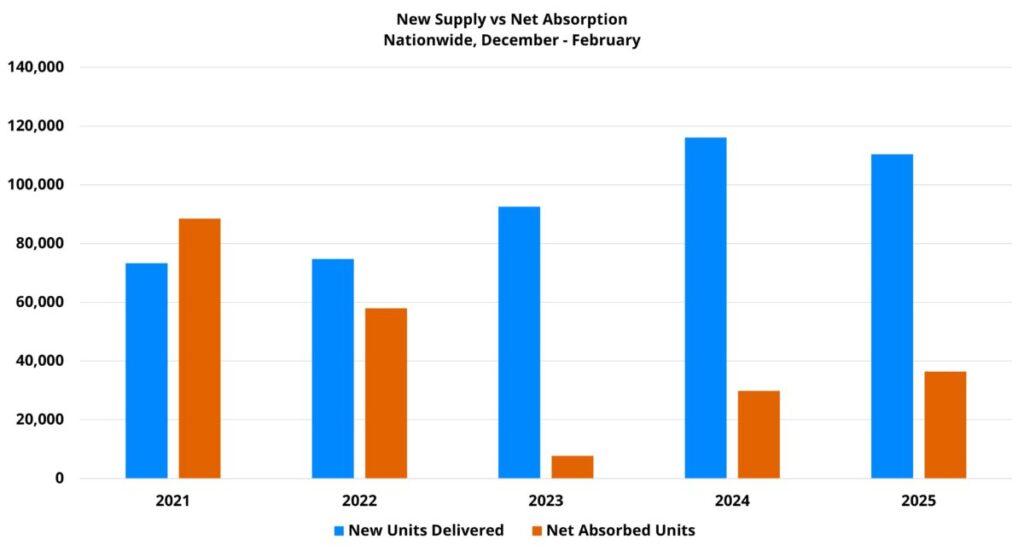

One anticipated aspect of industry performance this year was improvement in the supply versus demand relationship. Not that net absorption is likely to match new supply in 2025, but rather that absorption would continue its steady march toward closing the gap. This is due to both national deliveries beginning to subside moderately and the continuation of an upward trend in apartment demand that began in 2023.

From December through February, both parts of the equation have emerged in the data. A little more than 110,000 new units were delivered nationally in that three-month period. An expected decline in annual deliveries this year should not be interpreted as supply falling off a cliff. This year will remain a very active one for multifamily new supply.

The roughly 110,000 new units in the period was slightly less than the approximately 116,000 units from the same portion of the calendar a year ago. The previous five-year average for these three months was around 76,000 units delivered.

Along with the start of an ebb to new supply, apartment demand continued its positive momentum. More than 36,000 net units were absorbed from December through February – 22% higher than a year ago.

As already mentioned, the promising performance in recent months came despite a slip up in January. After a net loss of more than 35,000 leased units that month, national net absorption roared back in February to the tune of about 61,000 net absorbed units. This kind of volatility is not uncommon for the winter period and the strong bounce back in February bodes well for the spring.

One cautionary note – net absorption for stabilized properties took a step back. Specifically, Class B and Class C properties. Those two subsets suffered a net loss of nearly 30,000 leased units in the three-month period.

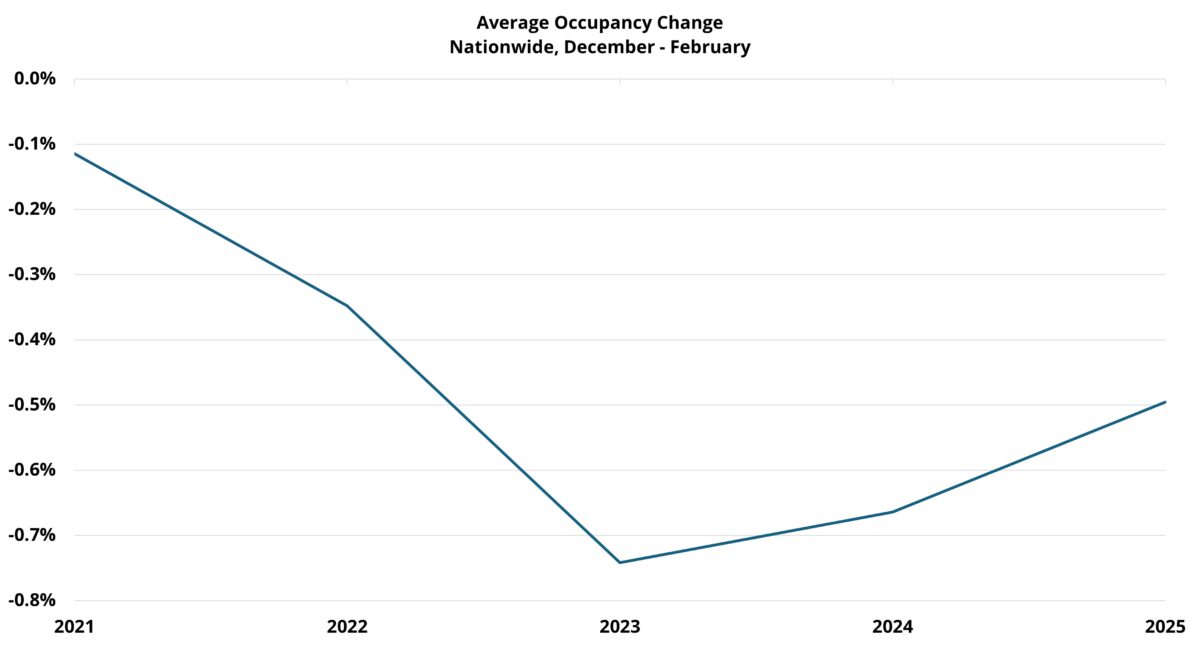

Occupancy Decline Moderating

Another expectation for 2025 was that lower supply and higher demand, while likely insufficient to reverse the negative average occupancy trend, would be enough to lessen the rate of decline. Recent months have played out along those lines.

A 0.5% drop in national average occupancy over the last three months brought the average to about 87%. That decline was the lowest of the last three years and was within the range of the downward movement from the same period ending in February of 2018 and 2019. Those years still provide a useful benchmark prior to the unusual volatility of the last handful of years.

It should be mentioned that the softness for stabilized properties has resulted in stabilized average occupancy not yet fitting into the paradigm described above. The substantial net loss of leased units recently led to a 0.3% decline in stabilized average occupancy – larger than last year’s 0.1% dip in the period.

Nevertheless, the worst of the occupancy contraction during this period of sustained downward pressure that began in late 2021 appears to be over. A turnaround in stabilized net absorption as 2025 unfolds would be salutary. Given the performance of stabilized properties in 2024, this is a development we may well see as we get to the spring and summer portions of the year. However, the backlog of recently delivered units in lease-up properties is of such magnitude that average occupancy change in 2025 could outperform 2024 even with some weakness in stabilized properties.

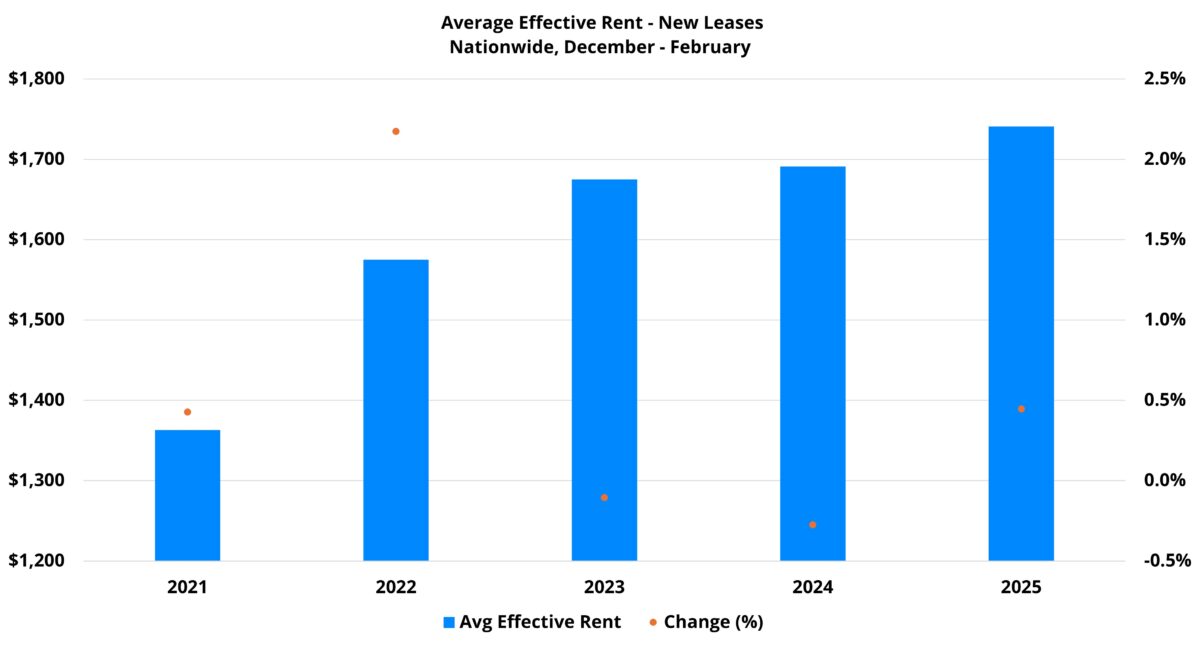

Rent Growth on the Mend

Rent growth was anticipated to improve further this year after two consecutive years of muted gains. Among many factors, the positive momentum of last year combined with predicted improvement in the supply and demand relationship provided for a more positive outlook than had been the case for the last couple of years.

A 0.4% increase in the average effective rent for new leases in the last three months was the best result for that period of the last three years. The gain was squarely within the normal range looking back over the last decade.

Understanding where the market is headed can give you a competitive edge. Access the latest industry insights to refine your strategy.

One encouraging aspect of the recent performance was the widespread nature of the improvement. Stabilized properties, despite their demand struggles, saw the same year-over-year improvement and return to the longer-term average. That positive momentum may falter if demand does not improve, but positive seasonal trends are in that subset’s favor.

Similarly, recent rent growth by price class reflects broad-based improvement. Class A and Class B made the most progress compared to a year ago, but Class C gained ground as well. Only Class D lost ground. The silver lining for Class D was the softening in rents came alongside improvement in net absorption.

Another promising recent development had to do with lease concessions. Lease concession availability rose over the last three months, as is typical for the winter season, but by the smallest margin in three years. After double-digit jumps from December through February of the previous two years, this year discount availability rose by only 2% in the same three-month period.

A 2% rise in discount availability was well below the average for this time of year and could be the early signs of a turnaround for a metric that has seen massive gains over the last three years. A moderation of growth in concession availability this year, and certainly an outright decline, would be another tailwind to effective rent growth.

Takeaways

Even with some volatility in apartment demand in recent months, early returns for 2025 have been encouraging for multifamily. New supply has begun to recede, if only slightly in these early days of the year. Apartment demand has continued to build on the positive momentum that has been growing for more than two years now. Rent growth has responded to these developments by returning to its longer-term average for this portion of the calendar for the first time in three years.

Much uncertainty remains, with sources both inside and outside the industry, but the year has gotten off to a healthy start. With the traditionally stronger spring and summer ahead, the multifamily industry is better positioned to meet the challenges ahead than at any time in the last few years.

Disclaimer: All content and information within this article is for informational purposes only. ALN Apartment Data makes no representation as to the accuracy or completeness of any information in this or any other article posted on this site or found by following any link on this site. The owner will not be held liable for any losses, injuries, or damages from the display or use of this information. All content and information in this article may be shared provided a link to the article or website is included in the shared content.

ALN Apartment Data delivers industry-leading multifamily market intelligence, empowering thousands of apartment industry professionals with accurate, research-driven insights.

- Owners and Management Companies leverage ALN OnLine for property search, rental market analysis, and competitor benchmarking—ensuring data-driven decision-making. Discover more about ALN OnLine here

- Multifamily Suppliers & Service Providers trust Vendor Edge Pro to identify property management companies, target apartment communities, and optimize B2B sales strategies with our curated data and must-have features like sales routing. Get started with Vendor Edge Pro today

- Enterprise-Level Multifamily Suppliers scale their business with Compass, the ultimate tool for nationwide property and management company insights, targeted prospecting, and market expansion strategies. Explore Compass now

Not sure how we can help you? Learn more about all of our services for Multifamily Professionals